ARCHIVE

Vol. 10, No. 1

JANUARY-JUNE, 2020

Editorials

Research Articles

In Focus

Tribute

Agrarian Novels Series

Book Reviews

Women’s Access to Banking in India:

Policy Context, Trends, and Predictors

Abstract: There has been an increase in women’s share in bank credit in India in recent years, which includes credit given directly to women and indirectly via microfinance institutions that lend to women. However, bank credit to women has not grown as fast as credit given to men, resulting in a widening gender gap. The gender gap in credit is even wider when the credit received by women and men is seen as a ratio of the bank deposits they contribute. Credit received by women is only 27 per cent of the deposits they contribute, while the credit received by men is 52 per cent of their deposits. The policy of financial inclusion has significantly enhanced the probability of women holding bank deposits, and has pushed India above the world average in terms of the percentage of women with bank deposits. This increase in deposits is not matched by a corresponding increase in women’s access to bank credit. To address the gender gap, the policy of financial inclusion must be gender-sensitive and correct its disproportionate emphasis on deposits.

Keywords: Gender gap, banking policy, financial inclusion, credit-deposit ratio, microfinance, credit to women, bank deposits, India, rural.

1. Introduction

Historically, formal finance has sidestepped women and their credit needs. This is because formal finance typically relies on security, which women often lack owing to their limited access to wealth, education, secure job opportunities, and property rights. The absence of formal finance can itself hinder women’s access to education, employment, and the means of production, thus limiting their participation in economic activity over time.

Over time, microfinance has become almost synonymous with women’s finance in many developing countries. Since its origin in the late 1980s, microfinance has been regarded as an innovative means of lending to women from economically backward sections by organising them into groups. The “social collateral” of the group is expected to address the absence of physical collateral (Haldar and Stiglitz 2016, p. 471).

The growth of microfinance also needs to be seen in light of the wave of financial liberalisation since the 1980s. The self-regulated for-profit form of microfinance is consistent with the economics of financial liberalisation.1

Equating women’s finance with microfinance limits the scope of women’s finance because it assumes that the credit needs of women may not just start small but also remain small over time. Further, the for-profit nature of microfinance can be detrimental to the cause of women’s finance.2 Evidence from India as well as other developing countries shows that microfinance institutions, aspiring for higher profits through high interest rates and lower default rates, take to coercion in lending and recovery, and have caused debt-related distress among women (Karim 2011; Ramakumar 2010). In fact, for-profit microfinance quite consciously factors in the restricted physical mobility of women in traditional environments as contributing to low credit risk. (Beck 2015).

The tendency to equate women’s finance with microfinance is reflected in the literature, with studies on women’s finance from most countries focusing on the social and economic outcomes of microfinance.3 By contrast, there is limited discussion on women’s access to formal or bank finance, an issue that this paper aims to address in the Indian context.

India offers an interesting case for women’s banking for various reasons. First, India has a rich history of social banking aimed at extending basic banking services to underserved sections of society. Secondly, banks have been the most important source of formal finance in India.4 They have also been instrumental in providing microfinance by way of lending to women’s groups directly and to microfinance institutions for on-lending, as will be discussed later. Hence, an analysis of women’s banking can cover the entire gamut of formal financial services available to women in the Indian context.

The paper analyses Indian banking policy from a gender perspective and quantifies the gender gap in banking services. The term gender gap is defined flexibly in the context of each banking service discussed in the paper. It broadly refers to the gap between the coverage of or access to a given banking service for women vis-à-vis men. While the paper discusses all major banking services, including deposit, credit and payments services, it focuses on credit, as credit supports both production-related activities and consumption smoothing, particularly when the social security system is weak.

Section 2 of the paper discusses major phases of Indian banking policy since bank nationalisation. It illustrates the changing perception about banks as purveyors of basic banking services to the Indian population, women included. Section 3 discusses the literature on women’s access to banking in India. The literature is small, owing partly to data limitations; and issues of data are discussed in Section 4. Sections 5 and 6 analyse women’s access in relation to men to each of the banking services, Section 7 estimates predictors of access to banking for women, and Section 8 concludes.

2. Banks as Purveyors of Basic (Banking) Services: Policy Insights

Based on the role that banks have played as purveyors of basic banking services, it is possible to divide Indian banking policy into two broad phases: the phase of bank nationalisation starting in 1969 and financial liberalisation from 1991 onwards. In this paper, the policy of financial inclusion, begun in 2005 is treated as a continuation of the policy on financial liberalisation.

2.1 Phase of Bank Nationalisation

This phase began with the nationalisation of 14 major banks in 1969 (six more in 1980). Prior to nationalisation, a large part of the Indian banking sector (except the State Bank of India nationalised in 1955) was controlled by and primarily serving the credit needs of a few industrial houses (Goyal 1967).

The three policy instruments that brought banks closer to the masses were: (a) branch licensing; (b) directed lending programme known as priority sector lending; and (c) interest rate regulations (Chavan 2017). The branch licensing policy, mainly through the 1:4 rule (of opening at least four branches in unbanked rural areas for every one branch in metropolitan/port areas), ensured the spread of bank branches to un/under-banked areas. Priority sector lending policy was aimed at the redistribution of bank credit in favour of under-served sectors or segments, including agriculture, small scale industries, and socio-economically “weaker” sections. In addition, there were numerous policy interventions for redistribution, including the creation of Regional Rural Banks (RRBs) for targeted lending to socio-economically weaker sections in rural areas.

This phase is often described as the social banking phase aimed at the “elevation of the entitlements of previously disadvantaged groups [and sectors/activities] to formal credit, even though it might have entailed a weakening of the [more prudent] conventional banking practice[s]” (Wiggins and Rajendran 1987). The “conventional banking practices” included “commercial stability through deposit mobilisation, high recovery rates and caution in lending decisions” (ibid.). Evidently, the objective of redistribution was given priority over profitability and commercial viability of banks.

Although critics associate this phase with “financial repression,” they still agree that India witnessed a significant increase in the overall (and household) savings and investment rates during this phase, which is not typically indicative of a repressive policy regime (Joshi and Little 1994). Studies also highlight the expansion of bank branches, particularly in rural areas and under-banked geographical regions, increased growth of agricultural credit and credit to economically weaker sections during this phase (Shetty 2005).

2.2 Phase of Financial Liberalisation

The phase of financial liberalisation is generally associated with structural reforms triggered by the balance of payments crisis in 1991. The phase witnessed either withdrawal or dilution of most measures adopted earlier in order to give more importance to profitability and efficiency of banks.

Needless to say, this phase changed the perception about banks as purveyors of basic banking. Two quotes from official sources summarise this change. First, the Committee on the Financial Systems (CFS), while offering a blueprint for financial liberalisation, argued that “the pursuit of the redistributive objective should use the instrumentality of the fiscal rather than the credit system” (RBI 1991). Secondly, although it was acknowledged that the previous phase had achieved considerable expansion of banking, its redistributive policies were viewed as responsible for the weak profitability of banks and hence, it was declared that social banking had “outlived its purpose” and banks had to move towards “more commercial modes of operation” (RBI 2001).

Consequently, branch licensing policy was liberalised by withdrawing the 1:4 norm. Priority sector targets were neither withdrawn nor reduced but there were definitional changes, particularly in the case of agriculture – a key priority sector.5 These changes altered the nature of agricultural credit in favour of large-scale, commercial, capital-intensive agricultural production and away from marginal and small farmers (Ramakumar and Chavan 2014). Finally, there was almost complete deregulation of interest rates putting an end to cross-subsidisation of borrowers by banks (Mohanty 2010).6

The effects of these changes could be seen during the 1990s and early-2000s in the form of a fall in the number of rural bank branches; widening differential in banking spread between rural and urban areas, and economically backward and vanguard regions; steep fall in agricultural credit growth; and decline in the share of small-sized agricultural loans (Shetty 2005; Subbarao 2012).

2.2.1 Policy of Financial Inclusion

The policy on financial inclusion was adopted in 2005. Officially, financial inclusion was defined as

the process of ensuring access to appropriate financial products and services (read deposit, payments, credit and insurance) needed by all sections of the society in general and vulnerable groups such as low income groups in particular at an affordable cost in a fair and transparent manner by regulated mainstream institutional players. (Chakrabarty 2011)

Notwithstanding the emphasis on universal provision of basic services, financial inclusion can be viewed as a continuation of the policy of financial liberalisation. This is because inclusion has to be pursued while taking into account “business considerations” to ensure the “long-term sustainability of the process” (RBI 2008a). The emphasis on making inclusion profitable for banks underlines a disregard for cross-subsidisation. This emphasis is reflected in the way inclusion has been pursued since 2005:

- There is a greater thrust on mobilising small-sized deposits as compared to giving small-sized credit as part of financial inclusion. This is because deposits are a cheap and stable source of funding for banks (Khan 2011). In comparison, the transaction costs associated with the financing a large number of small borrowers are high.

- There is a greater thrust on non-branch means of banking, such as through agents or business correspondents (BCs) as compared to brick-and-mortar branches. Again, this is because of the high operating costs for opening and maintenance of branches as compared to agents.

- The idea of involving private institutions, including for-profit microfinance institutions, small finance banks (specialising in small-sized loans) and payments banks (specialising in small-sized payments services) reflects the thrust on commercially-oriented financial inclusion. The new-generation private institutions for financial inclusion are different from the old-generation public institutions, such as the Regional Rural Banks.

Furthermore, there has been little or no reversal in the process of (i) liberalising interest rates; and (ii) changing the definition of priority sectors in favour of large-sized loans during the period of financial inclusion. High interest rates (such as on microfinance) are, in fact, justified given the high transaction costs associated with extending small-sized loans.7 A few large-sized loans unlike a large number of small-sized loans help in achieving the priority sector targets at lower transaction costs.

Although financial inclusion has essentially been a continuation of the policy of financial liberalisation, there has been a return of some policy mandates from the bank nationalisation phase, although in a diluted form. First, banks were instructed in 2011 to open at least 25 per cent of their total branches in a year in unbanked rural centres – a 4:1 norm as against the previous 1:4 norm. However, the mandate of opening bank branches in rural areas was modified in 2015 in conformity with the commercial approach to financial inclusion. Branches were replaced by banking outlets (defined as fixed point outlets manned by a banking correspondent/bank staff which operated five days a week for four hours a day) and banks were instructed to open at least 25 per cent of such banking outlets in a year in unbanked rural centres.

Secondly, banks were asked to adopt board-approved financial inclusion plans (since 2010) and achieve targets under these plans for opening branches, small-sized (savings) deposit accounts and debit cards, and providing small-sized overdrafts. In 2014, Prime Minister’s Jan Dhan Yojana (PMJDY) (translated as Prime Minister’s people’s money scheme) was introduced for accelerating the pace of financial inclusion. As part of financial inclusion plans and PMJDY, there has been a striking increase in the number of banking agents/business correspondents employed by banks, small-sized deposit accounts, and debit cards (issued against these deposit accounts). However, the emphasis on mobilising deposits has been greater than on extending credit, in line with the commercially-oriented approach to financial inclusion.8

2.3 Banking Policy and Women

All policies discussed above apply to women. Additionally there are some policies specifically directed towards women:

- Adoption of microfinance. Banks in India took a lead in providing microfinance to women from economically backward sections. While the bank-led microfinance model was more popular initially, the self-regulated and profit-oriented microfinance institution-led model emerged as a faster growing alternative in the 2000s (RBI 2008b). Over time, the onerous lending and recovery practices of microfinance institutions came to light, prompting the Reserve Bank of India to place them under a stricter regulatory purview in 2010 and prescribing ceilings on their interest rates and margins to be eligible for priority sector credit from banks, as banks had been a major source of funds for these institutions.9 Unlike in other countries, banks in India have been direct lenders to self-help groups under the bank-led model, and to microfinance institutions under the microfinance institution-led model for on-lending to self-help groups.

- Inclusion of women under priority sector. Although socio-economically “weaker sections” was a priority sector category from the early 1970s, it did not explicitly include women till 2013. Originally, weaker sections were defined as small and marginal farmers, agricultural labourers, and Scheduled Castes and Scheduled Tribes. Later, self-help groups were included as part of weaker sections (Chavan 2012). In 2013 for the first time, women were explicitly mentioned as a weaker section, by including loans to individual women beneficiaries up to Rs 50,000 (increased to Rs 0.1 million in 2015) in the priority sector.

- Creation of a women-oriented bank. Bharatiya Mahila Bank, a public sector bank with the mandate to cater to banking needs of women, was created in 2013. The Bank had all women board members with its branches manned by both men and women. It lent primarily to women but solicited deposits from both women and men (Gaikwad 2014).10 Loans to women were charged a slightly lower interest rate than those to men.

Although the Bank was described as a women-oriented bank, it was governed by the same set of regulations, including priority sector lending and branch authorisation policies, as any other commercial bank. Hence, strictly speaking, it was not a differentiated public institution such as a Regional Rural Bank.11 Moreover, rapid branch expansion and brand building needed for any new commercial bank to compete effectively with the existing banks was seen to be missing in the case of the Bharatiya Mahila Bank (Bandyopadhyay 2014). The Bank thrived on treasury profits for a few years before it was merged with the State Bank of India in 2017. - Interest subvention. Although interest rates have been largely deregulated as part of financial liberalisation, since 2007, a subvention is offered to women’s self-help groups for loans up to Rs 0.3 million. The effective rate, thus, works out to 7 per cent for women’s groups (going down further to 4 per cent if the group repaid on time).

- Targeted allocation of credit. In 2000, the Central Government created a 14-point programme to give dedicated attention to women’s credit needs. It included introducing women’s cells in banks and stipulating a 5 per cent target of total credit for women. Although women were explicitly included under “weaker sections” as a priority sector only in 2013, the overall target for women’s credit has been binding on banks since 2000. While the target brought in a focus on women in credit allocation, it has limited relevance as: (a) it was fixed at a low level not adequately representing women’s contribution to economic activity, and kept unchanged over time; and (b) being an overall target, it is hard to infer how the allocated credit reaches women from economically backward sections.

3. Review of Studies on Women and Banking

The empirical literature on gender gap in formal finance is limited. Research has, however, increased with the availability of gender-wise data on banking from the World Bank through its periodic Global Financial Index (Findex) surveys, begun in 2011. The following are the major observations from research based on cross-country data from Findex.

- A negative effect of gender on financial inclusion. Studies are unanimous in their conclusion that gender has a negative effect on financial inclusion across countries, with women having lower access (in terms of both ownership and usage) to banking services than men (Kunt et al. 2013; Deléchat et al. 2018). Women are even more under-represented in business banking; their share in business loan portfolio declines as the size of business increases (Deléchat et al. 2018).

- A wider gender gap in developing countries. While access to banking for women is generally low across countries, women from developing countries are worse off than those in developed countries (Kunt et al. 2013). Gender affects women’s access to banking directly and indirectly through its effect on women’s access to employment, income and education (ibid.).

- Direct discrimination and indirect barriers to access for women. Some studies report direct gender discrimination by banks (Safavian 2012 cited in Kunt et al. 2013). To illustrate, women were charged higher interest rates than men in India (Vani, Bhattacharjee, and Rajeev 2011; RBI 2015b). The inability to provide collateral, low financial literacy, poor credit histories, and restrictions on physical mobility are factors that indirectly affect women’s access to credit (Narain 2009; Coleman 2002).

In India, there are a few studies that show restricted access to formal credit for female-headed households as compared to male-headed households, particularly in rural areas (Vani, Bhattacharjee, and Rajeev 2011). Studies also argue that the decline in rural branches after financial liberalisation disproportionately affected the availability of credit for rural women notwithstanding the rapid growth of microfinance (Chavan 2012). With the onset of Prime Minister’s Jan Dhan Yojana, there has been an expansion in the ownership of bank accounts among women but usage of these accounts has remained low (Kohli 2018).

4. Gender-Disaggregated Banking Data

Global Findex is the only source of gender-wise and country-wise data on ownership and use of banking services. There have been three rounds of Findex in 2011, 2014, and 2017. In 2017, Findex covered a random sample of 150,000 adults (15 years and above) from 144 countries including India, (representing 97 per cent of the world’s population) (Kunt et al. 2017). In this paper, Findex is used to compare India with other countries with regard to financial inclusion of women.

I use data from the Basic Statistical Returns of Scheduled Commercial Banks in India (BSR) from 1996 onwards to analyse trends in women’s access to banking. Gender-wise data for earlier years are not publicly accessible. I also use data from Consumer Pyramids survey of the Centre for Monitoring Indian Economy (CMIE) to identify the predictors of women’s access to banking. Consumer Pyramids provides a longitudinal panel data on a sample of households from 514 districts across 27 States.12 Every sample household is interviewed thrice every year. I use data from January 2014 to December 2018. Consumer Pyramids provides data on bank deposits at the individual level but the data on bank credit are available at the household level. Thus, the predictors for ownership of bank deposits are analysed for individual women, while those for access to bank credit are attempted for female-headed households. I use a balanced panel of 6,276,118 individuals and 1,924,097 households.13

The head of a household is generally identified based on recognition and management of the functions of the household (Ramachandran, Swaminathan, and Rawal 2001).14 As no large-scale survey, including Consumer Pyramids and All-India Debt and Investment Survey, provides a definition of a female-headed household, the tendency of the enumerator to identify a female-headed household based on recognition alone cannot be ruled out. Hence, a household whose chief earner/decision maker is a woman may still be recognised by its adult male member, and classified as a male-headed household. Such a bias can result in under-counting of the female-headed households (Ramachandran, Swaminathan, and Rawal 2001; Agarwal 1986).

Only about 12 per cent of households in Consumer Pyramids are female-headed households; the corresponding proportion is 10 per cent in the All-India Debt and Investment Survey (2012–13). Households reported as female-headed households are generally headed by widows/separated women (explicitly marked by the absence of an adult man), corroborating the recognition bias discussed earlier. I use the data on female-headed households from Consumer Pyramids acknowledging that the count may be a conservative one.

5. Women’s Access to Banking: India Compared with Other Countries

5.1 Bank Deposits

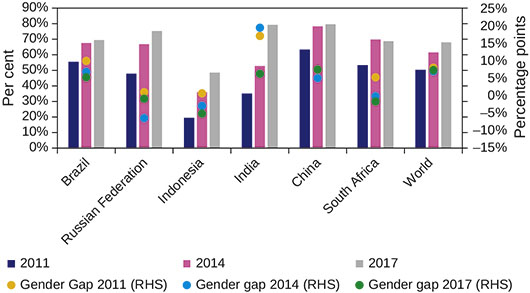

In comparison with the world average and the average for BRIICS (Brazil, Russia, India, Indonesia, China, and South Africa) countries, India showed the most rapid increase in the percentage of adults owning deposit accounts in financial institutions (read banks in the Indian context) between 2011 and 2017, the period coinciding with the policy of financial inclusion and Prime Minister’s Jan Dhan Yojana (Figure 1).15

Figure 1 Adult population with deposit accounts in financial institutions, India with BRIICS countries, 2011, 2014, and 2017, in per cent

Source: Findex, World Bank.

The reduction in gender gap (difference between the percentage of men and women) in owning an account too was the largest for India between 2011 and 2017, but the gap, at 6 percentage points, remained the second highest after China among the BRIICS countries.

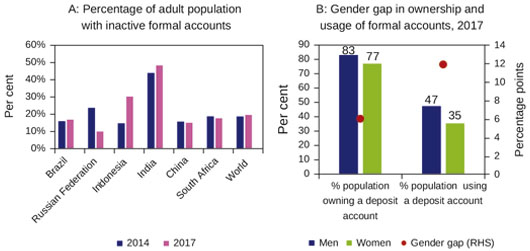

Owning a deposit is perhaps the first step in initiating customers into banking. With regard to the second step of usage of accounts for savings or payments, India’s performance was rather poor. Between 2014 and 2017, as the percentage of adults owning deposit accounts increased, the percentage of adults with inactive accounts (zero deposit or withdrawal during preceding 12 months) too increased (Figure 2A). In 2017, the only year for which gender-wise data on usage are available, only 35 per cent of India’s women actually used a bank account (Figure 2B). This was an average for all women; the percentage is, of course, expected to be lower for women from the economically weaker sections.16

Figure 2 Extent of usage of bank deposit accounts, by gender, India with BRIICS countries, 2014 and 2017, in per cent

Source: Findex, World Bank.

According to Findex, the main reason for not using bank accounts was insufficiency of funds (about 54 per cent of adults reported this as the reason in 2017). Insufficiency of funds is likely to be a stronger reason for women than men given their poorer access to economic opportunities.

5.2 Retail Payments

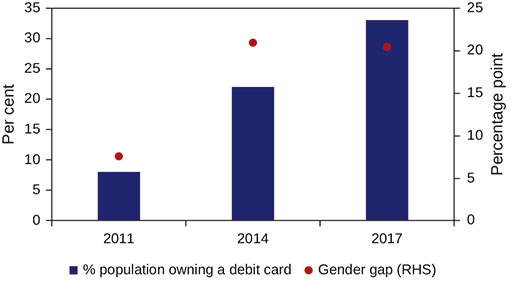

Generally, there are four phases in the evolution of the payments system of any country: cash or paper-based, card-based, web-based, and mobile phone-based payments (Credit Suisse2016). In India, there has been a proliferation of the means of retail payment as part of financial inclusion, which include card-based (credit and debit cards), web-based (National Electronic Fund Transfer and Immediate Payments Switch), and mobile phone-based (Unified Payments Interface) (RBI 2019a). Given the paucity of gender-wise data, in this paper, I study one of the most basic means of payment, namely debit cards.17

Although the percentage of adults owning debit cards rose between 2011 and 2017, the gender gap widened (Figure 3). In 2017, only 22 per cent of women had a debit card as against 43 per cent of men. Although Findex does not give data on usage of debit cards, the gender gap in usage of cards is likely to be wider than in deposits. This is because apart from insufficiency of funds, the availability of payments infrastructure can further constrain the usage of debit cards.

Figure 3 Adult population owning a debit card, India, 2011, 2014, and 2017, in per cent

Source: Findex, World Bank.

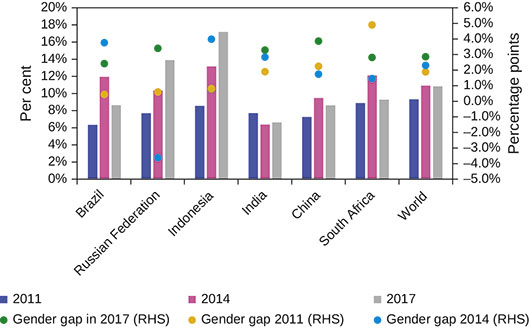

5.3 Bank Credit

India continued to lag far behind the world average and other BRIICS countries in terms of access to formal (bank) credit.18 There was a wide divergence between the share of adults possessing bank deposits and accessing bank credit in India. The divergence corroborated the deposit-centric approach of financial inclusion. The gender gap in credit access in India was second to China (Figure 4). In 2017, only 5 per cent of India’s women accessed bank credit. The corresponding proportion was 7 per cent in both China and Brazil.

Figure 4 Adult population accessing formal credit, India with BRIICS countries, 2011, 2014, and 2017 in per cent

Source: Findex, World Bank.

6. Trends in Women’s Access to Banking in India

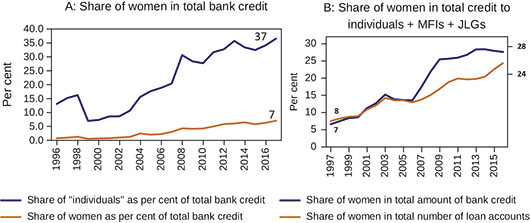

Women’s share in total bank credit has shown a steady rise over the last two decades but the rise has been far slower than for men (Figure 5A). Total bank credit includes credit going to institutions (including public and private corporate, cooperative, microfinance and non-profit sectors), and households (including individuals (men and women) and “other household” entities (proprietorial/partnership firms, joint families, joint liability groups/non-governmental organisations/trusts).19 In order to analyse the gender gap, it is necessary to separate credit to individuals from total credit. The growing divergence between the shares of individuals and women in Figure 5A reflects the share of men. In 2017, women accounted for about 7 per cent of total bank credit, men’s share was about 30 per cent (Figure 5A).

Figure 5 Share of women in total bank credit/credit to individuals in India, in per cent

Note: Shares in Figure 5B are based on three year moving averages.

Source: Basic Statistical Returns of Scheduled Commercial Banks in India, RBI, various issues; https://censusindia.gov.in.

Women get access to bank credit not just as individuals but also as the primary beneficiaries of credit given to microfinance institutions, self-help groups and joint liability groups. Hence, I have added credit to microfinance institutions, and joint liability groups/trusts/non-governmental organisations to the credit going to (individual) women to arrive at a revised estimate of women’s credit.20 As per the revised estimate, women accounted for about 28 per cent of the total credit going to all individuals + microfinance institutions + joint liability groups/trusts/non-governmental organisations (or 8 per cent of total bank credit) in 2017 (Figure 5B).

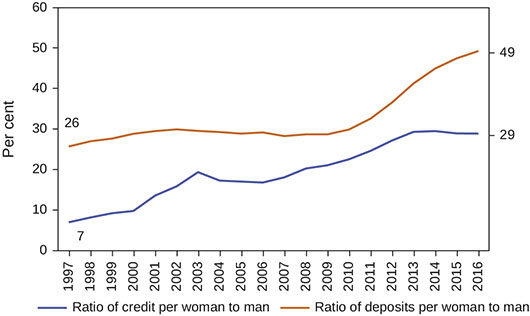

To make the gender gap more meaningful, I look beyond bank credit received by women to the credit that they are entitled to get. To ascertain entitlements, I have first used the share of women in total population. An average woman receives only a fraction of the credit received by a man; in 2017, the ratio of credit amount per woman (including credit given to microfinance institutions + joint liability groups/trusts/non-governmental organisations) to credit amount per man was 29 per cent (Figure 6). The ratio was 23 per cent, when only the credit going to individual women (excluding microfinance institutions + joint liability groups/trusts/non-governmental organisations) was considered.

Figure 6 Relative amount of credit to and deposit from women vis-a-vis men, India, 1997–2016, in per cent

Notes: Shares are three year moving averages to smooth out variations.

Credit to women includes credit given individually to women+ microfinance institutions + joint liability groups/trusts/non-governmental organisations. Credit figures are normalised by population of men and women.

Source: Basic Statistical Returns of Scheduled Commercial Banks in India, RBI, various issues; https://censusindia.gov.in.

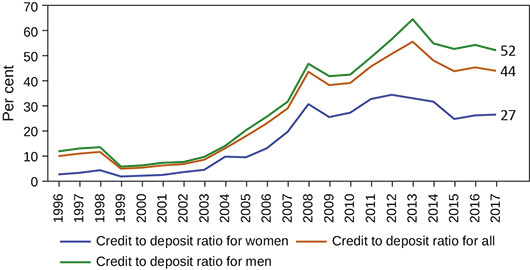

A second yardstick to measure women’s entitlement to bank credit is their contribution to banks by way of deposits. In 2017, credit received by women was only 27 per cent of the deposits they contributed against 52 per cent for men (Figure 7). The credit-to-deposit ratio of women was only half that of men. A lower credit-to-deposit ratio for women is an advantage for banks from the point of view of liquidity. However, for women, it is a sign of credit deprivation.

Figure 7 Credit to deposit ratio by gender, India, 1996–2017, in per cent

Source: Basic Statistical Returns of Scheduled Commercial Banks in India, RBI, various issues; https://censusindia.gov.in.

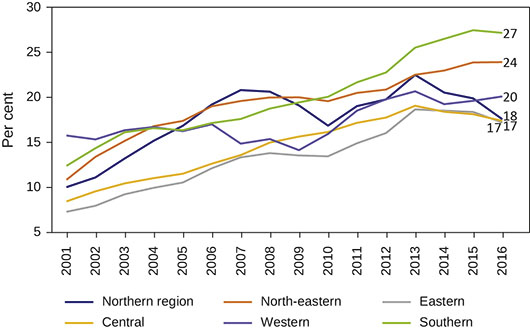

6.1 Gender Gap by Geographical Region

While there has been an increase in the amount of bank credit going to women (relative to men) in every geographical region, the ratio in each region still remains close to 25 per cent (Figure 8). Leading all the regions is the southern region (comprising Andhra Pradesh, Telangana, Karnataka, Kerala, and Tamil Nadu), which is the most well-banked and economically vanguard region (with a higher average State Domestic Product per capita in India (Chavan 2017).

Figure 8 Relative amount of credit to women vis-à-vis men by regions, India, 2001–16 in per cent

Notes: The figures are three-year moving averages. The figures are worked out dividing the per capita amount of bank credit to women vis-à-vis men in a given region.

Southern region - Andhra Pradesh, Telangana, Karnataka, Kerala and Tamil Nadu; North-eastern region - Assam, Arunachal Pradesh, Mizoram, Manipur, Meghalaya, Nagaland, Tripura and Sikkim; Central region - Madhya Pradesh, Chattisgarh, Uttar Pradesh, Uttarakhand; Eastern region - Bihar, Jharkhand, Odisha and West Bengal; Western region - Goa, Gujarat and Maharashtra; and Northern region - Delhi, Haryana, Himachal Pradesh, Jammu and Kashmir, Punjab and Rajasthan.

Source: Basic Statistical Returns of Scheduled Commercial Banks in India, RBI, various issues; https://censusindia.gov.in.

Interestingly, it is hard to establish any direct correlation between women’s relative share in credit in a region and the state of banking and economic development of that region, as the second lowest gender gap was in the north-eastern region (comprising Assam, Arunachal Pradesh, Mizoram, Manipur, Meghalaya, Nagaland, Tripura, and Sikkim), the most under-banked region of India (ibid.).

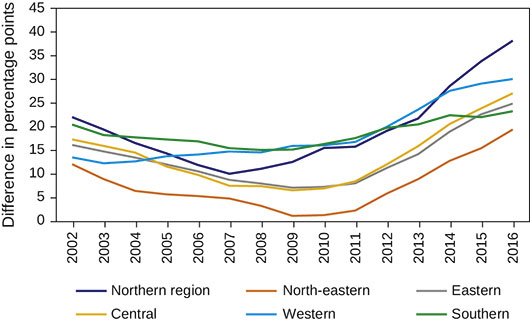

Women from the southern and north-eastern regions have been ahead not just in terms of the relative amount of bank credit, they also obtain a larger share of what they contribute as deposits than women in other regions. The differential between the ratio of deposits by women to men and the ratio of credit obtained by women to men has been fairly narrow in these two regions (Figure 9). However, the gap between the ratio of deposits by women to men and the ratio of credit obtained by women to men has unmistakably widened in recent years. In other words, across regions, women’s contribution to total deposits has outpaced their share in total credit relative to men.

Figure 9 Differential between the ratio of deposits contributed by women to men and the ratio of credit accessed by women to men, by regions, India, 2002–2016

Note: The difference is worked out between the three year moving averages of the amount of deposits per woman to man and the amount of credit per woman to man.

Source: Basic Statistical Returns of Scheduled Commercial Banks in India, RBI, various issues; https://censusindia.gov.in.

6.2 Gender Gap in Rural and Urban Areas

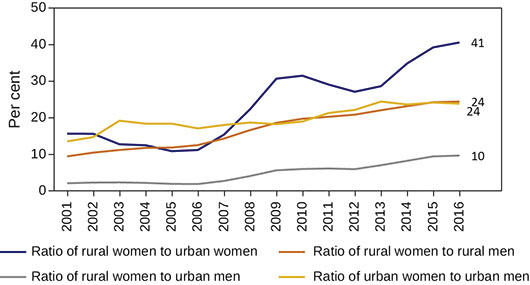

Women from rural India are most deprived in terms of access to bank credit; they fare poorly compared to rural men, urban women, and urban men (Chavan 2008; Chavan 2016). However, there have been significant gains for rural women in recent years, which have not only narrowed the gap between them and rural men but has also brought them closer to urban women in terms of access of credit. The gains for rural women in terms of bank credit have come about after 2006, coinciding with the period of financial inclusion (see Section 2.2.1) (Figure 10).

Figure 10 Relative amount of credit to rural/urban women vis-à-vis rural/urban men, India, 2001-2016 in per cent

Source: Basic Statistical Returns of Scheduled Commercial Banks in India, RBI, various issues; https://censusindia.gov.in.

On average, rural women obtained 41 per cent of credit obtained by urban women in 2016 but the ratio has shown a rising trend during the last decade.21 In comparison, rural women obtained only 24 per cent of the credit given to rural men in 2016, underlining the stark gender gap in rural areas.

The gender gap in urban areas has been as wide as in rural areas, with urban women getting 24 per cent of the credit given to urban men in 2016. Evidently, gender matters more than location when it comes to access to credit.

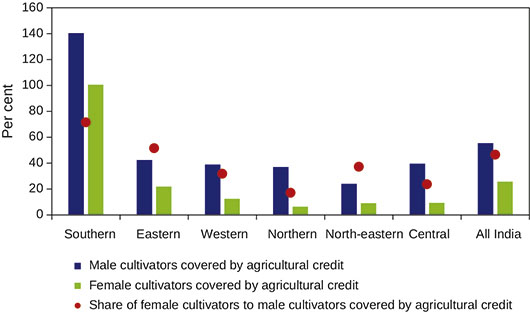

6.3 Gender Gap Among Cultivators

The gender gap among cultivators in access to agricultural credit has been fairly large. Taking data on the number of cultivators from the Census of India 2011, only 26 per cent of female cultivators had access to “direct” agricultural credit while the corresponding percentage was 55 per cent for male cultivators.22

There are also regional disparities in the inclusion of female cultivators by banks. Coverage of female cultivators is highest, and the resultant gender gap the narrowest, in the southern region (Figure 11). The proportion in the southern region was close to 100 per cent in 2011. However, this does not imply that all female cultivators were covered by banks as one cultivator could have more than one loan account.

Figure 11 Coverage of cultivators by direct agricultural credit, by gender and region, India, 2011 in per cent

Source: Basic Statistical Returns of Scheduled Commercial Banks in India, RBI, various issues; https://censusindia.gov.in.

Over time, there has been a slow increase in access to direct agricultural credit for female cultivators relative to male cultivators. Banks covered about 47 female cultivators per 100 male cultivators in 2011, the corresponding coverage was 41 per cent in 2001. Female cultivators received about 40 per cent of the direct agricultural credit received by male cultivators in 2011; the corresponding percentage was 27 per cent in 2001.

7. Predictors of Access to Banking Services

7.1 Predictors of Ownership of Bank Deposits

As per Consumer Pyramids, 78.5 per cent of adults in India owned a bank deposit account, a close match with the figure given in Findex (Section 5.1).23 About 71 per cent of women and 85 per cent of men owned an account according to Consumer Pyramids but the proportion of population operating accounts is not known.24 There has been a striking increase in the ownership of accounts after the implementation of Financial Inclusion Plans and Prime Minister’s Jan Dhan Yojana (PMJDY). About 79 per cent of women reported a deposit account after the announcement of the PMJDY as compared to 47 per cent earlier.

I analyse the predictors for ownership of bank deposits by applying a linear probability model to the Consumer Pyramids data. I test the hypothesis that women have a lower probability of owning an account than men. The details of the specification are in Appendix 1.

The results indicate that the average probability of owning an account is about 14 percentage points lower for women than men (Table 1, Column 1).25 The finding is in line with the literature that highlights the negative effect of gender on financial inclusion.26 The probability is lower by 17 percentage points for rural women relative to rural men (Table 1, Column 1, Specification 5). It is even lower for rural women relative to urban men, the differential being 18 percentage points.

Table 1 Individual-level predictors of ownership of bank deposit accounts

| Covariates | Ownership of deposit account | |||

| (1) | (2) | (3) | (4) | |

| Baseline specification | Specification (2) | Specification (3) | Specification (4) | |

| Gender | -0.144*** (0.001) | -0.262*** (0.003) | -0.466*** (0.003) | -0.183*** (0.002) |

| Gender*Rural | -0.052*** (0.001) | -0.052*** (0.002) | ||

| Gender*Literacy | 0.044*** (0.004) | 0.037*** (0.004) | ||

| Gender*School education | 0.125*** (0.004) | 0.112*** (0.004) | ||

| Gender*College education | 0.138*** (0.004) | 0.126*** (0.004) | ||

| Gender*Higher education | 0.037*** (0.003) | 0.032*** (0.003) | ||

| Gender*Religion groups (A) | -0.023*** (0.003) | -0.026*** (0.003) | ||

| Gender*Religion groups (B) | -0.0006 (0.004) | 0.001 (0.004) | ||

| Gender*Social groups (A) | 0.011*** (0.003) | 0.006** (0.002) | ||

| Gender*Social groups (B) | -0.012*** (0.003) | -0.006* (0.003) | ||

| Gender*PMJDY | 0.255*** (0.002) | |||

| Gender*Branch_penetration | 0.072*** (0.002) | |||

| Rural women: Rural men (5) | -0.167** (0.047) | |||

| Women from Religion groups (A): Men from Religion groups (A) (6) | -0.172** (0.064) | |||

| Women from Social groups (B): Men from Social Groups (B) (7) | -0.153** (0.054) | |||

| Women in pre-demonetisation PMJDY period: Women in pre-PMJDY period (8) | 0.147*** (0.002) | |||

| No. of observations | 6,276,118 | 6,276,118 | 6,276,118 | 5,912,785 |

| R2 | 0.27 | 0.28 | 0.27 | 0.27 |

| District-Time FE | Y | Y | Y | Y |

Note: See Appendix 1 for equations underlying the specifications. Baseline specification – Equation (1); Specification (2) – Equation (2); Specification (3) – Equation (3); Specification (4) – Equation (4). Specification (4) relates to a mapped Consumer Pyramids and Basic Statistical Returns of Scheduled Commercial Banks in India data. Specification (5) shows the average differential effect for a rural woman compared to rural man. It involves running a specification involving Gender, Rural and Gender*Rural; Specification (6) involves running a specification with Gender, Religion group (A), Religion Group (B)and Gender*Religion groups (A); (7) involves a specification with Gender, Social group (A), Social group (B) and Gender*Social groups (B); (8) involves running Specification (3) by restricting the sample to the pre-demonetisation PMJDY period (between September 2014 and November 2016) containing 2,788,127 observations. *** p< 0.01; ** p < 0.005; * p < 0.1. Standard errors are clustered by individuals.

Source: Estimated from Consumer Pyramids.

Literacy and education enhance the probability of women owning an account (Table 1, Columns 2 and 3). Women from minority communities have a lower probability of owning an account than Hindu women.27 Women from backward social groups (Scheduled Castes and Scheduled Tribes referred to as Social Group (B) in Table 1) have a lower probability of owning an account than “upper” caste (non-SC/ST/Other Backward Class) women.28

The effects of financial inclusion policies and PMJDY are evident, as women’s probability of owning an account is higher by about 26 percentage points in the post-September 2014 period than before (Table 1, Column 3). To delineate the effect of financial inclusion measures from demonetisation, which was announced in November 2016 and which resulted in a striking increase in bank deposits, I considered only the period between September 2014 and November 2016 (post-PMJDY but pre-demonetisation period).29 Women’s probability of owning an account was higher by about 15 percentage points even during the pre-demonetisation PMJDY period than before (Table 1, Column 3, Specification 8). Evidently, financial inclusion measures increased the probability of owning bank accounts among women; the probability, of course, increased further following demonetisation. Finally, the probability of deposit ownership was higher by about 7 percentage points for women belonging to districts with higher branch penetration (Table 1, Column 4).

7.2 Predictors of Access to Bank Credit

The access to bank credit is extremely limited in India. Only 6 per cent of households report having taken bank credit as per Consumer Pyramids.30 The incidence of bank loans is only marginally higher for urban households. Also, it is marginally higher for male-headed households as compared to female-headed households; on an average, 6.3 per cent of the male-headed households access credit as compared to 5.5 per cent of female-headed households.

There is a positive but of financial inclusion policies on household access to bank credit. About 6 per cent of households reported an outstanding bank loan after September 2014 as compared to 3 per cent earlier.

Using household-level data from Consumer Pyramids, I test the hypothesis that female-headed households have a lower probability of accessing bank credit than male-headed households, ceteris paribus (see Appendix 2 for the econometric specification). The results showed that on average the probability of accessing bank credit was lower by about 2 percentage points for female-headed households relative to male-headed households (Table 2, Column 1).31 No socio-economic characteristic of female-headed households in the specifications selected significantly explained their access to credit (Table 2, Column 2).32

Table 2 Household-level predictors of access to bank credit

| Covariates | Access to bank credit | |||

| (1) | (2) | (3) | (4) | |

| Baseline specification | Specification (2) | Specification (3) | Specification (4) | |

| Gender_HoH | -0.018*** (0.001) | -0.018*** (0.003) | -0.010*** (0.002) | -0.017*** (0.002) |

| Gender_HoH*Rural | -0.003 (0.003) | |||

| Gender_HoH*Religion groups (A) | -0.003 (0.006) | |||

| Gender_HoH*Religion groups (B) | -0.0008 (0.007) | |||

| Gender_HoH*Social groups (A) | 0.002 (0.003) | |||

| Gender_HoH*Social groups (B) | 0.008* (0.005) | |||

| Gender_HoH*Physical Assets Index | 0.0004 (0.0006) | |||

| Gender_HoH*PMJDY | -0.007*** (0.002) | |||

| Gender_HoH*Branch_penetration | 0.002 (0.003) | |||

| FHHs in pre-demonetisation PMJDY period-FHHs in pre-PMJDY period (5) | 0.002 (0.002) | |||

| No. of observations | 1,924,097 | 1,924,097 | 1,924,097 | 1,820,558 |

| R2 | 0.17 | 0.17 | 0.17 | 0.17 |

| District-Time FE | Y | Y | Y | Y |

Note: See Appendix 2 for equations underlying the specifications. Baseline specification – Equation (5); Specification (2) – Equation (6); Specification (3) – Equation (7); Specification (4) – Equation (8).

Specification (4) relates to a mapped Consumer Pyramids and Basic Statistical Returns of Scheduled Commercial Banks in India data. Specification (5) involves running Specification (3) by restricting the sample to pre-demonetisation PMJDY period (between September 2014 and November 2016) containing 714,081 observations. *** p< 0.01; ** p < 0.005; * p < 0.1. Standard errors are clustered by households.

Source: Estimated from Consumer Pyramids

Financial inclusion policy had a positive correlation with women’s ownership of bank deposits (see Section 7.1) and a negative correlation with access to bank credit. The probability of credit access for female-headed households was nearly one percentage point lower post-September 2014 than before (Table 2, Column 3). Given that credit growth slowed down after demonetisation, I restricted the sample to the pre-demonetisation but post-PMJDY period to analyse the effect of financial inclusion policies alone.33 It turned out that financial inclusion policies showed no significant effect on credit access for female-headed households (Table 2, Column 3, Specification 5).

The penetration of bank branches also showed no effect on credit access for female-headed households, although it increased the access to deposits for women (see Section 7.2). The finding is in line with the argument that financial inclusion has focused more on deposit mobilisation than credit provision. It also corroborates a point made in the literature that having branches may be a necessary but not a sufficient condition for credit access, particularly for the underserved sections of society (Chavan 2016). Banks may need more proactive efforts to extend credit to such sections through innovative platforms and products (ibid.).

8. Concluding Observations

After bank nationalisation, the redistribution of banking services was upheld as the most important objective of banking policy. Banks assumed the role of public institutions providing basic banking services to underserved sections of the population. Women, being such an underserved section, were also expected to benefit from the increased reach of banking, although the policy did not have an explicit focus on women.

The policy of financial inclusion adopted in 2005 was an attempt to reaffirm banks’ commitment to serving underserved sections, while being mindful of their own commercial interests. The profit-maximising nature of the current form of “inclusion” is evident from the greater emphasis on opening branchless banking outlets over physical branches; and mobilising small-sized deposits over extending small-sized credit.

Over time, the shares of both women and men in total bank credit have increased. Total bank credit includes credit given to men and women individually as well as to households, private and public corporations, etc. The increase in women’s share, however, has been much slower than the corresponding increase for men, creating a widening gender gap. In 2017, women accounted for only 7 per cent of total bank credit as compared to 30 per cent for men. Even if we are to include credit to microfinance institutions, self-help groups, and joint liability groups as part of “women’s credit,” women’s share in total credit was only 8 per cent. In 2017, the credit received by women was 27 per cent of the deposits they contributed as compared to 52 per cent for men, further underlining the gender gap.

Financial inclusion measures have had a positive effect on women’s ownership of bank deposits. The gender gap in ownership of bank deposits has narrowed significantly in India in recent years in comparison with the reduction seen for the other BRIICS countries. However, financial inclusion measures have not been able to deliver on two fronts. The first is with respect to usage of deposit accounts by women. In 2017, even though 77 per cent of women in India had deposit accounts in their names, only 34 per cent actually used them. The second is with respect to access to bank credit. Only 5 per cent of women in India reported any form of formal loan in 2017 with their share showing absolutely no increase in the period of financial inclusion.

Acknowledgements: Paper presented at the International Conference on Women’s Work in Rural Economies in Kerala on December 2, 2018. Views expressed are those of the author and not of the organisation to which she is affiliated. The author benefitted from several insightful discussions with S. K. Ritadhi while working on the paper. She gratefully acknowledges his contribution, and the useful comments received from Anwesha Das, V. K. Ramachandran, and an anonymous referee on an earlier draft.

Notes

1 Formal financial institutions in this paper typically refer to commercial banks and non-banking financial institutions that are regulated/supervised by public regulatory authorities (Beck 2015). By contrast, informal sources include money lenders, and friends and family, who are completely unregulated (ibid.). In between these two ends lie an array of semi-formal institutions that are self-regulated or relatively less-regulated. Microfinance evolved in Bangladesh with Grameen, a non-governmental non-profit lending institution. At present, microfinance institutions include a wide array of institutions, including non-banking financial companies, credit unions/cooperatives, trusts as also commercial banks with differences in the degree and type of regulation. These microfinance institutions operate either on the principle of “double-bottom line” (profits and social impact) or “triple-bottom line” (including environmental impact) underlining the role of profits in their operations (Beck 2015, p. 3).

2 Microfinance is defined by small-sized unsecured loans. To illustrate, the cap on individual micro loans in India is set at Rs 0.125 million (RBI 2019b). Systemically, microfinance accounts for a small portion of the total formal finance. For instance, microfinance was only 2 per cent of the total bank credit in India in 2017–18 (MFIN 2018; Basic Statistical Returns of Scheduled Commercial Banks in India, RBI).

3 See Singh (2018) for a literature review on microfinance and its effects on various financial and social indicators concerning the poor, particularly poor women.

4 Banks accounted for 61 per cent of the total formal debt of households in 2013 (NSSO 2014).

5 There was a widening of the definitions under both constituents of agricultural credit: direct and indirect agricultural credit (Ramakumar and Chavan 2014).

6 There were also policy changes that led to diversification to infrastructural and core industrial financing on a large scale (Chavan 2017).

7 It has been argued that “. . . freedom from poverty is not for free. The poor are willing and capable to pay the cost.” (RBI 1999, cited in Ramakumar 2010). Although following the crisis in the microfinance sector in 2010, interest rates on microfinance were capped, they have been liberalised over time (Chavan and Dutta 2019).

8 In 2018, deposit accounts and debit cards were 355 million and 276 million, respectively. However, overdrafts worked out to only 0.4 per cent of the total amount of deposits mobilised, see https://pmjdy.gov.in.

9 See RBI circular “Bank Loans to MFIs Priority Sector Status,” May 3, 2011, available at https://www.rbi.org.in/scripts/NotificationUser.aspx?Id=6381&Mode=0.

10 Apart from offering retail loans to women, industrial loans were offered for beauty parlours, child care centres and catering services, as sectors with self-employment opportunities to women (ibid.).

11 Regional Rural Banks were created to meet the credit needs exclusively of its targeted sections, such as the small and marginal farmers.

13 About 60 per cent of the sample of Consumer Pyramids is from the urban areas (CMIE 2019). The issue of over-sampling of urban households is addressed by weighting every estimation by the sample weights provided in the database. The weights reflect the inverse of the sampling probability for each household.

14 The Census of India notes that, “The head of household for census purposes is a person who is recognised as such by the household. She or he is generally the person who bears the chief responsibility for managing the affairs of the household and takes decisions on behalf of the household” (italics added) (Census of India 2000, p. 48).

15 The definition of (formal) financial institution in Findex includes “all types of financial institutions that offer deposit, checking, and savings accounts – including banks, credit unions, microfinance institutions, and post offices – and that fall under prudential regulation by a government body” (Kunt et al. 2017). In India, banks can be taken as a proxy for financial institutions given their key role in both deposit mobilisation and credit.

17 Although Findex provides data on gender-wise ownership of both debit and credit cards, I use only the former as the penetration of credit cards is extremely limited in India with a credit-to-debit card ratio of only 4 per cent (RBI 2018).

18 The three major formal institutions providing retail credit in India are commercial banks (including Regional Rural Banks), cooperative banks and non-banking financial companies. Of these, banks’ share in the total retail credit provided by all three agencies was 87 per cent; calculation based on RBI (2018).

19 See the organisation-wise division of bank credit in Basic Statistical Returns of Scheduled Commercial Banks in India, RBI. Joint liability groups are a new variant of group lending; see details at https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=9336&Mode=0#APP.

20 This may be an over-estimate as the data are not provided separately for joint liability groups. Joint liability groups are clubbed with trusts and non-governmental organisations, although the latter may not necessarily be credit going to women.

22 It is to be noted that female cultivators accounted for 30 per cent of the total cultivators in 2011, partly a reflection of the disparity in land ownership.

23 This is the average taken from January 2014 to December 2018. While Consumer Pyramids does not spell out the definition of a bank, by way of elimination of other institutions in the database, it can be inferred that banks include commercial banks, credit cooperatives and Regional Rural Banks.

24 Although the figure for men reported in Consumer Pyramids matches closely with that in Findex, the figure for women is distinctly lower in the former, rendering a much wider gender gap in deposit ownership as per Consumer Pyramids than Findex (Section 5.1).

25 The linear probability model has been used, as it lends itself well to the interpretation of the coefficients and controlling for district-time fixed effects. Although the logit model, which assumes the natural log of the odds p/(1-p) as a linear function of the regressors, is commonly used for testing the outcomes for dichotomous dependent variables, its interpretation is not direct and it also does not allow for controlling fixed effects. Hence, as robustness checks, first, I compared the linear probability and logit models after removing the district-time fixed effects. The results from the two models were qualitatively very similar. Secondly, I also worked out the distribution of the predicted probability values from the baseline specification of the linear probability model and observed that only about 0.02 per cent of the predicted values were beyond the 0-1 range. This implied that the linear probability model was able to produce consistent results.

26 Deléchat et al. (2018) observe that the financial inclusion index for women is lower by 1.1 percentage points than men for their sample of countries, which includes India. The finding is also similar to Kunt et al. (2013). The sample of countries in Kunt et al. (2013) includes India; they find that the probability of owning savings and credit accounts is lower for women.

27 In relative terms, the average probability is lower by about 17 percentage points for Muslim women than Muslim men (Table 1, Column 1, Specification 6). It is about 18 (17+1) percentage points lower than Hindu men.

28 The probability of owning an account for Scheduled Caste/Scheduled Tribe (SC/ST) women is lower by about 15 percentage points than SC/ST men (Table 1, Column 1, Specification 7). Further, it is 18 (15+3) percentage points lower than the “upper” caste men.

29 Demonetisation involved the exchange of specified bank notes and resulted in an increase in the growth of bank deposits by households, particularly individuals, in 2016-17 (Saxena and Sreejith 2018).

31 A direct comparison of the results for the ownership of bank deposit and access to bank credit may be misleading because: a) ownership of deposits does not imply actual operation unlike credit, which refers to a household reporting an outstanding bank loan; b) ownership of deposits is at the individual level, while credit access is at the household level. Hence, even if one man or woman from the household reports a loan, it gets counted against the household.

32 As a robustness check, apart from the household-specific characteristics listed in Appendix 2, I have also included the following time-variant socio-economic characteristics as explanatory variables in the baseline specification and the specification interacting the baseline variables with Gender_HoH (represented by Equations 5 and 6 in Appendix 2, respectively): 1. Average years of schooling of the household; 2. Size of the household; 3. Total number of females in the household. I observe no qualitative difference between the results from the expanded and the original specifications, underlining the overall robustness of the results obtained from the original specifications.

33 Unlike deposit growth, credit growth across sectors slowed down after demonetisation and returned to the pre-demonetisation level only after January 2018 (RBI 2019).

34 I also controlled for within-household time-invariant factors using the household fixed effects. However, the strength and sign of the coefficients remained largely unchanged between the specifications with and without the household fixed effects. Hence, the specification including household fixed effects has not been reported here separately.

35 Data on bank branches and population figures are sourced from Basic Statistical Returns of Scheduled Commercial Banks in India and National Sample Survey, 68th round (2011–12), respectively, to work out the population per bank branch at the district and State levels. The districts from Consumer Pyramids are mapped to districts from Basic Statistical Returns of Scheduled Commercial Banks in India. As the list of districts sourced from Basic Statistical Returns of Scheduled Commercial Banks in India does not include districts from the north-eastern region except Assam, the number of observations after the mapping of the districts is lower than that used in all specifications other than (4).

37 The index is constructed following the definition used in Kling, Liebman, and Katz (2007).

References

| Agarwal, B. (1986), “Women, Poverty and Agricultural Growth in India,” Journal of Peasant Studies, vol. 13, no. 4. | |

| Bandyopadhyay, Tamal (2014), “Mahila Bank: UPA’s Rs 1000 Crore Misadventure,” Livemint, November 21. | |

| Beck, T. (2015), “Microfinance: A Critical Literature Survey,” IEG Working Paper no. 4. | |

| Census of India (2000), Instruction Manual for Filling up the Household Schedule, Office of the Registrar General and Census Commissioner, Ministry of Home Affairs, Government of India, New Delhi. | |

| Chakrabarty, K. C. (2011), “Financial Inclusion and Banks: Issues and Perspectives,” Speech at the FICCI-UNDP Seminar, New Delhi, October 14. | |

| Chavan, Pallavi (2008), “Gender Inequality in Banking Services,” Economic and Political Weekly, vol. 43, no. 47, November 22. | |

| Chavan, Pallavi (2012), “The Access of Dalit Borrowers in India’s Rural Areas to Bank Credit,” Review of Agrarian Studies, vol. 2, no. 2, July–December. | |

| Chavan, Pallavi (2016), “Bank Credit to Small Borrowers: An Analysis based on Demand and Supply Side Indicators,” RBI Occasional Papers, vols. 35 and 36, nos. 1 and 2, Reserve Bank of India, Mumbai. | |

| Chavan, Pallavi (2017), “Public Banks and Financial Intermediation in India: The Phases of Nationalisation, Liberalisation, and Inclusion,” in Christoph Scherrer (ed.), Public Banks in the Age of Financialisation: A Comparative Perspective, Edward Elgar Publishing Limited, Cheltenham. | |

| Chavan, Pallavi, and Dutta, Ritam (2019), “A Contemporary Study of Rural Credit in West Bengal,” An unpublished note. | |

| Centre for Monitoring Indian Economy (CMIE) (2019), Consumer Pyramids dx, People of India, Code Book, January–April. | |

| Coleman, Susan (2002), “Access to Capital and Terms of Credit: A Comparison of Men- and Women-owned Small Businesses, Journal of Small Business Management, vol. 38, no. 3. | |

| Credit Suisse (2016), “The Quick and the Dead,” Credit Suisse Securities Research and Analytics, June 29. | |

| Deléchat, Corinne C., Newiak, Monique, Xu, Rui, Yang, Fan, and Aslan, Goksu (2018), “What is Driving Women’s Financial Inclusion across Countries?” IMF Working Paper WP/18/38, International Monetary Fund, Washington D.C. | |

| Gaikwad, M. (2014), “Entry of Bandhan and Bharatiya Mahila Bank into the Indian Banking Sector,” Women’s Equality, nos. 1 and 2, January–June. | |

| Goyal, S. K. (1967), “Banking Institutions and Indian Economy,” ISID Working Paper 1, Institute for Studies in Industrial Development, New Delhi, available at http://isid.org.in/pdf/banking.PDF, viewed on April 3, 2020. | |

| Haldar, Antara, and Stiglitz, Joseph (2016), “Group Lending, Joint Liability, and Social Capital: Insights from the Indian Microfinance Crisis,” Politics and Society, vol. 44, no. 4. | |

| Joshi, Vijay, and Little, I.M.D. (1994), India: Macroeconomics and Political Economy, 1964–1991, World Bank, Washington, D.C. | |

| Karim, Lamia (2011), Microfinance and Its Discontents: Women in Debt in Bangladesh, University of Minnesota Press, Minneapolis. | |

| Kling, J.R., Liebman, J. B., and Katz, L. F. (2007), “Experimental Analysis of Neighbourhood Effects,” Econometrica, vol. 75, no. 1, January. | |

| Khan, H. R. (2011), “Financial Inclusion and Financial Stability: Are they two sides of the same coin?” Address by H. R. Khan, Deputy Governor, Reserve Bank of India at BANCON 2011, November 4, available at https://rbi.org.in/scripts/BS_SpeechesView.aspx?Id=623, viewed on March 9, 2020. | |

| Kohli, Renu (2018), “Women and Banking: India’s Financial Inclusion Suffers from a Gender Gap,” Next Billion, available at www.nextbillion.net/news/women-banking-indias-financial-inclusion-suffers-from-a-gender-gap, viewed on March 9, 2020. | |

| Kunt, Asli D., Klapper, Leora, and Singer, Dorothe (2013), “Financial Inclusion and Legal Discrimination against Women Evidence from Developing Countries,” Policy Research Working Paper no. WPS 6416, World Bank, Washington, D. C. | |

| Kunt, Asli D., Klapper, Leora,Singer, Dorothe, Ansar, Saniya, Hess, Jake Richard (2017), The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution, World Bank Group, Washington, D.C. | |

| Microfinance Network (MFIN) (2018), Micrometer, no. 30, Microfinance Institutions Network. | |

| Mohanty, Deepak (2010), “Perspectives on Lending Rates in India,” speech delivered at Banker’s Club, Kolkata, available at https://www.rbi.org.in/scripts/BS_SpeechesView.aspx?id=508, viewed on March 26, 2020. | |

| Narain, Sushma (2009), “Gender and Access to Finance,” Analytical Paper, World Bank, available at http://siteresources.worldbank.org/EXTGENDERSTATS/Resources/SushmaNarain-AccesstoFinanceAnalyticalPaper.doc, viewed on March 26, 2020. | |

| National Sample Survey Office (NSSO) (2014), “Key indicators of Debt and Investment in India,” National Sample Survey 70th Round, Ministry of Statistics and Programme Implementation, Government of India, New Delhi, available at http://www.mospi.gov.in/sites/default/files/publication_reports/KI_70_18.2_19dec14.pdf, viewed on March 10, 2020. | |

| Ramachandran, V. K., Swaminathan, Madhura, and Rawal, Vikas (2001), “Female-Headed Households: A Note on Methodology,” paper presented at the Annual Conference of the International Association for Feminist Economics, June 22–24, Oslo. | |

| Ramakumar, R. (2010), “A Route to Disaster,” Frontline, vol. 27, no. 24, November 20–December 3. | |

| Ramakumar, R., and Chavan, Pallavi (2014), “Agricultural Credit in the 2000s: Dissecting the Revival,” Review of Agrarian Studies, vol. 4, no. 1, February–June. | |

| Reserve Bank of India (RBI) (1991), Report of the Committee on the Financial System, Reserve Bank of India, Mumbai. | |

| Reserve Bank of India (RBI) (2001), “Developmental Issues in Micro-credit,” Speech by Jagdish Capoor, RBI Bulletin, Reserve Bank of India, Mumbai, March. | |

| Reserve Bank of India (RBI) (2008a), Report on Currency and Finance 2006–08, Reserve Bank of India, Mumbai. | |

| Reserve Bank of India (RBI) (2008b), Report on Trend and Progress of Banking in India, 2007-08, Reserve Bank of India, Mumbai. | |

| Reserve Bank of India (RBI) (2015a), Financial Stability Report, Issue no. 11, June, Reserve Bank of India, Mumbai. | |

| Reserve Bank of India (RBI) (2015b), Report of the Committee on Medium-term Path on Financial Inclusion, Reserve Bank of India, Mumbai. | |

| Reserve Bank of India (RBI) (2018), Report on Trend and Progress of Banking in India 2017–18, Reserve Bank of India, Mumbai. | |

| Reserve Bank of India (RBI) (2019a), Annual Report 2018–19, Reserve Bank of India, Mumbai. | |

| Reserve Bank of India (RBI) (2019b), Statement of Developmental and Regulatory Policies, Reserve Bank of India, Mumbai. | |

| Saxena T. K. and Sreejith T. B. (2018), “Post-Demonetisation Patterns of Deposits with Scheduled Commercial Banks: 2016-17 and 2017-18,” Reserve Bank of India Bulletin, December 2018. | |

| Shetty, S. L. (2005), “Regional, Sectoral and Functional Distribution of Bank Credit,” in V. K. Ramachandran, and Madhura Swaminathan (eds.), Financial Liberalisation and Rural Credit, Tulika Books, New Delhi. | |

| Singh, Nirvikar (2018), “Financial Inclusion: Concepts, Issues and Policies for India,” University of California, Santa Cruz, available at https://mpra.ub.uni-muenchen.de/91047/1/MPRA_paper_91047.pdf, viewed on March 10, 2020. | |

| Subbarao, Duvvuri (2012), “Agricultural Credit: Accomplishments and Challenges,” Speech at NABARD, Mumbai, July 12. | |

| Vani, B. P., Bhattacharjee, Manojit, and Rajeev, Meenakshi (2011), “Credibility of Equal Access to Credit: Does Gender Matter?” Economic and Political Weekly, vol. 46, no. 33. | |

| Wiggins, Steve and Rajendran, S. (1987), “Rural Banking in Southern Tamil Nadu: Performance and Management,” Final Research Report no. 3, The University of Reading, United Kingdom. |

Appendix

Appendix 1: Econometric Specification for Individual Access to Bank Deposits

Following is the equation representing the baseline specification:

Bank_depositihdt = αdt + βGenderihd + Xihdtφ + εihdt (1)

The unit of observation is individual ‘i’ belonging to household ‘h’ from district-State combination ‘d’ in time period ‘t’ represented by month-year combination in Consumer Pyramids. Bank deposit takes value 1 if individual ‘i’ reports ownership of at least one bank deposit at the time of the survey, 0 otherwise. α represent district-time fixed effects controlling for the district-specific time varying factors affecting the ownership of bank deposits.34 Effectively, I limit the comparison between individuals belonging to a household within the same district during the same time period. Gender takes value 1 if individual ‘i'’ is a woman, 0 otherwise. X represents the vector (other than Gender) of individual-specific socio-economic covariates that may be correlated with ownership of deposits (illustrated in Appendix Table 1).

The baseline specification in equation (1) is modified by interacting vector X with Gender to give the following specification:

Bank_depositihdt = αdt + βGenderihd + Xihdtφ + Genderihd ∗ Xihdtθ + εihdt (2)

I develop a third specification to tease out the effects of financial inclusion measures, termed Prime Minister’s Jan Dhan Yojana (PMJDY):

Bank_depositihdt = αdt + βGenderihd + Xihdtφ + Genderihd ∗ Xihdtθ + γGenderihd ∗ PMJDYt + εihdt (3)

PMJDYt takes value 1 for ‘t’ from September 2014 onwards and 0 otherwise.

Finally, I capture the correlation of bank branch penetration – as a supply-side factor – with the ownership of bank deposits as follows:

Bank_depositihdt = αdt + βGenderihd + Xihdtφ + Genderihd ∗ Xihdtθ + μGenderihd ∗ Branch_penetrationdt + εihdt (4)

Branch_penetrationd refers to population per bank branch for district ‘d’ in time ‘t’ taking value 1 if the district has population per bank branch above the median population per bank branch for the corresponding State in ‘t,’ 0 otherwise.35

Appendix Table 1 Individual-specific covariates (X) for estimating probability of ownership of bank deposits

| Variable | Description of the variable |

| Rural | 1 if rural; 0 otherwise |

| Literacy | 1 if literate; 0 otherwise |

| School_education | 1 if completed up to secondary education; 0 otherwise |

| College_education | 1 if completed graduation; 0 otherwise |

| Higher_education | 1 if studied up to or beyond post-graduation; 0 otherwise |

| Religion group (A) | 1 if belonged to Muslim/Khasi; 0 otherwise |

| Religion group (B) | 1 if belonged to Sikh/Christian/Jain/Buddhist/any other minority community excluding those included under Religion groups (A); 0 otherwise |

| Social group (A) | 1 if belonged to Other Backward Class/intermediate caste; 0 otherwise |

| Social group (B) | 1 if belonged to Scheduled Caste/Scheduled Tribe; 0 otherwise |

Appendix 2: Econometric Specification for Household Access to Bank Credit

The baseline specification is as given below:

Bank_credithdt = αdt + βGender_HoHhdt + X1hdtφ + εhdt (5)

The unit of observation is household ‘h’ from district-State combination ‘d’ in month-year combination ‘t’. Bank_credit takes value 1 if the household ‘h’ reports at least one outstanding bank loan at the time of the survey, 0 otherwise. α represent the district-time fixed effects controlling for the district-specific time varying factors affecting credit access. Gender_HoH takes value 1 if household ‘h' is headed by a woman, 0 otherwise. X1 represents the vector of household-specific socio-economic covariates (other than Gender_HoH) that may be correlated with credit access (Appendix Table 2).

The baseline specification in equation (5) is modified by interacting Gender_HoH with vector X1:

Bank_credithdt = αdt + βGender_HoHhdt + X1hdtφ + Gender_HoHhdt ∗ X1hdtθ + εhdt (6)

The baseline specification is modified to analyse the differential effect of financial inclusion measures:

Bank_credithdt = αdt + βGender_HoHhdt + X1hdtφ + γGender_HoHhdt ∗ PMJDYt + εhdt (7)

To capture the effect of branch penetration, the following specification is used:36

Bank_credithdt = αdt + βGender_HoHhdt + X1hdtφ + θGender_HoHhdt ∗ Branch_penetrationdt + εhdt (8)

Appendix Table 2 Household-specific covariates (X1) for estimating probability of credit access

| Variable | Description of the variable |

| Rural | 1 if rural household; 0 otherwise |

| Religion group (A) | 1 if household belonged to Muslim/Khasi; 0 otherwise |

| Religion group (B) | 1 if household belonged to Sikh/Christian/Jain/Buddhist/any other minority community excluding those included under Religion groups (A); 0 otherwise |

| Social group (A) | 1 if household belonged to Other Backward Class/intermediate caste; 0 otherwise |

| Social group (B) | 1 if household belonged to Scheduled Caste/Scheduled Tribe; 0 otherwise |

| Household physical assets index |  Where, x takes value 1 if household ‘h’ in district ‘d’ in time ‘t’ reports saving in gold in the past four months, 0 otherwise; and y takes value 1 if household reports saving in real estate in the past four months, 0 otherwise.37 |