ARCHIVE

Vol. 14, No. 2

JULY-DECEMBER, 2024

Editorial

Research Articles

Research Notes and Statistics

Tribute

Agrarian Novels Series

Review Article

Book Review

Challenging Times for the Sugarcane Economy of Western Uttar Pradesh

*Senior Research Fellow, Economic Analysis Unit, Indian Statistical Institute, Bengaluru, and PhD scholar, Department of Liberal Arts, Indian Institute of Technology (IIT), Hyderabad, kunal.munjal17@gmail.com

https://doi.org/10.25003/RAS.14.02.0006

Sugarcane cultivation in the State of Uttar Pradesh employs over 5 million farmers and many workers, processors, and traders in the post-harvest economy. Throughout the 2010s, Uttar Pradesh’s sugarcane economy expanded substantially, with sugarcane production increasing by nearly 50 per cent and sugar production doubling. However, in 2023–24, there was a substantial decline in the production of sugarcane output. There was a sharp decline also in the district of Bijnor, where my fieldwork is based. Low farm output and the premature closure of sugar mills and jaggery makers resulted in economic losses for different sections of the rural sugarcane economy.

This note has two objectives: (i) to describe the crop losses of 2023–24 and illustrate the impact of this shock on farmers, sugar mills, and jaggery makers and (ii) to identify possible reasons for this crop loss. This note derives from my fieldwork in Bijnor district, western Uttar Pradesh, over the past two years, and is based on interviews with farmers, managers of sugar mills and jaggery-making units, jaggery traders, farmer union leaders, government officials, and sugarcane scientists.1

Sugarcane Expansion Driven by Co 0238 Variety

The gross output per hectare of sugarcane increased significantly over the past decade. The area under sugarcane cultivation also increased, and the processing sector, including sugar mills and jaggery makers, expanded to handle surplus cane. The jaggery and khandsari industries revived; sugar mill capacity increased by over 0.1 million tonnes crushed per day (TCD); old mills were restored and new ones established; and the commercial production of by-products such as ethanol, power, and industrial alcohol increased. Uttar Pradesh overtook Maharashtra as India’s largest producer of sugarcane, sugar, and ethanol.

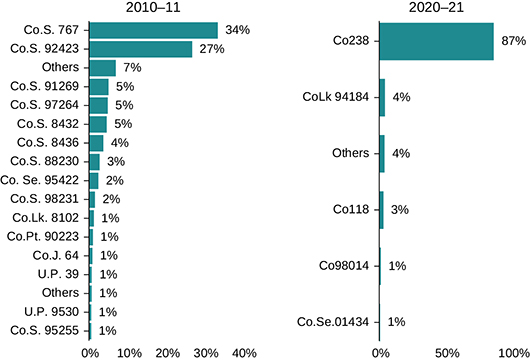

This expansion was primarily driven by the “wonder variety” Co 0238, introduced in 2013–14 in 3 per cent of the area sown with sugarcane. This proportion expanded to 87 per cent in 2020–21, displacing varieties such as Co S767, Co S92423, and Co S8436. Understanding variety-specific production is crucial to understanding overall production, since each variety’s unique characteristics – yield, sucrose content, maturity period (or “age group”), ratooning potential, and resistance to diseases and pests – directly affect production outcomes. In Uttar Pradesh, varieties are classified into early (11–12 months), with high sucrose content and low yields, and mid-late (12–15 months), with high yields and moderate sucrose content. In 2010–11, mid-late varieties covered 89 per cent of the area under sugarcane cultivation, while early varieties covered 11 per cent of the area (Directorate of Sugarcane Development [DSD] 2017). Within each age group, variety adoption varied. Co S767 and Co S92423 (both mid-late) were the most prevalent varieties, covering 34 per cent and 27 per cent of the area respectively. The area under other varieties differed across regions (Figure 1).

Figure 1 Area under sugarcane, by variety, Uttar Pradesh, 2010–11 and 2020–21 in per cent

Figure 2 Area under sugarcane, by variety, Uttar Pradesh, 2015–16 to 2023–24 in hectares

By 2020–21, early varieties covered 98 per cent of the sown area. In 2015, before the introduction of Co 0238, the average yield was 65 tonnes per hectare, with an average recovery rate of 9 per cent. In 2022, after the adoption of Co 0238, yield and recovery rate increased to 85 tonnes and 12 per cent. Co 0238’s adaptability to waterlogged and water-deficit conditions, different sowing periods, subtropical regions, and climatic extremes made it a popular variety. Its widespread adoption led to surplus production, benefiting farms, industries, and trade. In 2019–20, Co 0238 covered 2.59 million hectares in the States of north India, about 80 per cent of the total area under sugarcane in these States. According to an estimate by Ram and Hemaprabha (2020), this variety helped farmers make an additional profit of Rs 45,000 per hectare. According to Ram (2018), this “sweet revolution” generated over Rs 300,000 million annually between 2013–14 and 2017–18 across India, with Co 0238 alone contributing Rs 71,980 million per year, of which Rs 66,820 million came from Uttar Pradesh.

Production Loss and Market Disruption

With regard to the production of sugarcane, sugar, and jaggery, Bijnor comes second only to Lakhimpur Kheri among the districts of Uttar Pradesh. The area under sugarcane in the district increased by 3.2 per cent, from 255,708 hectares in 2022–23 to 263,883 hectares in 2023–24, with 99.98 per cent covered by early varieties. Co 0238 covered 249,736 hectares (94.6 per cent of total area) in 2023–24, an increase of 3,000 hectares from 2022–23. Bijnor district boasts an average yield of 90 tonnes per hectare, surpassing most regions in the State. It has nine sugarcane growers’ cooperative societies, that mediate between 0.45 million farmers and 10 sugar mills to ensure regular supply and timely payment. In 2023–24, Bijnor had 10 sugar mills with a total crushing capacity of approximately 80,000 TCD, one of the highest among districts in the State. The district also has a significant jaggery-making industry, with 102 licensed crusher units with a capacity of 7,290 TCD. Additionally, an estimated 343 unregistered kolhus (micro-crushers) were operational, with a total capacity of 4,460 TCD (an average of 13 TCD per day per kolhu). On the whole, the jaggery-making industry can crush approximately 11,750 TCD or the equivalent of 14.7 per cent of the total capacity of sugar mills in the district.

Sugarcane is sold to sugar mills and jaggery makers. To sell to a mill, a farmer must maintain a basic supply quota to obtain a slip (parchi) for next year’s cane sale. Each mill has a defined procurement zone, and farmers in the zone can sell only to that particular mill. The basic supply quota is based on the highest average of cane supplied to the mill over the last two, three, or five years. Farmers prioritise sales to mills that buy cane at relatively high State Advised Prices (SAPs) to ensure they can maintain a regular supply in the years to come. The SAP is set by the northern sugar-growing States of India (Uttar Pradesh, Punjab, Haryana, and Uttarakhand) at a level that is over and above the Fair and Remunerative Price (FRP) of sugarcane announced by the Central Government. All sugar mills are legally bound to pay this SAP to farmers. The sugarcane growers’ cooperative society, a State-facilitated institution, acts as the mediator between farmers and sugar mills for registration, provision of slips, supply of cane, and payments. Jaggery makers offer prices that are lower than the SAPs paid by sugar mills; these prices fluctuate throughout the season. Despite this comprehensive support mechanism (between the State and millers), many farmers end up selling cane to jaggery makers at lower prices because they have no slips, they are not members of the cooperative, or because of their immediate cash needs.2

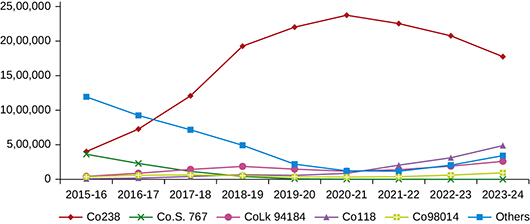

Decline in Production: The Role of Red Rot Disease

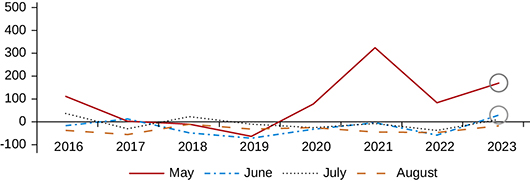

In 2023–24, there was a 25 per cent reduction in the quantity of cane supplied to mills in Bijnor, suggesting that sugarcane production declined about 15–25 per cent. The decline in production was caused by two immediate factors: flooding because of rain and the prevalence of red rot disease. There was incessant rain from May to August, 2023 (Figures 3 and 4). Bijnor is situated near the foothills of the Himalayas. All the rivers in Bijnor’s Ganga basin (and the linked extensive canal system) that sustain its agriculture were overflowing by mid-July, crossing the highest flood levels in 13 years (Rawat 2023). This led to flooding in fields and villages (the flooding was reported extensively in the media (Anwar 2023; Dabas 2023b)). Fields near canals and villages close to rivers, particularly the Ganga, were flooded through July and August (Figures 3 and 4) (Sharma 2022; ChiniMandi 2023). Prolonged waterlogging rendered the sugarcane crop highly vulnerable to red rot, and there was extensive damage to the crop, particularly in the Gangetic region (Dabas 2023a; Kumar 2023). Newly planted cane, sown and harvested between March and May, suffered the most destruction. Yields dropped by 25–30 per cent, causing substantial losses for farmers. Consequently, cane supply to sugar mills decreased and mills shut down nearly two months ahead of schedule, reducing the crushing period (typically 200 days) by 50 days. In 2022–23, nine sugar mills in Bijnor received 124.636 million quintals of cane; in 2023–24, the figure fell to 94.284 million quintals despite the addition of a new mill. This reduction of 30.4 million quintals was the largest in over a decade.

Figure 3 Map of flood-inundated areas along the Ganga River in Bijnor, as on August 16, 2023

Source: Remote Sensing Application Centre (2023).

Figure 4 Deviation between normal and actual rainfall, western Uttar Pradesh, May–August, 2016–2023 in per cent

Red rot, the most destructive of sugarcane diseases, was first identified in India in 1901. India has a history of red rot epidemics, including in Uttar Pradesh and Bihar in 1939–40. Severe red rot outbreaks in Tamil Nadu in the late 1980s led to the banning of the elite variety Co C671, causing significant losses for farmers and the closure of sugar mills (Viswanathan 2021). No sugarcane variety has successfully withstood red rot.3 The disease, caused by the fungus Colletotrichum falcatum, is identified by reddish lesions with white crossbands on the stalk’s tissues and a sour, alcoholic odour when the cane is split open (Viswanathan 2023). It spreads through water (especially monsoon floodwater), soil, setts, and air. It reduces cane yield, impairs juice quality, and lowers sugar, jaggery, and bagasse output, and has caused economic losses of hundreds of millions of rupees over the last century (Viswanathan 2023).

Past epidemics have shown that the monocropping of any particular variety of sugarcane makes cultivation highly susceptible to red rot. Red rot follows a boom-and-bust cycle tied to extensive monocropping, leading to the “vertifolia” effect, in which a pathogen evolves to overcome a plant’s genetic resistance, leading to widespread and severe disease outbreaks in previously resistant crops (Viswanathan 2021). This effect is now to be seen in western Uttar Pradesh, where Co 0238 covered more than 86 per cent of the sown area in 2020–21. There has been, as a consequence, widespread disease and yield reduction in the Co 0238 crop (Chauhan et al. 2022; Viswanathan, Singh et al. 2022).

Effect on Farmers

In 2023–24, farmers lost incomes because of production losses, increased input costs (to treat plant disease and replace seed varieties), and the fact that mills would not buy rot-affected cane. When red rot strikes, cane has to be uprooted and fields treated and resown, all of which add to the total costs of cultivation. Over the last three to four years, the costs of treating disease and of plant protection have increased, reducing profit margins. Bad harvest years such as 2023–24 further worsen economic outcomes. The combination of high cultivation costs, yield reduction, and crop failure led to significant income losses.4 Production losses from flooding and red rot cause particular damage in low-lying lands, often operated by poorer farmers. “Rich farmers prefer leasing out low-quality low-lying land to cultivating it themselves,” said Subodh, who owns 1.4 acres and leases in 3.6 acres, all planted with sugarcane.5 He lost 90 per cent of his output because of two months of flooding. These issues have become central to farmers’ concerns, leading farmers’ unions to put pressure on the Sugar Industry and Cane Development Department, Government of Uttar Pradesh (hereafter referred to as the SICD Department), and millers to support cane development work by addressing issues of production losses and rising cultivation costs.

Despite the struggles of growing and selling cane, farmers are reluctant to move away from the Co 0238 variety. Even absentee landowners lease land for sugarcane cultivation because of high returns, often through in-kind tenancy contracts averaging rent of 125 quintals of sugarcane per acre. Despite losing 100 out of 400 tonnes of cane to rain and red rot in 2023–24, Surya Tyagi, a big farmer from Najibabad, insists, “How can we retire this prodigy? I will try to sow Co 0238 again!” This reluctance to change varieties is an indicator of the challenges involved in inducing farmers to shift away from Co 0238. Varietal replacement has historically been economically challenging for farmers because the cost of uprooting diseased cane and sowing new varieties poses a significant burden.

The sugar mills and the SICD Department offered new cane seeds at Rs 400 per quintal and are promoting varieties like Co 118, CoLk 14201, Co 15023, and CoLk 94184. However, the sudden production loss this year created a seed shortage. Some large farmers now sell seeds at inflated prices, ranging from Rs 600–1,200 per quintal, well above regulated rates. Their influence and access to new seeds leave many farmers, both big and small, with no choice but to purchase seeds at these higher prices due to inadequate availability. The desperate search for a new wonder variety has driven farmers to buy unapproved seeds like CoPb 95 (approved in Punjab but not in Uttar Pradesh), and even varieties from Maharashtra, hoping that they match or surpass Co 0238’s potential. Similar instances were reported in central Uttar Pradesh a few years ago (Agarwal 2022). Seed price inflation for new varieties adds to farmers’ burdens; better off farmers pay high prices, and poor farmers continue with Co 0238 because it is more affordable and more easily available. Reliance on Co 0238 persists even as farmers seek to cover their high investments in the crop.

Sugar Mills Affected Too

To illustrate the operational economics of sugar mills for the current season, a private sugar mill in Najibabad block, typically the last administrative block to conclude operations, ceased operations on April 14, 2024, as opposed to June 11 in 2023. This early shutdown resulted in a substantial reduction of 3.3 million quintals in cane crushing volume. Similarly, the cooperative sugar mill in Najibabad experienced significant operational setbacks, with its crushing season reduced from 191 days to 142 days. The total volume of crushed cane declined from 4.95 million quintals to 3.56 million quintals, resulting in a corresponding decrease in sugar production from 0.53 to 0.39 million quintals. As a direct consequence, payments to sugarcane farmers diminished by Rs 412.02 million, indicating the broader economic impact of this season’s operational challenges. Reductions in output also followed for co-products of all kinds: bagasse, molasses, press mud, ethanol, and rectified spirit. Bijnor’s 10 mills faced similar consequences. Reduced cane supply to mills stemmed primarily from production decline due to excessive rain and red rot spread, but competition from jaggery makers further complicated mill operations.

Disruption in the Post-Harvest Market of Sugarcane

Jaggery, also known as lump sugar, is an important traditional sweetener. Jaggery makers sell jaggery through commission agents and traders in Bijnor’s two key mandis, Kiratpur and Chandpur. The competitive trade in these mandis requires daily auctions for each trolley of jaggery, causing high price volatility. This volatility often influences the prices offered for cane by jaggery makers. The State government set the SAP for 2023–24 at Rs 370 per quintal, a price that all sugar millers are required to pay. In contrast, the prices offered by jaggery makers exhibit daily fluctuations throughout the eight-month harvest season, typically staying 20 per cent below the SAP. These prices occasionally vary within the same day. This year, jaggery production was erratic, with disruptions because of reduced cane supply, causing jaggery makers to halt operations intermittently. This is an uncommon occurrence, as jaggery makers usually operate 22 hours a day, all week, for seven months during the harvest season.

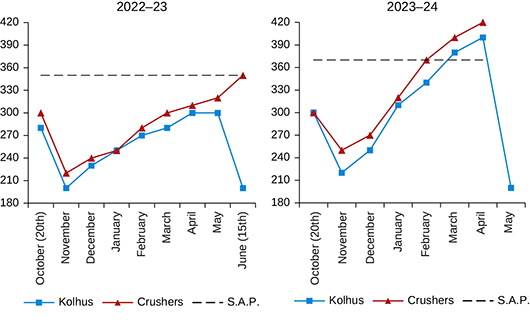

In 2023–24, cane procurement prices from jaggery makers started higher than usual and rose quicker than usual until December 2023 (Figure 5). The State Government had not announced the SAPs for the 2023–24 season by mid-January despite three months of harvest. Farmers staged protests (Dilshad 2024). Driven by market speculation, jaggery makers increased prices to attract limited cane supplies: to Rs 370 per quintal in February, Rs 390 per quintal by March, and Rs 400–450 per quintal by mid-March, surprisingly exceeding SAPs (Figure 5). By April, mills and most crushers shut down because of losses (cane shortage limited full-capacity operation). Kolhus continued operations until mid-May. As a result of reduced competition and declining cane quality, these micro-crushing units dropped prices to Rs 200 per quintal by season’s end. This was very different from a normal year (such as 2022–23). In a normal year, jaggery makers start high to attract early cane supply, prices dip in November as the harvest peaks, there is a gradual rise from December till March, and prices then stabilise till May. The price surges of 2023–24 were thus far from normal.

Figure 5 Month-wise prices offered for sugarcane by sugar mills and jaggery makers, Bijnor, 2022–23 and 2023–24 in rupees per quintal

Source: Author’s fieldwork, 2024.

Despite the smaller scale of production in jaggery-making units, jaggery makers, faced with conditions of low supply, competed intensely for cane in 2023–24. However, another external factor influenced the disruption in the cane market. In 2023–24, although jaggery makers struggled to survive the length of the season, jaggery prices in Bijnor’s Kiratpur and Chandpur mandis rose to Rs 3,500–4,500 per quintal, which was Rs 300–400 higher than in the previous season. Reduced local production (supply) and high demand from other States pushed jaggery prices higher. In addition to the demand for sweets production, alternative uses in the informal economy and its seasonal demand have influenced this surge, indicating a range of applications for jaggery beyond officially reported purposes. Higher demand led jaggery makers to buy cane at prices higher than SAPs, offsetting their losses.

Although jaggery makers offered higher prices, most farmers sold to mills to preserve their supply quotas for future seasons. However, mills have quality standards and would not buy dried or diseased cane. In 2023–24, higher prices from jaggery makers cushioned the losses incurred by farmers who could sell their lower-quality cane. This unprecedented pricing from jaggery makers, above SAPs, partially affected sugarcane supply to sugar mills and is a rare occurrence in the industry’s recent history.

Looking Ahead: Addressing Challenges

Given the challenges faced in 2023–24, a proactive approach to cane development is essential.6 The advantages of Co 0238 continued steadily until 2020–21; however, its cultivation now faces challenges due to increased susceptibility to red rot. Scientists recommend limiting any one variety to 40–50 per cent of cultivated area to prevent varietal breakdown. This recommendation was not put into practice in Uttar Pradesh, increasing disease risk. The scientific community has also repeatedly emphasised the need for varietal replacement to mitigate the risk of diseases (Viswanathan, Rao et al. 2021; Chauhan et al. 2022; Indian Institute of Sugarcane Research [IISR] 2023). The All India Coordinated Research Project on Sugarcane (AICRP-S) has played a key role in introducing new varieties, releasing 139 sugarcane varieties between 1970 and 2021, with 76 introduced in the last decade. However, only 33 varieties were in the seed chain in 2020–21, indicating a need for better implementation of varietal diversity (Chauhan et al. 2022; Ram et al. 2022). Varietal replacement – supported by research and development institutes, sugar mills, and progressive farmers, mainly large-scale growers – usually takes five years from development to commercial planting.7

Between 2015–16 and 2020–21, several studies pointed towards the increasing susceptibility of Co 0238 sugarcane to various diseases in the eastern and central districts of UP and warned of impending threats (Singh, S. et al. 2018; Singh, S. P. et al. 2021; Viswanathan, Rao et al. 2021; Viswanathan, Singh et al. 2022). Varietal replacement is under way in the eastern and central districts of Uttar Pradesh that have been facing losses since 2020–21. The situation in 2023–24 was not an abrupt outbreak; it had been developing over the past five years and reached its peak this year. In 2020–21, high rainfall deviation in May affected UP, with eastern UP experiencing above normal levels even in June. Red rot spread across 22,000 hectares in Lakhimpur, Sitapur, Balrampur, and 20 other districts, while the western region remained unaffected (Singh, S. P. et al. 2021). The area sown with Co 0238 declined from 2.37 million hectares in 2020–21 to 1.77 million hectares in 2023–24, with their place being taken by fields planted with new early varieties such as Co 118, CoLk 14201, Co 15023, and Co Lk94184 (Figure 2). Nevertheless, Co 0238 continued to cover 60 per cent of the area in 2023–24, primarily in western Uttar Pradesh.

The SICD Department has established sugarcane development councils to promote farm-level cane development. Since 2018, in collaboration with Indian Council for Agricultural Research–Indian Institute of Sugarcane Research (ICAR-IISR) scientists, they have repeatedly issued yearly directives to address the problem of red rot as well as other diseases. In 2023, they developed micro-plans for varietal diversification at the council and district levels, supervised by the District Cane Officer (DCO). Each of these plans has targets for sowing new varieties of seeds. The SICD Department, along with sugar mills, is actively raising awareness to diversify sugarcane cultivation, promote new varieties, and educate farmers on pest and disease protection techniques during crop surveys and through social media. Despite ongoing efforts, the State’s role in the sugarcane economy presents an opportunity to adopt a more proactive and cohesive strategy to manage red rot and varietal replacement effectively.

Sugar mills have cane development wings to conduct scientific research on farms. The mills depend entirely on the cane supplied by farmers, and any reduction in output has a direct impact on their profits. They are now actively promoting the planting of diverse seed varieties for survival in the competitive industry.

Concluding Remarks

Since its introduction in Uttar Pradesh a decade ago, the Co 0238 variety has provided higher incomes and consistent benefits to sugarcane farmers and processors. However, the crop was hit by a combination of floods and severe attacks of red rot, a disease which is known to particularly attack monocrop sugarcane. When the disease struck Bijnor district in 2023, the combination of severe rain and Co 0238 covering 95 percent of the area led to an intensified crisis that affected production and disrupted the post-harvest economy.

Sugarcane scientists and extension workers have recommended alternative proposals for diversifying crop varieties in areas sown with sugarcane. In the meantime, farmers, particularly poor farmers, have experienced substantial income losses from the levels that were achieved during the peak years of Co 0238 production. The sugarcane industry was also hit by the consequences of crop losses. As ameliorative measures, the scientific community, Sugar Industry and Cane Development Department, and sugar mills advocate varietal diversification and replacement – a process requiring a minimum of three years. This transition phase is a challenging time for the sugarcane economy of western Uttar Pradesh.

Acknowledgements: I thank my respondents in Bijnor and Lucknow for sharing their experiences and expertise with me. I acknowledge the support of Rampal Singh during my fieldwork in Bijnor. I am grateful to my doctoral supervisors Amrita Datta and Madhura Swaminathan, and to Barbara Harriss-White, and two referees of this journal for their guidance and comments.

Notes

1 A more detailed analysis of production economics, marketing, and industry structure will follow in subsequent writings as part of my doctoral research.

2 Jaggery makers pay cash during the sale while sugar mills take at least 14 days to make the official payment and several months practically.

3 In the nineteenth century, a red rot epidemic caused the loss of 20–50 per cent of sugarcane harvest across the globe – in Mauritius and Réunion (1840), Brazil (1860), Cuba (1860s), Puerto Rico (1872), Queensland (1875), and the West Indies (1890s) (Bosma 2023).

4 Income loss and increased production costs were repeatedly observed in the field. A more thorough analysis of data will be done in subsequent work.

6 Cane development work includes resource mobilisation, information and knowledge dissemination, and extension efforts towards production, irrigation facilities, and agricultural facilities as well as protection of cane crops against pests/diseases. It is done by both the SICD Department and sugar mills.

7 Examples of R&D institutes are the Indian Council of Agricultural Research–Sugarcane Breeding Institute (ICAR–SBI), UP Council for Sugarcane Research (UPSCR), and ICAR–Indian Institute of Sugarcane Research (IISR).

References

| Agarwal, Keshav (2022), “Uttar Pradesh: Cane Authorities to Lodge FIRs for Overpriced Seed, Rate List Issued,” The Times of India, Nov 13, available at https://timesofindia.indiatimes.com/city/bareilly/uttar-pradesh-cane-authorities-to-lodge-firs-for-overpriced-seed-rate-list-issued/articleshow/95480995.cms, viewed on June 5, 2024. | |

| Anwar, Shahbaz (2023), “UP: Floods Hit Bijnor Early This Year, Compounding Annual Misery,” NewsClick, Aug 17, available at https://www.newsclick.in/floods-hit-bijnor-early-year-compounding-annual-misery, viewed on June 5, 2024. | |

| Bosma, U. (2023), The World of Sugar: How the Sweet Stuff Transformed Our Politics, Health, and Environment Over 2,000 Years, Harvard University Press. | |

| Chauhan, J., Govindraj, P., Ram, B., Singh, J., Kumar, S., Singh, K. H., Choudhury, P. R., and Singh, R. K. (2022), “Growth, Varietal Scenario and Seed Production of Sugarcane in India: Status, Impact and Future Outlook,” Sugar Tech, vol. 24, no. 6, pp. 1649–69. | |

| ChiniMandi (2023), “Bijnor: Heavy Rains, Floods Cause Damage to Sugarcane Crops,” Sep 18, 2023, available at https://www.chinimandi.com/bijnor-heavy-rains-floods-cause-damage-to-sugarcane-crops, viewed on June 5, 2024. | |

| Dabas, Harveer (2023a), “Red Rot Strikes: Sugarcane’s ‘Cancer’ Detected in UP Dists,” The Times of India, Oct 1, 2023, available at https://timesofindia.indiatimes.com/city/meerut/red-rot-strikes-sugarcanes-cancer-detected-in-up-dists/articleshow/104077770.cms, viewed on June 5, 2024. | |

| Dabas, Harveer (2023b), “UP: 326 Villages Affected by Floods in Bijnor District,” The Times of India, July 14, available at https://timesofindia.indiatimes.com/city/meerut/up-326-villages-affected-by-floods-in-bijnor-district/articleshow/101746685.cms, viewed on June 5, 2024. | |

| Dilshad, Mohd (2024), “Farmers Launch Indefinite Protest in Muzaffarnagar over Cane Price Hike,” The Times of India, Jan 4, available at https://timesofindia.indiatimes.com/city/meerut/farmers-protest-in-muzaffarnagar-over-cane-price-hike-latest-news/articleshow/106530231.cms, viewed on June 4, 2024. | |

| Directorate of Sugarcane Development (DSD) (2017), “Status Paper on Sugarcane,” Ministry of Agriculture, Government of India, Lucknow, available at https://sugarcane.dac.gov.in/Circulars.aspx, viewed on June 5, 2024. | |

| DSD (2024), “Variety Wise Area in Major Sugarcane Growing States,” Department of Agriculture and Farmers Welfare, Ministry of Agriculture and Farmers Welfare, Government of India, Lucknow, available at https://sugarcane.dac.gov.in/schemes/VarietywiseArea-07_11_2024.pdf. | |

| Indian Council for Agricultural Research–Indian Institute of Sugarcane Research (ICAR–IISR) (2023), Red Rot Management Advisory, ICAR–IISR, Lucknow, Uttar Pradesh, available at https://iisr.icar.gov.in/iisr/download/Advisory/IISRRedRotManagementAdvisory.pdf, viewed on June 5, 2024. | |

| Indian Meteorological Department, Ministry of Earth Sciences, GoI, accessed from Indiastat. | |

| Kumar, Kapil (2023), “खतरे में वेस्ट यूपी के हजारों गांव, नदियों में फिर आईं बाढ़, चिंता में डाल रहे इन जिलों के हालात” [“Flood in UP: Thousands of Villages in West UP in Danger, Rivers Flood Again, Conditions in These Districts Cause for Worry”], Amar Ujala, Aug 14, available at https://www.amarujala.com/uttar-pradesh/meerut/meerut-flood-in-rivers-of-west-up-and-villages-of-meerut-bijnor-and-shamli-are-in-danger-2023-08-14?pageId=10, viewed on June 1, 2024. | |

| Ram, B. (2018), “Co0238: An Extraordinary Sugarcane Variety – Benefitted Millions by Reaping Billions,” ICAR – Sugarcane Breeding Institute: Extension Publication. | |

| Ram, B., and Hemaprabha, G. (2020), “The Sugarcane Variety Co0238 – A Reward to Farmers and Elixir to India’s Sugar Sector,” Current Science, vol. 118, no. 11, pp. 1643–46. | |

| Ram, B., Hemaprabha, G., Singh, B., and Appunu, C. (2022), “History and Current Status of Sugarcane Breeding, Germplasm Development and Molecular Biology in India,” Sugar Tech, vol. 24, no. 1, pp. 4–29. | |

| Rawat, Bhim Singh (2023), “Rivers Crossing Highest Flood Levels in India in August 2023,” South Asia Network on Dams, Rivers and People, Sep 6, available at https://sandrp.in/2023/09/06/rivers-crossing-highest-flood-levels-in-india-in-august-2023, viewed on June 5, 2024. | |

| Remote Sensing Applications Center (2023), “Flood 2023,” Department of Science and Technology, Government of Uttar Pradesh, available at https://rsac.up.gov.in/en/page/flood-2023, viewed on June 5, 2024. | |

| Sharma, Sanjeev (2022), “Bijnor: Flood-like Situation in Ganga Khadar, Villages Affected due to Waterlogging,” India Today, Aug 22, available at https://www.indiatoday.in/india/story/bijnor-flood-situation-ganga-khadar-villages-affected-waterlogging-1991235-2022-08-22, viewed on June 5, 2024. | |

| Singh, S. P., Singh, S., Vishwakarma, S., Kashyap, S., and Tiwari, N. (2021), “Disease Status of Sugarcane in Uttar Pradesh,” International Journal of Tropical Agriculture, vol. 39, no. 3, pp. 297–304. | |

| Singh, S., Vishwakarma, S., and Singh, A. (2018), “Deterioration in Qualitative and Quantitative Parameters of Sugarcane due to Yellow Leaf Disease,” International Journal of Current Microbiology and Applied Science, vol. 7, no. 12, pp. 2320–26. | |

| Viswanathan, R. (2021), “Red Rot of Sugarcane (Colletotrichum falcatum Went),” CAB Reviews, vol. 16, no. 23, pp. 23–57. | |

| Viswanathan, R. (2023), “Severe Red Rot Epidemics in Sugarcane in Sub-tropical India: Role of Aerial Spread of the Pathogen,” Sugar Tech, vol. 25, pp. 1275–77. | |

| Viswanathan, R., Rao, G., and Solomon, S. (2021), “Measures to Minimize the Growing Menace of Red Rot of Sugarcane in Subtropical India,” Sugar Tech, vol. 23, pp. 1207–10. | |

| Viswanathan, R., Singh, S. P., Selvakumar, R., Singh, D., Bharti, Y. P., Chhabra, M. L., Parameswari, B., Sharma, A., and Minnatullah, M. (2022), “Varietal Break Down to Red Rot in the Sugarcane Variety Co0238 Mimics Vertifolia Effect: Characterizing New Colletotrichum falcatum Pathotype CF13,” Sugar Tech, vol. 24, pp. 1479–96. |

Date of submission of manuscript: June 11, 2024

Date of acceptance for publication: September 19, 2024