ARCHIVE

Vol. 9, No. 1

JANUARY-JUNE, 2019

Editorials

Research Articles

Research Notes and Statistics

In Focus: Rural Protest Music in India

Book Reviews

On Improving Awareness about Crop Insurance in India

*Indian Institute of Management Calcutta, subhankarm13@iimcal.ac.in

†Indian Institute of Management Calcutta, parthapal@iimcal.ac.in

Abstract: Income from agriculture is volatile and crop insurance can be a means to mitigate this volatility. In India, however, the coverage of crop insurance is very low. Attempts by the government to increase coverage have primarily been through premium subsidies. Although the literature points to several factors responsible for low take-up of crop insurance, most of these studies are based on crop insurance products designed by private organisations. These products are fundamentally different from public crop insurance schemes. While active marketing and campaigning are done for private crop insurance products, there is almost no campaigning for government-sponsored schemes. Corroborating this, countrywide survey data show lack of awareness as the primary reason for not insuring crops. This paper looks at the factors that are associated with awareness about crop insurance. Its main findings are that farmers who obtained technical advice and/or attended agricultural training are more likely to be aware, and that higher financial inclusion does not help in improving awareness. These results are robust after controlling for other possible confounding variables. The results suggest that strengthening agricultural extension services may be critical for improving awareness and, in turn, coverage of crop insurance in India.

Keywords: crop insurance, agricultural insurance, awareness, risk mitigation in agriculture, financial inclusion, technical advice, agricultural extension, Situation Assessment Survey

Introduction

Existing research on reasons for buying agricultural insurance assumes the presence of effective demand for crop insurance products.1 Low take-up of insurance may be because of absence of demand due to lack of awareness about its existence (Da Costa 2013). This is plausible, given that insurance is a sophisticated financial product, and in a developing country like India, where coverage by any kind of insurance is low (RBI 2017), farmer households may not have adequate understanding of the operational intricacies of a formal risk management instrument like crop insurance. It is thus important to analyse the reasons for this lack of awareness and to suggest possible ways to improve it. In this paper, we endeavour to do that. We use the latest countrywide sample survey on the situation of agricultural households conducted by the National Sample Survey Organisation (NSSO), and employ a multivariate logistic regression analysis to investigate individual-level, household-level, as well as region-level factors that contribute towards higher awareness about crop insurance.

In our empirical analysis, we find that farmers who have attended agricultural training and/or received technical advice from public sources (such as the Krishi Vigyan Kendra, television, radio campaigns, etc.), or even from private sources (such as progressive farmers), are more likely to be aware than those who did not. A higher level of financial inclusion in the State/district of residence of the farmers (measured through three dimensions: bank branch penetration, deposit penetration, and credit penetration [CRISIL 2015]) has almost no effect on the level of awareness. This result is robust after controlling for other possible confounding factors, such as wealth, income, educational attainment, and social group of farmers, and also region-specific characteristics. In India, providing relevant technical knowledge to farmers is undertaken through agricultural extension services. We therefore argue that utilisation of the existing agricultural extension services infrastructure can go a long way in improving awareness about crop insurance and, in turn, its coverage.

This paper relates to three strands of literature. The first derives from policy reports produced by the Government of India that have recognised awareness improvement as an important step towards higher crop insurance coverage. A report on studying the feasibility of weather-based crop insurance in India states:

For a technically intricate concept like crop insurance, the aim of achieving a minimum threshold of awareness and understanding among farmers should be held paramount before empowering farmers with the option of choosing between different types of a social good like crop insurance.2

Another report, while reviewing the possibilities of crop insurance in India, states:

Several participants pointed out that the lack of awareness among farmers about the mechanism of crop insurance leads to lower participation, adverse selection, and dissatisfaction among those who do participate.3

More recently, the Economic Survey of the Government of India set the building of awareness for higher coverage of crop insurance as a priority (GoI 2018).

Secondly, this paper relates to the literature on factors affecting demand for agricultural insurance products. Premium price has been found to be the most important factor affecting crop insurance demand. A policy bulletin published by J-PAL analyses 10 studies conducted in four countries: Ethiopia (two studies), Ghana (two studies), Malawi (one study), and India (five studies) (J-PAL, CEGA, and ATAI Policy Bulletin 2016). All the studies found that there was very low take-up when crop insurance was sold at market price, and estimated high price elasticity of demand for the products. There are also several non-price factors that affect take-up. Cole et al. (2013) found that trust towards agents who sell insurance and also towards the company that sells the product is an important factor. Casaburi and Willis (2018) highlight the impact of liquidity constraint on purchase decisions. The ability to perform basic mathematical calculations is positively correlated with understanding of an insurance product, and thus take-up (Cole, Stein, and Tobacman 2014). The presence of basis risk, or the potential gap between actual loss incurred and payout received, is another important factor behind lack of demand. Farmers do not buy full insurance in the presence of basis risk, even when it is actuarially fair and farmers are not liquidity-constrained (Clarke 2011). The possibility of loan waiver by the government may also reduce demand. In an experiment on farmers from Malawi, Giné and Yang (2009) found that the limited liability nature of a loan reduces propensity to insure the loan. Familiarity with the product also plays an important role in take-up decisions. In a longitudinal study on Indian farmers, Stein (2011) found that previous experience with crop insurance by the farmers themselves and by other farmers in the village had a positive effect on take-up decisions in the current year. Finally, wealth, financial education, and age of household head also affect take-up decisions (Giné, Townsend, and Vickery 2008; Gaurav, Cole, and Tobacman 2011). However, most of these studies are based on crop insurance products developed by a private insurance company or by the researchers themselves, which are different from government-sponsored crop insurance schemes prevalent in India. The differences are as follows. First, for privately developed products, typically, the researchers can vary the premium price in order to estimate the demand curve. For government-sponsored schemes, on the other hand, the premium amount is fixed for a crop or season. Secondly, for private insurance products, there is generally a supply-side intervention in the form of active campaigning to potential buyers. There is almost no supply-side push to sell more crop insurance in the case of government-sponsored schemes.4 Thirdly, all the studies mentioned above are confined to a few States. While these studies probably provide an accurate picture for that State/region (strong internal validity), there could be concerns regarding the applicability of these results in other regions and contexts (weak external validity).

A third connection is to literature on the relation between awareness and its effect on various economic outcomes, although there are only a handful of studies that address this question in the context of crop insurance.5 Cole et al. (2013) conducted a study among farmers in Gujarat and Andhra Pradesh to assess the impact of awareness-building programmes through different marketing campaigns on insurance take-up. They found that approximately one-fourth of treated households bought insurance as compared to the control villages, where almost no farmer bought insurance. Similarly, Gaurav, Cole, and Tobacman (2011) provided financial education and conducted three different kinds of marketing treatment (namely, money-back guarantee, demonstration of functioning of payout trigger, and providing weather forecast) among a group of farmers before offering them crop insurance. They too reported that, while different treatments had different impacts on take-up, the effect of making farmers aware increased take-up by up to eight percentage points.

In this study, we take a step back and investigate the factors affecting awareness. The study is important for the following reasons. First, it may help set the priority of spending on crop insurance subsidies. Given that almost one-third of spending in agriculture is on crop insurance subsidies (Bera 2018) and almost all crop insurance schemes in the world run under government subsidy (Mosley and Krishnamurthy 1995; Cole and Xiong 2017), it is important to set this priority. The focus of current government-sponsored crop insurance schemes is on premium subsidies for increasing coverage. According to the Situation Assessment Survey (SAS) of 2013, a majority of farmers reported being either “not aware” or “not aware about availability of facility”6 as reasons for not insuring crops, while only around 4 per cent of farmers reported inability to pay premium as the reason for not insuring (Table 1).7 Secondly, in the study by Gaurav, Cole, and Tobacman (2011), the authors noted that the cost of providing financial education and conducting a marketing campaign outweighs the benefit earned by the insurer through insurance subscription. Therefore, investigating cost-effective ways to improve awareness is important.

Table 1 Distribution of farmers by reason for not insuring crops, all-India, 2013 in per cent

| Reason | Proportion of farmers |

| 01 – not aware | 44.2 |

| 02 – not aware about availability of facility | 17.5 |

| 03 – not interested | 15.1 |

| 04 – no need | 6.0 |

| 05 – insurance facility not available | 6.5 |

| 06 – lack of resources for premium payment | 3.8 |

| 07 – not satisfied with terms and conditions | 2.3 |

| 08 – nearest bank at a long distance | 0.2 |

| 09 – complex procedures | 2.2 |

| 10 – delay in claim payment | 0.7 |

| 11 – others | 1.6 |

Source: Situation Assessment Survey, NSS 70th round, Visit 1.

The paper is organised as follows. After the Introduction, section two discusses the importance of crop insurance as a risk management mechanism. The third section describes the data sources, the construction of dependent and independent variables, the empirical methodology, and provides summary statistics of our sample. The fourth section discusses the results from our baseline regression as well as from an alternate specification, and the last section concludes.

Role of Crop Insurance

Structural changes in an economy are expected to be accompanied by similar changes in the share of employment (Papola 2005). While the share of agriculture in India’s GDP declined from over 50 per cent in 1950–51 to nearly 16 per cent in 2016–17, the share of agriculture in employment remained at 49 per cent of the workforce (GoI 2018). Average income has also remained low in agriculture as compared to other sectors of the economy. Chand, Saxena, and Rana (2015) have argued that the average income of farm households that are completely dependent on agriculture was only 58 per cent higher than the rural poverty line. Not only is the income level low, but the income uncertainty of agricultural households in developing countries is very high (Deaton 1989).

Farming households adopt various mechanisms to cope with such uncertainties arising out of adverse economic or climatic shocks. Working for longer hours, taking up employment in non-farming sectors, borrowing from formal or informal sources, keeping buffer stocks of grain, buying and selling bullocks, engaging in sharecropping, participating in informal insurance through cash transfer with relatives or other villagers, receiving remittances from migrants, engaging in certain marital arrangements, ritualised gift-giving, participating in contract farming, futures markets, etc., are some of the informal risk-sharing mechanisms adopted by farmers (Dercon 2002; Fafchamps 1999; Morduch 1999). However, many of these mechanisms are risk-coping strategies rather than risk management strategies, and have been found to be incomplete or even absent in many societies. Moreover, a large part of the risk that farmers face is covariate in nature. Flood or drought generally affects a large number of farmers in an area simultaneously, making risk mitigation through local asset markets difficult. Gaurav (2015) found that villagers in India are significantly exposed to both idiosyncratic and covariate risks. Also, reciprocal transfer works best when the participants are richer, i.e. have a cushion against poverty (Coate and Ravallion 1993), and works better within the same community (Mobarak and Rosenzweig 2012). Lastly, formal mechanisms to cope with risks are better than informal mechanisms because the latter may retard economic growth and social mobility (Morduch 1999; Munshi and Rosenzweig 2009).

Given the inadequacy of informal risk-sharing mechanisms, policymakers across the world have tried to establish formal interventions through government support or market-based mechanisms. Examples of such formal market-based mechanisms include providing credit to farmers, ensuring guaranteed prices of output, and encouraging farmers to participate in contract farming and futures markets. Agricultural insurance is an important mechanism to address risk faced by farm households.

Formal agricultural insurance has several advantages over traditional and informal insurance practices described above. First, a formal market-based mechanism has the potential of spreading risk spatially. In a large country like India, it is unlikely that rainfall will show similar patterns across different regions, and so the conventional insurance theory of risk-pooling among farmers can be applied easily. Secondly, market-based insurance can spread risk temporally as well. This is especially important for smaller countries where weather variation may not be present across regions. Thirdly, crop insurance can help maintain farmers’ credit-worthiness. In India, and some other developing countries, crop insurance is attached to crop loans. In case there is a crop loss, the banks providing crop loans are directly repaid by the insurance company. This arrangement ensures that farmers get loans from the banks in the next cropping season as well. It has been argued that inability to pay off loans is one of the reasons for farmers’ suicides in India (Mishra 2008). Crop insurance attached to crop loans may be able to address this issue, since the loans are insured.8 Fourthly, formal insurance coverage can reduce the downside risk for any given level of investment. Thus, access to crop insurance encourages farmers to shift investment on inputs away from low-yield and low-volatility crops to riskier crops which give higher profitability. Evidence of such shifts have been found in recent studies (Cole, Giné, and Vickery 2017; Mobarak and Rosenzweig 2012). Finally, crop insurance may be an effective tool in managing production shocks related to climate change (Falco et al. 2014; Rao 2010).

Even with all these advantages, coverage for crop insurance products is very low among farmers in developing countries. According to the Situation Assessment Survey (SAS) of farm households conducted by the NSSO in 2003, only 4 per cent of farmers in India insured their crops. In the second round of the SAS, conducted in 2012–13, the number increased to around 8 per cent.9 This is despite the existence of several agricultural insurance schemes since 1972 and the launch of at least three new schemes in the last decade (Raju and Chand 2007, 2008). Mukherjee and Pal (2017) analysed demand-side as well as supply-side constraints related to low take-up among Indian farmers. On the supply side, they found that information asymmetry and the absence of an adequate number of channels to sell crop insurance impede take-up, while on the demand side, delay in claim settlement and lack of awareness were the primary constraints. One reason for lack of awareness may be incomplete understanding of how insurance works. Insurance is a sophisticated product, and it is bought with the expectation that one never needs to use it (Banerjee and Duflo 2011). In years when there is no crop loss, farmers tend to view the insurance premium as a loss. Clearly, better knowledge about the benefits of formal insurance can lead to increasing the take-up of crop insurance.

Data

To investigate the factors that determine awareness about crop insurance, we used data from the nationally representative survey of farm households conducted by the NSSO. The NSSO has so far conducted two rounds of Situation Assessment Survey (SAS) for farmers. The first round was conducted during January–December 2003 (NSSO 59th Round), and the second round was conducted during July 2012–June 2013 (NSSO 70th Round). The basic objective of this survey is to assess the standard of living of farmers by measuring consumption expenditure, productive assets, farming practices, incomes, and indebtedness.

This study uses data collected in the NSSO 70th Round SAS survey (NSSO 2014). The nationally representative survey covered all 36 States and Union Territories of India. Any rural household that earned at least Rs 3,000 from agricultural activities in the previous year was eligible to be included in the sample. Each household was visited twice. During the first visit, a total of 35,200 households from 4,529 villages were interviewed on activities performed during the period July–December 2012. During the second visit, 99 per cent (34,907) of the households were re-interviewed on the basis of the same questionnaire, but this time focusing on activities performed during the period January–June 2013. Visit 1 was made during the kharif sowing season, whereas visit 2 coincided with the rabi sowing season. We undertook econometric analysis only for visit 1, since most of the household-level characteristics used for our study either did not change from visit 1 to visit 2, or were not collected during visit 2.

The NSSO data we used for our study have several merits. First, it is the only countrywide household-level survey conducted in India in which detailed questions on crop insurance were asked. Secondly, in this survey, data on several other aspects of farm households were collected, giving us flexibility to construct empirical models.

In addition, we used the financial inclusion index constructed by the Credit Rating Information Services of India Limited (CRISIL 2015). CRISIL started publishing its financial inclusion index from 2011 onwards with support from the Ministry of Finance, Government of India and the Reserve Bank of India. The index is constructed by taking three dimensions of financial inclusion, namely, bank branch penetration, deposit penetration, and credit penetration, and is published for the States as well as districts of India. We use the State-level and district-level index for the year 2013, which matches the time-period of the NSSO survey.10

Description of Variables

This section describes the construction of dependent and independent variables from the survey data. In the NSSO dataset, some variables have been captured at the household level, whereas some others have been captured for each member of a household. For example, information on crop insurance has been collected for each crop the household cultivates, but information on educational attainment has been collected for each household member. In our study, however, we are interested in household-level characteristics. Therefore, we constructed the variables of our interest at household level from the granular data available to us.

The dependent variable for our study is a dichotomous variable, containing value “1” when a farmer household reported being aware about crop insurance, and “0” when not aware. The survey data capture the level of awareness in 11 categories for farmers who did not insure their crops (Table 1). For our baseline regression, we grouped farmers who responded with either code “01” (not aware) or “02” (not aware about availability of facility) as reasons for not insuring under “not aware” category, and the rest of the farmers under “aware” category. To alleviate concerns about including farmers who reported code “02” under “not aware” category, we performed a robustness check with an alternate definition, in which these farmers were included under “aware” category. According to the survey design, insured farmers are aware about crop insurance. We therefore considered farmers who insured their crops in the “aware” category in both regressions. We re-ran our regression after dropping the latter group of farmers from the sample and considering only farmers who did not insure. These results are reported in Appendix Table 1. As noted earlier, the reasons in Table 1 were captured at each crop level, possibly because crop insurance is sold separately for each crop. Ideally, a household should be consistent in responding about awareness, but the data in hand show that a small percentage (less than 1 per cent) of households responded as “aware” for a set of crops and “not aware” for another set of crops. We have dropped these records from our sample.

For selecting factors that might affect awareness about crop insurance as well as demand for crop insurance, we have followed the categorisation in Eling, Pradhan, and Schmit (2014). The main independent variable for our analysis is the indicator for access to agricultural information. The survey captured data on whether a farm household received technical advice and if any member of the household attended agricultural training. A household may obtain technical advice through eight different channels, as shown in Table 2. We considered a household as having received information if it obtained technical advice from at least one of these eight channels, and/or if any member of the household attended agricultural training. We included the following household-level characteristics as control variables. Access to formal loan was included, since crop credit in India is linked to crop insurance. A farm family’s highest level of educational attainment was included as a categorical variable with four levels of educational achievement: illiterate, up to primary level of education, up to secondary level of education, and beyond secondary-level education. The rationale behind considering the highest level of education rather than the educational achievement of the household head was that a household member with higher educational level than the household head may have more knowledge about a sophisticated financial product such as agricultural insurance. Caste was included in following four categories: Scheduled Tribe (ST), Scheduled Caste (SC), Other Backward Classes (OBC), and Others, where the first group is the socially most disadvantaged and the last group is the least disadvantaged. We used extent of land owned and monthly per capita consumption expenditure (MPCE) of households as proxies for wealth and income, respectively, since NSSO data do not capture income and wealth variables directly. Besides these, we also used proportion of cultivated area with irrigation, age of household head, and an indicator to identify principal source of income (whether agriculture or not) as additional household-level controls.

Table 2 Different sources of technical advice, all India, 2013 in per cent

| Source of technical advice | Proportion of farmers that availed this service |

| Extension agent | 7.9 |

| Krishi Vigyan Kendra | 4.3 |

| Agricultural university/college | 1.9 |

| Private commercial agents (including drilling contractor) | 6.1 |

| Progressive farmer | 19.5 |

| Radio/television/newspaper/internet | 23.7 |

| Veterinary department | 10.6 |

| Non-government organisation (NGO) | 1.2 |

Source: Situation Assessment Survey, NSS 70th Round, visit 1.

Along with household characteristics, we used a financial inclusion index (prepared by CRISIL) for the State/district of residence of the farmer. In India, crop insurance is primarily sold through bank branches. Therefore, a larger number of bank branches in an area should normally indicate higher levels of awareness about crop insurance. The financial inclusion index incorporates the density of banks and financial transactions in every State and district in India.

Empirical Model for Multivariate Analysis

To investigate the determinants of awareness about crop insurance, we employ a logistic regression model as shown in

We use State/district-level fixed effects to control for geographic variations. To avoid perfect multi-collinearity issues, we use the district-level financial index along with the State-level fixed effect and vice versa.

Summary Statistics and Bivariate Analysis

Table 3 shows summary statistics for variables used in the empirical analysis. The total sample size for this analysis is 14,085 farmer households. Of them, 6,672 (47 per cent) households were aware about crop insurance, while 7,413 (53 per cent) households were not aware. Approximately 51 per cent farmers received some kind of technical advice and/or attended agricultural training, and close to 69 per cent farmers reported taking institutional loans. A quarter of the farmer households in our sample belonged to either ST or SC category, while the majority (45 per cent) were OBC households. On average, educational attainment was found to be above the secondary level of education. There are two possible reasons for this. First, we considered the highest educational level within a household rather than the educational attainment of the head of the household. Secondly, only 5 per cent of farmer households reported all family members as being illiterate, while close to 40 per cent of families had at least one member with educational qualification beyond secondary level. Almost 78 per cent of farmers in the sample reported agriculture as their primary source of income. The average monthly per capita consumption expenditure was Rs 1,479 for our sample, while average landholding per household was 1.66 hectares. Among the aggregate-level variables, Kerala showed the highest level of financial inclusion while Bihar showed the lowest.

Table 3 Summary statistics for determinants of awareness

| Variable name | Variable type | Mean | Standard deviation | Min. | Max. |

| Aware (aware = 1, not aware = 0) | Categorical | 0.47 | 0.50 | 0 | 1 |

| Whether accessed technical advice or attended training (accessed = 1, not accessed = 0) | Categorical | 0.51 | – | 0 | 1 |

| Whether accessed formal loan (accessed = 1, not accessed = 0) | Categorical | 0.69 | – | 0 | 1 |

| Social group of household (ST = 1, SC = 2, OBC = 3, Others = 4) | Categorical | 2.94 | 0.95 | 1 | 4 |

| Highest level of education in household (Illiterate = 1, upto primary = 2, upto secondary = 3, beyond secondary = 4) | Categorical | 3.13 | 0.86 | 1 | 4 |

| Principal source of income for household (agriculture = 1, otherwise = 0) | Categorical | 0.78 | – | 0 | 1 |

| Log of land owned by household | Continuous | –0.12 | 1.40 | -6.91 | 3.92 |

| Log of MPCE | Continuous | 7.09 | 0.59 | 4.83 | 11.70 |

| Proportion of cultivable area irrigated | Continuous | 0.54 | 0.48 | 0 | 1 |

| Number of crops cultivated by household | Continuous | 1.93 | 1.15 | 1 | 5 |

| Age of household head | Continuous | 51.20 | 13.03 | 16 | 103 |

| State-level financial inclusion index | Continuous | 51.88 | 17.18 | 21.6 | 89.4 |

| District-level financial inclusion index | Continuous | 48.59 | 18.74 | 8.9 | 100 |

Note: Number of observations for each household-level variable is 14,085.

Source: NSS 70th Round, Situation Assessment Survey, visit 1.

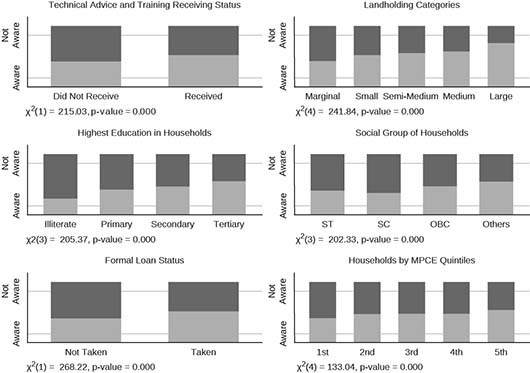

Figure 1 shows bivariate analyses of changes in awareness across different household-level characteristics. All the patterns are on expected lines. A household was more likely to be aware about insurance when it received technical advice or agricultural training. Awareness level was higher for farmers belonging to socio-economically advantaged groups, with higher level of educational attainment, with higher level of MPCE, with larger extent of cultivable landholding, and from a historically advantaged social category. Finally, farmers who took loans from institutional sources were more likely to be aware than those who did not. Chi square tests for each table separately reveal that there is a statistically significant relation between the factors chosen in our analysis and insurance awareness. However, these results show the association between one factor and awareness level without taking into account the impact of other confounding variables. Therefore, we next turn to our results from multivariate regression analysis.

Figure 1 Bivariate analyses for determinants of awareness

Note: For this figure, the definitions of “aware” and “not aware” categories areas per our baseline specification.

Source: NSS 70th Round, Situation Assessment Survey, visit 1.

Results

Table 4 shows results from the baseline regressions. In our baseline specification, we consider farmers who responded with both code “01” and code “02” as reasons for not insuring, in the “not aware” category. All other farmers are considered as “aware” about crop insurance. The coefficients in Table 4 are the odds ratios, i.e. the ratio of the odds of being aware and the odds of being not aware. If the value of a coefficient is more than 1, then the value on the right side of the decimal point represents approximate percentage point difference by which odds of success (being “aware” in this case) are more than odds of failure (being “not aware”). If the coefficient value is less than 1, then 1 minus the value of the coefficient represents the difference by which odds of failure are more than odds of success. Column 1 in Table 4 presents results with district-level fixed effects and State-level inclusion index, and column 2 presents results with State-level fixed effects and district-level inclusion index. We cannot use fixed effects and financial inclusion index at the same level of disaggregation due to perfect multi-collinearity.

Table 4 Results for determinants of awareness (I) from baseline regressions

| Independent variables | (1) | (2) |

| Accessed agricultural technical advice orattended agricultural training (base = no) | 1.21** | 1.36*** |

| (0.011) | (0.000) | |

| Formal loan taken (base = no) | 1.45*** | 1.40*** |

| (0.000) | (0.000) | |

| State-level financial inclusion index | 0.99*** | – |

| (0.001) | ||

| District-level financial inclusion index | – | 1.01 |

| (0.132) | ||

| Highest education in household (base = not literate) | ||

| Educated up to primary level | 1.50*** | 1.44*** |

| (0.000) | (0.000) | |

| Educated up to secondary level | 1.69*** | 1.58*** |

| (0.000) | (0.000) | |

| Educated above secondary level | 2.09*** | 1.85*** |

| (0.000) | (0.000) | |

| Social group of household (base = ST) | ||

| SC | 1.17 | 1.08 |

| (0.249) | (0.503) | |

| OBC | 1.65*** | 1.48*** |

| (0.000) | (0.000) | |

| Others | 1.81*** | 1.75*** |

| (0.000) | (0.000) | |

| Log of MPCE | 1.39*** | 1.16** |

| (0.000) | (0.010) | |

| Log of landholding | 1.12*** | 1.14*** |

| (0.000) | (0.000) | |

| Per cent irrigated | 1.09 | 0.89 |

| (0.312) | (0.194) | |

| Age of household head | 1.00 | 0.99*** |

| (0.235) | (0.001) | |

| Agriculture is principal source of income (base = no) | 0.95 | 1.03 |

| (0.411) | (0.587) | |

| Number of crops cultivated | 0.99 | 1.01 |

| (0.934) | (0.692) | |

| Constant | 0.10*** | 0.10*** |

| (0.000) | (0.000) | |

| District dummies | Yes | No |

| State dummies | No | Yes |

| Robust standard errors with clustering at district level | Yes | Yes |

| Pseudo R2 | 0.22 | 0.07 |

| Number of observations | 14,085 | 14,085 |

| Pseudo-log likelihood | −7611.68 | −9062.59 |

Notes: Dependent variable for the regressions is the dichotomous variable, which holds value 1 when a farmer is aware and 0 otherwise. We dropped district-level financial inclusion index in column 1 and State-level financial inclusion index in column 2 to avoid perfect multi-collinearity with the corresponding fixed effects.

p-values are in parentheses. *** p<0.01, ** p<0.05, * p<0.1.

Source: NSS 70th Round, Situation Assessment Survey, visit 1. Robust standard errors clustered at district level have been used for both regressions.

The results corroborate our findings from the bivariate analysis. For the model with district-level fixed effects (column 1 in Table 4), the odds of a farmer being aware is approximately 21 per cent higher when the farmer gets access to technical advice and/or agricultural training. In our sample, only half the farmers could access these services (Table 3). Therefore, bringing more farmers under the purview of these services should prove beneficial for improving awareness. The coefficient for training and technical advice for the model in column 1 (which includes district-level dummies) is lower compared to the model in column 2 (which includes State-level dummies). This implies that variation in locational characteristics around the neighbourhood of a farmer plays an important role in improving awareness.

As expected, we find that a farm household’s access to formal loans is an important determinant of awareness. Short-term crop credit in India (and in many other developing countries) is linked with crop insurance. However, all farmers taking a crop loan may not be insured, because the loan type may be different and/or crop insurance may not be sold in the area. Therefore, while not all farmers taking loans are insured, there is a high likelihood that they are aware about it when they take any type of institutional loan.

The effect of a higher level of education should be positive on awareness about crop insurance; educated farmers are likely to find it easier to understand the operational nature of an insurance scheme. However, in the literature, the impact of education on crop insurance take-up decision is mixed. While Giné and Yang (2009) found that take-up of agricultural loan clubbed with insurance increases with the educational level of farmers, Giné, Townsend, and Vickery (2008) did not find any significant effect of education on take-up. In our study, we found the estimates for educational attainment to be strongly positive and increasing with level of education. One reason could be that we considered the highest level of education in a household instead of the education of the household head. If the decision to buy insurance is taken by the most educated person within a household, then, accounting for the education of the household head may miss out on the impact of education on such decisions.

Our findings about the effect of social group are in line with the existing literature. Mobarak and Rosenzweig (2012, 2013), while studying agricultural insurance adoption, found that caste-based networks existed in Indian villages. Similarly, we found that the coefficients for social group are positively correlated with awareness. Further, the coefficient increases as we move from the most socially disadvantaged group (ST) to the least socially disadvantaged group (Others). In fact, the odds of a farmer from the most socially advantaged category being aware about crop insurance are almost twice that of a farmer from the most socially disadvantaged category. Households with larger landholdings and higher per capita consumption expenditure (MPCE) are also more likely to be aware than those with less land or lower MPCE. Da Costa (2013) argued that contrary to the theoretical prediction that poorer farmers buy more insurance, evidence shows that take-up among poorer farmers is low. Our findings show that poorer farmers are less likely to be aware about crop insurance than richer farmers.

In the literature, it is postulated that risk mitigation through formal mechanisms such as crop insurance may be substituted by other types of hedging mechanisms. We incorporated two variables which might act as substitutes for crop insurance. A farmer household might diversify the portfolio of crops it cultivates in order to avoid the risk of income loss arising from crop damage. We included the number of crops cultivated by a household in order to control for risk mitigation through this mechanism. Secondly, we included an indicator based on those who reported agriculture as the principal source of income and those who did not. Our hypothesis is that farmers who cultivated more than one crop will be more aware about insurance, as will households who earn a major portion of their income from agriculture. We did not find any effect of the number of crops cultivated or principal source of income on awareness. Lastly, there is no consensus in the literature on the impact of age of household head on demand for crop insurance. While some studies have found a positive effect (for example, Cao and Zhang 2012), other studies have found a negative effect (for example, Giné, Townsend, and Vickery 2008) or no effect at all (Cole, Giné, and Vickery 2017). In our study, we found that the age of household head does not affect awareness level.

Interestingly, we see almost no effect of degree of financial inclusion on awareness. The values of the coefficients of State-level and district-level financial inclusion index do not show high p values, and they are around 1, implying no major effect (positive or negative) on awareness. This implies that the mere presence of more bank branches is not helpful in improving crop insurance awareness and thus coverage. This finding strengthens our argument about the lack of a supply-side push on crop insurance in India. If farmers approach banks for credit, they become aware about crop insurance as well, but banks do not proactively work towards building awareness.

Robustness Check: Alternate Definition of “Aware” and “Not Aware” Categories

The NSSO data recorded the reasons for not insuring crops under 11 categories (Table 1), but the documentation does not provide definitions for those categories. While most categories are self-explanatory, there may be concern regarding the responses under reason code “’02,” i.e. “not aware about availability of facility.” In our baseline regression, we included these farmers under “not aware” category. But it may be the case that these farmers are aware about the concept of crop insurance but not aware if it is available in their area. Therefore, we performed a robustness check by considering this set of farmers under the “aware” category. The results are presented in Table 5. It is evident that our main inferences hold even after this change of definition. The results allow us to infer that, on average, obtaining technical advice or attending agricultural training has a positive effect on awareness about crop insurance even when other household-level characteristics are taken into account.

Table 5 Results for determinants of awareness (II)

| Independent variables | (1) | (2) |

| Accessed agricultural technical advice or attended agricultural training (base = no) | 1.24*** | 1.40*** |

| (0.004) | (0.000) | |

| Formal loan taken (base = no) | 1.37*** | 1.29*** |

| (0.000) | (0.000) | |

| State-level financial inclusion index | 0.96*** | – |

| (0.000) | ||

| District-level financial inclusion index | – | 1.01 |

| (0.241) | ||

| Highest education in household (base = not literate) | ||

| Educated up to primary level | 1.19*** | 1.17 |

| (0.166) | (0.127) | |

| Educated up to secondary level | 1.37*** | 1.33*** |

| (0.007) | (0.005) | |

| Educated above secondary level | 1.70*** | 1.60*** |

| (0.000) | (0.000) | |

| Social group of household (base = ST) | ||

| SC | 1.27* | 1.05 |

| (0.070) | (0.684) | |

| OBC | 1.66*** | 1.40*** |

| (0.000) | (0.001) | |

| Others | 1.79*** | 1.59*** |

| (0.000) | (0.000) | |

| Log of MPCE | 1.39*** | 1.22** |

| (0.000) | (0.000) | |

| Log of landholding | 1.13*** | 1.12*** |

| (0.000) | (0.000) | |

| Per cent irrigated | 1.09 | 1.09 |

| (0.014) | (0.306) | |

| Age of household head | 0.99 | 1.00** |

| (0.120) | (0.031) | |

| Agriculture is principal source of income (base = no) | 1.00 | 1.03 |

| (0.945) | (0.574) | |

| Number of crops cultivated | 1.01 | 1.02 |

| (0.815) | (0.462) | |

| Constant | 0.90 | 0.10*** |

| (0.841) | (0.000) | |

| District dummies | Yes | No |

| State dummies | No | Yes |

| Robust standard errors with clustering at district level | Yes | Yes |

| Pseudo R2 | 0.20 | 0.06 |

| Number of observations | 13,990 | 13,990 |

| Pseudo-log likelihood | −7469.47 | −8783.94 |

Notes: Dependent variable for the regressions is the dichotomous variable, which holds value 1 when a farmer is aware (according to alternate definition) and 0 otherwise. We dropped district-level financial inclusion index in column 1 and State-level financial inclusion index in column 2 to avoid perfect multi-collinearity with the corresponding fixed effects.

p-values are in parentheses. *** p<0.01, ** p<0.05, * p<0.1.

Source: NSS 70th Round, Situation Assessment Survey, visit 1. Robust standard errors clustered at district level have been used for both regressions.

Conclusion

The primary focus of government-sponsored schemes to improve coverage of crop insurance in India has been subsidising the premium price. In the latest Survey on Situation Assessment of farmer households, in the year 2013, only 4 per cent of farmers said that they could not insure crops due to inability to pay the premium. Further, even with subsidies, the coverage of crop insurance was very low. The same dataset shows that more than 90 per cent of farmers did not insure even a single crop. In this context, we argue in this study that lack of awareness about crop insurance may be the binding constraint behind low coverage. Analysing countrywide NSSO data, we show that the majority of farmers did not insure their crops because they were not aware about insurance. Therefore, to elicit demand, awareness-building is necessary. There are two possible institutional channels through which farmers can gain knowledge about crop insurance: agricultural extension services, and banks. In India (and in many other developing countries), imparting relevant technical knowledge to farmers is undertaken through publicly provided agricultural extension services. Also, since provision of crop insurance in India happens mainly through bank branches, this could be an effective channel to disseminate information on crop insurance. In our empirical analysis, we found that while farmers who attended agricultural training and/or received technical advice on agriculture are more likely to be aware of insurance, a higher level of financial inclusion in the State/district of residence of the farmer, which measures the density of bank branches within an area and frequency of financial transactions in those branches, did not improve awareness. Recent studies indicate that banks do not always comply with the policy of selling crop insurance along with crop loans (GoI 2014). We therefore argue that improving agricultural extension services is crucial for greater awareness about and thus take-up of crop insurance in India. The infrastructure for providing agricultural extension services has existed in India for a long time, even though the scale, mode of provision, and quality of these services vary across different States (Glendenning, Babu, and Asenso-Okyere 2010). According to the Situational Assessment Survey, most farmers could not gain access to these services, but among those who could, approximately 95 per cent reported that they found the advice useful.11 In the 1990s, extension services faced a setback in terms of allocation of human resources as well as financial resources (Sajesh and Suresh 2016). Even though expenditure has increased since 2004–05, the high cost of delivery of services, especially to remote locations, lack of channels for farmers to follow-up on information received, and misalignment of incentives for extension agents still constrict its efficacy (Cole and Fernando 2012). Improving extension services such that they reach a larger number of farmers can go a long way in improving awareness and thus take-up of crop insurance in India.

Acknowledgements: We sincerely acknowledge helpful comments from two anonymous referees. We are also grateful to Arijit Sen, Debarshi Das, Debashish Bhattacherjee, Manisha Chakrabarty, Rajesh Bhattacharya, and Tanika Chakraborty, and also the conference participants at IGIDR, Mumbai and PAN IIM World Management Conference, 2017 for valuable comments.

Notes

1 Agricultural insurance and crop insurance are not exactly the same. Agricultural insurance consists of crop, livestock, bloodstock, forestry, aquaculture, and greenhouse insurance (Iturrioz 2009). We, however, use the terms interchangeably in this paper, since crop insurance accounts for a major part of agricultural insurance.

2 Agricultural Finance Corporation Limited (2011), pp. 14–15.

3 GoI (2014), p. 61.

4 Recently, the Government of India made it mandatory for insurance companies to spend 0.5 per cent of their gross premium collection for awareness-building purposes (Parliament of India, Lok Sabha 2018).

5 For other contexts where this relation is explained, see Dupas (2011) on awareness about the potential risk of HIV on teenage girls in Kenya; Finkelstein and Notowidigdo (2018) on awareness and take-up of social safety net programmes in the US; Barr and Turner (2018) on awareness and enrolling in post-secondary education among unemployment insurance holders in the US.

6 The NSSO survey collected the responses for not insuring crops in 11 categories. The second category is defined as “not aware about availability of facility.” The report accompanying the dataset does not elaborate on this definition any further. In this paper, we have assumed that the farmers who gave this as the reason for not insuring their crops were aware of crop insurance, but were not aware whether it was available in their area or not. Our baseline regression was run excluding these farmers, but in one of our robustness checks, we included them in the “not aware” category. We found similar results in both cases.

7 This may be because of the subsidy on premiums. However, even with this subsidy, the take-up rate is very low.

8 Crop insurance attached to crop loan has another advantage in India, where a substantial portion of crop loans is still supplied by informal moneylenders. Insurance can work as an incentive for banks to offer loans to farmers, thereby increasing the penetration of formal loans.

10 The financial index prepared by CRISIL is available publicly at

References

| Agricultural Finance Corporation Limited (2011), “Report on Impact Evaluation of Pilot Weather Based Crop Insurance Study (WBCIS),” submitted to Department of Agriculture and Cooperation, Ministry of Agriculture, Government of India, Mumbai, January. | |

| Banerjee, Abhijit V., and Duflo, Esther (2011), Poor Economics, Random House India, Noida. | |

| Barr, Andrew, and Turner, Sarah (2018), “A Letter and Encouragement: Does Information Increase Postsecondary Enrolment of UI Recipients?” American Economic Journal: Economic Policy, vol. 10, no. 3, August, pp. 42–68. | |

| Bera, Sayantan (2018), “Is Narendra Modi’s Crop Insurance Scheme Running Aground?” Livemint, March 14, available at https://www.livemint.com/Politics/D8bPcMgzsPDw31yQbf1aWK/Is-Narendra-Modis-crop-insurance-scheme-running-aground.html, viewed on March 5, 2019. | |

| Cao, Ying, and Zhang, Yuehua (2012), “Hog Insurance Adoption and Suppliers’ Discrimination: A Bivariate Probit Model with Partial Observability,” China Agricultural Economic Review, vol. 4, no. 2, pp. 233–55. | |

| Casaburi, Lorenzo, and Willis, Jack (2018), “Time Versus State in Insurance: Experimental Evidence from Contract Farming in Kenya,” American Economic Review, vol. 108, no. 12, pp. 3778–813, available at https://doi.org/10.1257/aer.20171526, viewed on May 29, 2019. | |

| Chand, Ramesh, Saxena, Raka, and Rana, Simmi (2015), “Estimates and Analysis of Farm Income in India, 1983–84 to 2011–12,” Economic and Political Weekly, vol. 50, no. 22, May, pp. 139–45. | |

| Clarke, Daniel J. (2011), “A Theory of Rational Demand for Index Insurance,” Economic Series Working Papers, No. 572, Department of Economics, University of Oxford. | |

| Coate, Stephen, and Ravallion, Martin (1993), “Reciprocity Without Commitment: Characterisation and Performance of Informal Insurance Arrangements,” Journal of Development Economics, vol. 40, no. 1, February, pp. 1–24, available at http://doi.org/10.1016/0304-3878(93)90102-S, viewed on May 29, 2019. | |

| Cole, Shawn A., and Fernando, Nilesh A. (2012), “The Value of Advice: Evidence from Mobile Phone-Based Agricultural Extension,” Harvard Business School Working Paper, No. 13–047, November. | |

| Cole, Shawn A., Giné, Xavier, Tobacman, Jeremy, Topalova, Petia, Townsend, Robert M., and Vickery, James (2013), “Barriers to Household Risk Management: Evidence from India,” American Economic Journal: Applied Economics, vol. 5, no. 1, January, pp. 104–35. | |

| Cole, Shawn, Giné, Xavier, and Vickery, James (2017), “How Does Risk Management Influence Production Decisions? Evidence from a Field Experiment,” The Review of Financial Studies, vol. 30, no. 6, pp. 1935–70. | |

| Cole, Shawn, Stein, Daniel, and Tobacman, Jeremy (2014), “Dynamics of Demand for Index Insurance: Evidence from a Long-run Field Experiment,” American Economic Review, vol. 104, no. 5, pp. 284–90, available at https://doi.org/10.1257/aer.104.5.284, viewed on May 29, 2019. | |

| Cole, Shawn, and Xiong, Wentao (2017), “Agricultural Insurance and Economic Development,” Annual Review of Economics, vol. 9, August, pp. 235–62. | |

| Credit Rating Information Services of India Limited (CRISIL) (2015), “CRISIL Inclusix: An Index to Measure India’s Progress on Financial Inclusion,” Volume 3, CRISIL Limited, Mumbai, June. | |

| Da Costa, Dia (2013), “The ‘Rule of Experts’ in Making a Dynamic Micro-Insurance Industry in India,” The Journal of Peasant Studies, vol. 40, no. 5, pp. 845–65. | |

| Deaton, Angus (1989), “Saving in Developing Countries: Theory and Review,” The World Bank Economic Review, vol. 3, no. 1, December, pp. 61–96. | |

| Dercon, Stefan (2002), “Income, Risk Coping Strategies, and Safety Nets,” The World Bank Research Observer, vol.17, no. 2, pp. 141–66. | |

| Dupas, Pascaline (2011), “Do Teenagers Respond to HIV Risk Information? Evidence from a Field Experiment in Kenya,” American Economic Journal: Applied Economics, vol. 3, no. 1, pp. 1–34. | |

| Eling, Martin, Pradhan, Shailee, and Schmit, Joan T. (2014), “The Determinants of Microinsurance Demand,” The Geneva Papers on Risk and Insurance: Issues and Practice, vol. 39, no. 2, April 16, pp. 224–63. | |

| Fafchamps, Marcel (1999), Rural Poverty, Risk and Development, Edward Elgar, Cheltenham. | |

| Falco, Salvatore Di, Adinolfi, Felice, Bozzola, Martina, and Capitanio, Fabian (2014), “Crop Insurance as a Strategy for Adapting to Climate Change,” Journal of Agricultural Economics, vol. 65, no. 2, pp. 485–504. | |

| Finkelstein, Amy, and Notowidigdo, Matthew J. (2018), “Take-up and Targeting: Experimental Evidence from SNAP,” NBER Working Paper no. 24652, The National Bureau of Economic Research, Cambridge, May. | |

| Gaurav, Sarthak (2015), “Are Rainfed Agricultural Households Insured? Evidence from Five Villages in Vidarbha, India,” World Development, vol. 66, February, pp. 719–36, available at http://doi.org/10.1016/j.worlddev.2014.09.018, viewed on May 29, 2019. | |

| Gaurav, Sarthak, Cole, Shawn, and Tobacman, Jeremy (2011), “Marketing Complex Financial Products in Emerging Markets: Evidence from Rainfall Insurance in India,” Journal of Marketing Research, No. 48 (special interdisciplinary issue), November, pp. S150–S162. | |

| Giné, Xavier, Townsend, Robert, Vickery, James (2008), “Patterns of Rainfall Insurance Participation in Rural India,” World Bank Economic Review, vol. 22, no. 3, pp. 539–66, available at https://doi.org/10.1093/wber/lhn015, viewed on July 10, 2019. | |

| Giné, X., and Yang, D. (2009), “Insurance, Credit, and Technology Adoption: Field Experimental Evidence from Malawi,” Journal of Development Economics, vol. 89, no. 1, October 22, pp. 1–11, available at https://doi.org/10.1016/j.jdeveco.2008.09.007, viewed on May 29, 2019. | |

| Glendenning, Claire J., Babu, Suresh, and Asenso-Okyere, Kwadwo (2010), “Review of Agricultural Extension in India: Are Farmers’ Information Needs Being Met?” Discussion Paper no. 01048, IFPRI, Addis Ababa, November. | |

| Government of India (GoI) (2014), “Report of the Committee to Review the Implementation of Crop Insurance Schemes in India,” Department of Agriculture and Cooperation, Ministry of Agriculture, New Delhi. | |

| Government of India (GoI) (2018), Economic Survey 2017–18, Vol. 1, Ministry of Finance, Government of India, New Delhi. | |

| Iturrioz, Ramiro (2009), “Agricultural Insurance,” Primer Series on Insurance, Issue 12, World Bank, available at http://documents.worldbank.org/curated/en/985551468150558970/pdf/625120NWP0Agri00Box0361486B0PUBLIC0.pdf, viewed on June 24, 2019. | |

| J-PAL, CEGA, and ATAI Policy Bulletin (2016), “Make it Rain,” Policy Bulletin, Abdul Latif Jameel Poverty Action Lab, Centre for Effective Global Action, and Agricultural Technology Adoption Initiative, Cambridge, February. | |

| Mishra, Srijit (2008), “Risk, Farmers’ Suicide and Agrarian Crisis in India: Is There a Way Out?” Indian Journal of Agricultural Economics, vol. 63, no. 1, pp. 38–54. | |

| Mobarak, Ahmed Mushfiq, and Rosenzweig, Mark R. (2012), “Selling Formal Insurance to the Informally Insured,” Working Paper 1007, Economic Growth Centre, Yale University, New Haven. | |

| Mobarak, Ahmed Mushfiq, and Rosenzweig, Mark R. (2013), “Informal Risk Sharing, Index Insurance, and Risk Taking in Developing Countries,” American Economic Review: Papers and Proceedings, vol. 103, no. 3, pp. 375–80. | |

| Morduch, Jonathan (1999), “Between the Market and State : Can Informal Insurance Patch the Safety Net?” The World Bank Research Observer, vol. 14, no. 2, pp. 187–207, August, available at http://doi.org/10.1093/wbro/14.2.187, viewed on May 29, 2019. | |

| Mosley, Paul, and Krishnamurthy, R. (1995), “Can Crop Insurance Work? The Case of India,” The Journal of Development Studies, vol. 31, no. 3, pp. 428–50. | |

| Mukherjee, Subhankar, and Pal, Parthapratim (2017), “Impediments to the Spread of Crop Insurance in India,” Economic and Political Weekly, vol. 52, no. 35, September 2, pp. 16–19. | |

| Munshi, Kaivan, and Rosenzweig, Mark (2009), “Why is Mobility in India so Low? Social Insurance, Inequality and Growth,” NBER Working Paper no. 14850, The National Bureau of Economic Research, April. | |

| National Sample Survey Organisation (NSSO) (2014), “Key Indicators of Situation of Agricultural Households in India,” National Sample Survey 70th Round, Ministry of Statistics and Programme Implementation (MoSPI), Government of India, New Delhi. | |

| Papola, Trilok S. (2005), “Emerging Structure of Indian Economy: Implications of Growing Inter-Sectoral Imbalances,” Presidential Address, 88th Conference of the Indian Economic Association, December 27–29. | |

| Parliament of India, Lok Sabha (2018), Lok Sabha Starred Question No. 17 (2018), Ministry of Agriculture and Farmers Welfare, Government of India, available at http://164.100.24.220/loksabhaquestions/annex/16/AS17.pdf, viewed on July 15, 2019. | |

| Raju, S. S., and Chand, Ramesh (2007), “Progress and Problems in Agricultural Insurance,” Economic and Political Weekly, vol. 42, no. 21, pp. 1905–08. | |

| Raju, S. S., and Chand, Ramesh (2008), “Agricultural Insurance in India: Problems and Prospects,” NCAP Working Paper no. 8, National Centre for Agricultural Economics and Policy Research, Indian Council of Agricultural Research, New Delhi, March. | |

| Rao, Kolli N. (2010), “Index Based crop insurance,” Agriculture and Agricultural Science Procedia, vol. 1, pp. 193–203. | |

| Reserve Bank of India (RBI) (2017), “Report of the Household Finance Committee: Indian Househol Finance,” Household Finance Committee, Reserve Bank of India, Mumbai. | |

| Sajesh, V. K., and Suresh, A. (2016), “Public Sector Agricultural Extension in India: A Note,” Review of Agrarian Studies, vol. 6, no. 1, pp. 116–31. | |

| Stein, Daniel (2011), “Paying Premiums with the Insurer’s Money: How Loss Aversion Drives Dynamic Insurance Decisions,” Job Market Paper, London School of Economics, October. |

Appendix

Appendix Table 1 Determinants of awareness among farmers after dropping insured farmers from sample, all India, 2013

| Independent variables | (1) | (2) |

| Accessed agricultural technical advice or attended agricultural training (base = no) | 1.163* | 1.332*** |

| (0.056) | (0.000) | |

| Formal loan taken (base = no) | 1.153** | 1.109* |

| (0.022) | (0.065) | |

| State-level financial inclusion index | 0.991** | – |

| (0.038) | ||

| District-level financial inclusion index | – | 1.006 |

| (0.218) | ||

| Highest education in household (base = not literate) | ||

| Educated up to primary level | 1.640*** | 1.540*** |

| (0.000) | (0.000) | |

| Educated up to secondary level | 1.857*** | 1.743*** |

| (0.000) | (0.000) | |

| Educated above secondary level | 2.290*** | 2.048*** |

| (0.000) | (0.000) | |

| Percent of land irrigated | 1.117 | 0.925 |

| (0.225) | (0.380) | |

| Log of MPCE | 1.398*** | 1.174*** |

| (0.000) | (0.006) | |

| Social group of household (base = ST) | ||

| SC | 1.135 | 1.037 |

| (0.385) | (0.730) | |

| OBC | 1.499*** | 1.319** |

| (0.003) | (0.011) | |

| Others | 1.649*** | 1.593*** |

| (0.000) | (0.000) | |

| Log of landholding | 1.085*** | 1.107*** |

| (0.002) | (0.000) | |

| Age of household head | 0.997* | 0.994*** |

| (0.074) | (0.000) | |

| Agriculture is principal source of income (base = no) | 0.905 | 0.973 |

| (0.130) | (0.672) | |

| Number of crops cultivated | 1.024 | 1.045 |

| (0.503) | (0.157) | |

| Constant | 0.0735*** | 0.0952*** |

| (0.000) | (0.000) | |

| District dummies | Yes | No |

| State dummies | No | Yes |

| Robust standard errors with clustering at district level | Yes | Yes |

| Pseudo R2 | 0.21 | 0.07 |

| Pseudo-log likelihood | ‒6933.79 | ‒8215.89 |

| Observations | 12,919 | 12,919 |

Notes: This table is similar to Table 4, except that insured farmers have been dropped from the sample. The table shows that the results in our baseline regression run are not driven by the fact that insured farmers are already aware.

MPCE stands for monthly per capita expenditure.

p-values in parentheses.*** p<0.01, ** p<0.05, * p<0.1.

Source: NSS 70th Round, Situation Assessment Survey, visit 1. Robust standard errors clustered at district level have been used for both regressions.