ARCHIVE

Vol. 3, No. 1

JANUARY-JUNE, 2013

Research Articles

Research Notes and Statistics

Review Articles

Tribute

Book Reviews

Tractor Production and Sales in India, 1989–2009

Anupam Sarkar*

*Research scholar, Department of Economics, University of Calcutta, Kolkata.

Abstract: This paper argues that mechanisation of Indian agriculture, as measured by growth in the production and sale of tractors, has continued, although not uniformly, over the last two decades. While the last two decades were a period of slowdown in agricultural production, the data do not support a view of undifferentiated economic decline in rural areas. Our focus on tractors is justified as the Indian agricultural sector has a higher density of four-wheel tractors than other less-developed countries, and India is also one of the major manufacturers of tractors. The paper uses data from a range of sources on production, domestic sales, and exports of tractors for the period 1989 to 2009. Two factors associated with the sale of tractors, namely, availability of credit from banks and public investment in agriculture, are examined. The paper also shows that growth in tractor sales has been associated with a decline in the regional concentration of sales.

Keywords: Tractor production, tractor sales, Indian agriculture, agriculture and liberalisation, mechanisation.

Introduction

The state of Indian agriculture over the last two decades, particularly since 1991, has been a matter of concern to many scholars. Studies show that growth of production and productivity in agriculture have slowed down,1 affecting incomes and livelihoods from farming,2 and resulting in severe crises in certain regions and time-periods.3 Indeed, the poor performance of the agricultural sector has led some scholars to argue that there has been across-the-board income deflation in rural India (Patnaik 2003). Others have argued that the period from 1991 to the present has been one of crisis but not “undifferentiated crisis – that is, of deceleration, a general absence of dynamism and even retrogression across all classes, regions, crops and years” (Ramachandran 2011). Using a set of indicators, which includes the growth of production, public and private investment, and flows of rural credit, three broad phases of agricultural growth can be distinguished at the all-India level: a period of slow growth from 1991 to 1997–98, followed by a period of sharp decline from 1997–98 to 2003–04, and a period of recovery after 2003–04 (ibid.).4

In this paper, I argue that mechanisation of Indian agriculture, as measured by growth in the production and sale of tractors, has continued, although not uniformly, over the last two decades despite the slowdown in the agricultural sector. The focus on tractors is justified by the fact that the Indian agricultural sector has a higher density of four-wheel tractors than other less-developed countries (Vyas 1982; Pingali 2007). India is also one of the largest manufacturers of tractors in the world, and, more recently, has become an exporter of tractors as well.

Database

The data on aggregate production of tractors used in this note are from various issues of the Monthly Abstract of Statistics, a Central Statistical Organisation (CSO) publication. Data on domestic sales of tractors have been collected from Annual Reports of the Department of Agriculture and Cooperation, Ministry of Agriculture, Government of India. State-wise data on sales are from the Agricultural Engineering Data Book, published by the Central Institute for Agricultural Engineering (CIAE), Bhopal. Data on exports of tractors are from the United Nations Commodity Trade Database.

Growth of the Tractor Industry in India: 1989–2010

Production of tractors in India was started by Eicher Good Earth Limited in 1961, though the initial boost in the demand for tractors came after the advent of the Green Revolution in the late 1960s. The first tractor with fully indigenous technology, the Swaraj tractor, was produced in 1974 by Punjab Tractors Limited, based on a model developed by the Central Mechanical Engineering Institute, Durgapur. Today, India is one of the leading manufacturers of tractors in the world,5 with a production figure of 383,000 in 2009–10.6

Growth in Production

Between 1989–90 and 2009–10, there was a three-fold increase in tractor production, from 125,000 to 383,000, equivalent to an annual rate of growth of 4.3 per cent (Appendix Table A1). However, there were large year-to-year fluctuations in growth during this period. There were three instances where growth of production of tractors was negative for two or more successive years. The first such instance was during 1992–93 and 1993–94, that is, just after liberalisation of the Indian economy in 1991. There was a short recession in the tractor industry as production dipped from 166,000 in 1991–92 to 147,000 in 1992–93, and, further, to 139,000 in 1993–94. The second phase of negative growth was from 2000–01 to 2003–04, with the production of tractors in 2003–04 falling below the level of 1995–96. This slowdown began in 1997–98 with negative or low growth rates up to 2000, followed by large negative growth rates during 2001–02 and 2002–03. Production picked up and increased rapidly from 2004–05, with output crossing the 300,000 mark in 2006–07. There was then another dip in production in 2007–08 and 2008–09, followed by a big rise in 2009–10.

The phases of growth in tractor production closely follow the three post-1991 phases of growth in agricultural production and investment identified by Ramachandran (2011), namely, 1990–91 to 1997–98, 1997–98 to 2003–04, and the period after 2003–04. The years between 1997–98 and 2003–04 witnessed a particularly sharp fall in the growth rate of production and yield of foodgrains, investment, and input use. There was a partial recovery in the period after 2003–04.

As shown in Table 1, in the first phase, that is, from 1989–90 to 1997–98, tractor production grew at 9.2 per cent per annum. In the second phase, 1997–98 to 2003–04, tractor production declined at a rate of –7.7 per cent per annum. It then recovered rapidly, growing at a rate of 11 per cent between 2003–04 and 2009–10.

Table 1 Growth rate of production of tractors, 1989–90 to 2009–10

| Period | Annual compound rate of growth (CGR) |

| 1989–90 to 1997–98 | 9.2 |

| 1997–98 to 2003–04 | –7.7 |

| 2003–04 to 2009–10 | 11.0 |

| 1989–90 to 2009–10 | 4.3 |

Note: Growth rate was estimated from the semi-logarithmic trend line (instantaneous growth rate), Log y = log β1 + β2t, where y = production of tractors, t = time, and β1 and β2 are intercept and slope respectively. β2 is interpreted as the percentage change in production due to one unit change in time. Compound growth rate (r) was calculated from the semi-logarithmic equation using the relationship β2 = log (1+r). So CGR (r) = antilog (β2)–1.

Source: Monthly Abstract of Statistics, CSO, various issues.

It may be mentioned here that the period of recovery of agricultural growth in India, from 2003–04 onwards, is also a period when India’s industrial output, particularly manufacturing output, grew at a rapid pace. At current prices, industrial GDP and GDP from the manufacturing sector grew at an annual rate of 15 per cent between 2003–04 and 2009–10 (RBI 2012). During the same period, the index of industrial production (IIP) increased at a rate of around 9 per cent per year (CSO 2011). After a slowdown during the Ninth Plan period (1997–98 to 2001–02), when industrial GDP grew at 4.4 per cent per year, industrial GDP grew at 8 per cent per year from 2002–03 to 2005–06 (Acharya 2007). Hence, the period of recovery of tractor production also coincides with the period of some revival of general industrial growth in India.

It should also be pointed out that the automobile industry in India (of which tractors are a small part) has grown spectacularly in the last two decades. After an initial recession between 1992 and 1994, production of automobiles in general grew at 7 per cent during the 1990s and at 11 per cent during the 2000s (barring 2007–08). Global automobile companies have entered the Indian market; this is so even in the tractor industry (New Holland in 1998 and John Deere in 2000).

Growth in Domestic Sales

Growth in domestic sales of tractors has followed a similar trend: an annual growth rate of 8.3 per cent was registered between 1990 and 1997, followed by a decline of –7.5 per cent per year between 1997 and 2003, and a recovery at 10.5 per cent after 2003–04 (Table 2 and Appendix Table A1). The sharp fall in sales between 1997–98 and 2002–03, of around 40 per cent, resulted in an inventory pile-up of over 65,000 units by the end of 2002–03, almost twice the level that the industry regarded as acceptable (EPWRF 2003). The strategies followed by manufacturers to counter this included cutbacks in production and a search for export markets (ibid.). As discussed below, from the beginning of the 2000s, exports of tractors expanded rapidly.

Table 2 Growth rate of domestic sale of tractors, 1989–90 to 2009–10

| Period | Annual compound rate of growth |

| 1989–90 to 1997–98 | 8.3 |

| 1997–98 to 2003–04 | –7.5 |

| 2003–04 to 2009–10 | 10.5 |

| 1989–90 to 2009–10 | 4.4 |

Note: See note in Table 1.

Source: Annual Report, Department of Agriculture and Cooperation, Ministry of Agriculture, Government of India, various years.

Growth in Exports

India started exporting tractors in 1987–88, and there has been a consistent increase in exports since then. Over the last two decades, from 1989–90 to 2009–10, exports grew at an annual compound rate of growth of 28.5 per cent (Table 3). The growth rate was above 30 per cent in the first two phases, but declined to 19 per cent after 2003–04. This decline was mainly due to a big fall in exports in the financial year 2009–10. In 2009–10, India exported 34,984 tractors (Appendix Table A1).

Table 3 Growth rate of export of tractors, 1989–90 to 2009–10

| Period | Annual compound rate of growth |

| 1989–90 to 1997–98 | 41.3 |

| 1997–98 to 2003–04 | 34.0 |

| 2003–04 to 2009–10 | 19.0 |

| 1989–90 to 2009–10 | 28.5 |

Note: See note in Table 1.

Source: United Nations Commodity Trade Database.

Exports rose both in absolute terms and as a percentage of total sales. Starting from less than 1 per cent in 1987–88, India’s export of tractors as a percentage of sales increased to nearly 14 per cent in 2008–09. Thus, external demand became an important factor in keeping the tractor industry buoyant in the late 2000s. To boost the country’s export potential of tractors, a 4 per cent duty refund on exported tractors was announced under the Duty Entitlement Passbook scheme of 2009.7 Under this scheme, the basic import duty on imports of items for the manufacture of products that are meant for export is refunded to manufacturers.

The growth in volume of exports has been accompanied by a gradual widening of the international market for Indian tractors (Patel and Gandhi 1996). In 1987–88, tractors were exported to seven countries; the number rose to 26 countries in 1993–94 (ibid.). In 2009, India exported tractors to as many as 98 countries. The USA, Turkey, Nepal, Bangladesh, and Sri Lanka were the major export destinations: the share of these five countries in total quantity exported and total value of exports was 68.5 per cent and 59.2 per cent respectively.8

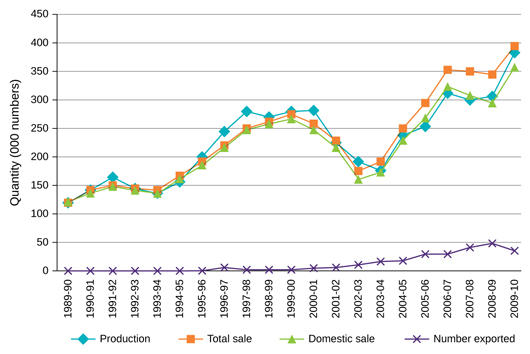

Trends in the growth of production, domestic sales, exports, and total sales of tractors from 1989–90 to 2009–10 are shown in Figure 1.

Figure 1 Production, domestic sales, export, and total sales of tractors in India, 1989–90 to 2009–10

Source: Monthly Abstract of Statistics, CSO, various issues; Annual Report, Department of Agriculture and Cooperation, Ministry of Agriculture, Government of India, various years; United Nations Commodity Trade Database.

A few points clearly emerge from the preceding discussion. First, barring the period of 1997–98 to 2002–03, there was more or less a steady increase in the production and sales of tractors in India. Secondly, the phases of growth of the tractor industry corresponded with phases of growth of agriculture. Thirdly, the period of rapid growth of the tractor industry since 2003–04 partly overlaps with the upward surge in industrial production in general in the 2000s, and with the post-liberalisation growth of the Indian automobile industry in particular. This suggests that, apart from the performance of the agricultural sector, the general industrial environment and internal dynamics of the industry have had a role to play in determining the course of the tractor industry. Lastly, the external demand for tractors of Indian make was an important source of tractor sales in the 2000s.

The Role of Credit in Tractor Sales

Many factors affect domestic sales of tractors, including the growth of farm output and incomes, steady availability of finance, the minimum support prices of agricultural products, the state of the monsoon, public investment in the farm sector, the spread of contract farming, and the demand for labour (influenced, in recent years, by the implementation of the National Rural Employment Guarantee Act and Scheme) (EPWRF 2003; CRISIL 2011). In this paper, I examine only two of these factors, namely, trends in the availability of long-term credit and the growth of public investment over the last two decades.

Formal credit plays a major role in financing the purchase of machinery. According to Pingali (2004), “nearly 95 per cent of purchases of mechanised power in India were through loans taken from banks and agricultural institutions.” A decline in agricultural credit, along with higher interest rates, is likely to have an adverse effect on tractor purchases. Investment in machinery such as tractors and pump-sets constitutes a major component of private investment in agriculture. In a less-developed country, there is little doubt that public and private investments are complementary.

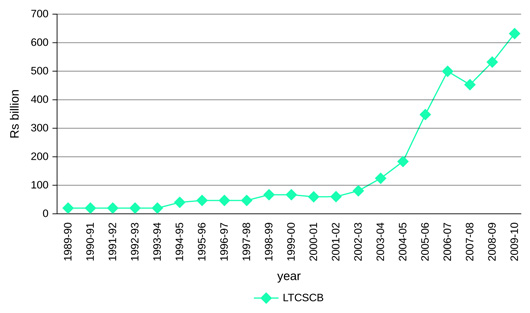

Figure 2 Long-term (direct) credit for agriculture from scheduled commercial banks (LTCSCB), at current prices, 1989–90 to 2009–10 in Rs billion

Source: Handbook of Statistics on Indian Economy, RBI, 2012.

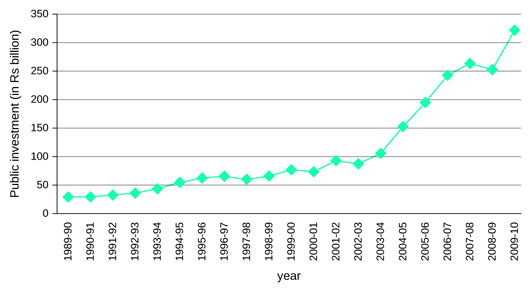

Figure 3 Public investment (gross capital formation) in agriculture, at current prices, 1989–90 to 2009–10 in Rs billion

Source: National Accounts Statistics, CSO, various years.

Figures 2 and 3 show a rise in long-term (direct) credit from scheduled commercial banks as well as in public investment (gross capital formation or GCF) in agriculture after 2002–03, following a long period of stagnation (at current prices).9 Table 4 indicates a slowdown in public investment and flow of credit to agriculture between 1997–98 and 2003–04, and a notable rise thereafter. In a regression exercise where change in domestic sales was the dependent variable, the coefficients of both long-term credit and public investment were positive.10

Table 4 Annual compound growth rate (CGR) of production of tractors, public investment in agriculture (at current prices), and long-term credit for agriculture from scheduled commercial banks (at current prices), over different periods

| Period | Domestic sale of tractors | Public investment in agriculture (GCF) | Long-term (direct) credit for agriculture from scheduled commercial banks |

| 1989–90 to 1997–98 | 8.3 | 12.0 | 12.0 |

| 1997–98 to 2003–04 | –7.5 | 9.3 | 10.2 |

| 2003–04 to 2009–10 | 10.5 | 18.0 | 30.0 |

| 1989–90 to 2009–10 | 4.4 | 12.5 | 19.0 |

Source: For domestic sales: Annual Report, Department of Agriculture and Cooperation, Ministry of Agriculture, Government of India, various years; for public investment: National Accounts Statistics, CSO, various years; for credit: Handbook of Statistics on Indian Economy, RBI, 2012.

While we have identified some of the factors that affect tractor sales at the aggregate level, and tested the relationship between tractor sales on the one hand, and long-term credit from formal sector banks and public investment in agriculture on the other, there are several other factors – such as the scope for custom work, marketing strategies of manufacturers, expenditure on advertising, dealer networks, modes of payment, and so on – that affect tractor sales, and that must be studied in detail for a more complete picture of the determinants of tractor sales.

State-Wise Sale of Tractors

We begin this section with a look at the State-wise density of tractors in India, as measured by the number of tractors per 1,000 hectares of net sown area. Table 5 shows that there is great disparity across States in the number of tractors per 1,000 hectares of net sown area, with Punjab and Haryana being in a class apart. In general, there are more tractors per 1,000 hectares of net sown area in northern Indian States than elsewhere.

Table 5 Number of tractors per 1,000 hectares of net sown area, 2005–08, by State

| State | Number of tractors per 1,000 hectares of net sown area |

| Andhra Pradesh | 8.2 |

| Assam | 0.5 |

| Bihar | 13.1 |

| Gujarat | 15.2 |

| Haryana | 56.4 |

| Jammu & Kashmir | 6.9 |

| Karnataka | 6.0 |

| Kerala | 1.0 |

| Madhya Pradesh | 13.2 |

| Maharashtra | 5.9 |

| Orissa | 2.9 |

| Punjab | 79.3 |

| Rajasthan | 18.9 |

| Tamil Nadu | 9.8 |

| Uttar Pradesh | 47.0 |

| West Bengal | 3.5 |

Note: Computed from Bhalla and Singh (2012).

Although huge regional disparities still exist in the level of tractorisation in the country, recent data on State-level tractor sales show that growth has been relatively high in States where tractor penetration in agriculture was low initially. Thus, over the last two decades, western, eastern, and southern India have emerged as the major markets for tractors. In the more heavily mechanised regions of northern India, the annual growth rate of the sale of tractors was sluggish or even negative in this period: 2.5 per cent in Uttar Pradesh, –2.6 per cent in Punjab, and 0.2 per cent in Haryana (Table 6).11

Table 6 Growth rate of sale of tractors, 1990–91 to 2009–10, by State

| State | Annual compound growth rate |

| Andhra Pradesh | 9.9 |

| Assam | 10.2 |

| Bihar | 9.2 |

| Gujarat | 4.4 |

| Haryana | 0.2 |

| Himachal Pradesh | 14.5 |

| Jammu & Kashmir | 9.9 |

| Karnataka | 8.2 |

| Kerala | –1.6 |

| Maharashtra | 6.4 |

| Madhya Pradesh | 4.0 |

| Orissa | 14.3 |

| Punjab | –2.6 |

| Rajasthan | 4.8 |

| Tamil Nadu | 5.3 |

| Uttar Pradesh | 2.5 |

| West Bengal | 11.2 |

Note: See note in Table 1.

Source: Computed from CIAE (2010).

The differential pattern of growth in sales, with faster growth in the initially laggard States, has reduced the regional concentration of tractor sales over time. To illustrate, the share of the top five States in total tractor sales was 55 per cent during the period 2004–05 to 2009–10, as compared to 70 per cent during the period 1990–91 to 1994–95. The value of the Hirschman–Herfindahl index (HHI) has declined, indicating diversification in State-wise sales of tractors over time (Table 7).

Further, there has also been a change in the composition of the top five States with respect to tractor sales. While Uttar Pradesh, Punjab, Haryana, Madhya Pradesh, and Rajasthan were the top five in the early 1990s (1990–91 to 1994–95), by the end of the 2000s, Punjab, Haryana, and Madhya Pradesh had been replaced by Andhra Pradesh, Maharashtra, and Gujarat.12

Some of the growing demand for tractors is also due to an increase in the use of tractors in construction work. According to Escorts, the company witnessed a nearly 70 per cent increase in the demand for tractors from the infrastructure sector in States such as Maharashtra and Gujarat (Mukherjee and Modi 2011). Similarly, in Bihar, tractor sales have tripled in recent years due to an infrastructure boom (ibid.). While no segment-wise data are available on the purchase of tractors, according to the Tractor Manufacturers Association, around 10–12 per cent of tractors sold in the domestic market are used in the construction sector (ibid.).

Table 7 Share of States in the sale of tractors over different periods

| State | 1990–91 to 1994–95 | 1995–96 to 1999–2000 | 2000–01 to 2004–05 | 2005–06 to 2009–10 |

| Andhra Pradesh | 4.8 | 5.4 | 7.2 | 11.5 |

| Assam | 0.2 | 0.2 | 0.3 | 0.6 |

| Bihar | 2.9 | 4.2 | 7.2 | 5.5 |

| Gujarat | 6.9 | 8.4 | 6.1 | 8.0 |

| Haryana | 12.3 | 9.1 | 6.6 | 7.2 |

| Himachal Pradesh | 0.1 | 0.2 | 0.3 | 0.3 |

| Jammu & Kashmir | 0.3 | 0.2 | 0.6 | 0.4 |

| Karnataka | 3.6 | 3.9 | 5.1 | 6.7 |

| Kerala | 0.4 | 0.3 | 0.2 | 0.3 |

| Madhya Pradesh | 9.2 | 12.0 | 14.1 | 8.0 |

| Maharashtra | 5.1 | 6.8 | 4.6 | 8.8 |

| Orissa | 0.6 | 0.7 | 1.9 | 2.1 |

| Punjab | 16.9 | 11.9 | 8.1 | 6.2 |

| Rajasthan | 8.5 | 9.7 | 8.5 | 9.8 |

| Tamil Nadu | 4.4 | 4.3 | 4.0 | 5.7 |

| Uttar Pradesh | 23.2 | 21.5 | 24.1 | 17.0 |

| West Bengal | 0.7 | 1.0 | 1.3 | 2.0 |

| Total | 100.0 | 100.0 | 100.0 | 100.0 |

| Measures of regional concentration | ||||

| Share of top 5 States | 70.0 | 64.2 | 62.0 | 55.0 |

| HHI | 0.12 | 0.11 | 0.1 | 0.07 |

Note: HHI is defined as  .

Here, Si is defined as the share of the i-th

State and N is the number of States. The value of HHI ranges from 1/N to 1. The

higher the value of HHI, the higher is the concentration.

.

Here, Si is defined as the share of the i-th

State and N is the number of States. The value of HHI ranges from 1/N to 1. The

higher the value of HHI, the higher is the concentration.

Source: Computed from CIAE (2010).

It should be noted that while there has been an increase in the sale of tractors and a closing of the gap between States with respect to sales, there remain wide State-wise variations in the use of tractors. Reported below is a section of the results on use of tractors in different agro-economic regions of India, from a large-scale survey conducted by the National Bank for Agriculture and Rural Development (NABARD) in 2001, on various economic aspects of tractors in India.

Table 8 shows the average annual use of tractors across different agro-climatic regions in the country in 2001. If we assume 1,000 hours per year as the standard annual norm for use of tractors, then, on average, only 59.5 per cent of the total annual capacity was used in the country at that time. Wide variations existed in capacity utilisation across regions. Capacity utilisation was highest in the Karnataka Plateau Division (98.2 per cent) and lowest in the Punjab Plains Division (Arid Zone) (38.3 per cent).

Table 8 Annual hourly use of tractors on own farm and in custom hiring

| Agro-climatic region | Tractor use (in hours) | Total use of tractor time as percentage of standard norm of 1,000 hours | ||

| Own Farm | Custom Hiring | Total | ||

| Trans Gangetic Plains Region | 469 | 85 | 554 | 55.4 |

| Punjab Plains Division (Arid Zone) | 317 | 66 | 383 | 38.3 |

| Punjab Plains Division (Semi-arid Zone) | 631 | 106 | 737 | 73.7 |

| Middle Gangetic Plains Region | 396 | 112 | 508 | 50.8 |

| Bihar Plains Division | 396 | 112 | 508 | 50.8 |

| Western Dry Region | 36 | 494 | 530 | 53.0 |

| Rajasthan Dry Division | 36 | 494 | 530 | 53.0 |

| Central Plateau and Hills Region | 333 | 274 | 608 | 60.8 |

| Eastern Plains and Hills Division | 245 | 433 | 678 | 67.8 |

| Northern Plains Division | 443 | 178 | 621 | 62.1 |

| Central Plateau and Hills Division | 413 | 167 | 580 | 58.0 |

| Vindhya Hills and Plateau Division | 248 | 298 | 546 | 54.6 |

| Southern Plateau and Hills Region | 721 | 261 | 982 | 98.2 |

| Karnataka Plateau Division | 721 | 261 | 982 | 98.2 |

| Eastern Plateau and Hills Region | 228 | 128 | 356 | 35.6 |

| Bihar Chhotanagpur Plateau Division | 228 | 128 | 356 | 35.6 |

| Western Plateau and Hills Region | 419 | 333 | 752 | 75.2 |

| Malwa Plateau Division | 419 | 333 | 752 | 75.2 |

| West Coast Plains and Ghats Region | 400 | 112 | 512 | 51.2 |

| Mysore Coastal and Hills Division | 400 | 112 | 512 | 51.2 |

| Gujarat Plains and Hills Region | 344 | 218 | 562 | 56.2 |

| Gujarat Plains and Hills Division | 518 | 126 | 644 | 64.4 |

| Western Dry Division | 363 | 247 | 610 | 61.0 |

| Saurashtra Plains Division | 215 | 261 | 476 | 47.6 |

| All Regions | 383 | 212 | 595 | 59.5 |

Source: Reproduced from Kishor and Mor (2001).

To summarise, the major trends from State-level data on tractor sales are as follows. In spite of the established and widely discussed fact of regional concentration of the level of tractorisation, there has been increasing diffusion in State-wise sales of tractors over the last two decades. The southern and western States have witnessed rapid growth in tractor sales. In particular, the States of Andhra Pradesh, Maharashtra, and Gujarat have emerged as major hubs of tractor sales in recent years. The data also show an increase in the non-agricultural use of tractors and severe under-utilisation of capacity of tractors in certain parts of the country.

Concluding Remarks

This paper has examined the pace and pattern of tractorisation in Indian agriculture in the period from 1989 to 2009, using data on production and sales of tractors. It would have been useful to complement this analysis with data from buyers. Unfortunately, however, since only aggregate data are available on expenditure on agricultural machinery in different rounds of the All-India Debt and Investment Survey, it has not been possible to separate expenditure on tractors from expenditure on other machinery.

Tractor production in India began in 1961. Today, more than five decades later, India is one of the leading manufacturers of tractors in the world, and exports tractors to many countries. Overall, there was a three-fold increase in tractor production and sales over the last two decades, that is, from 1989–90 to 2009–10. The growth was not uniform over the years, however, and there were at least three periods of negative growth for two or more successive years. The first of these was immediately after liberalisation in 1991, and the second was in the late 1990s and early 2000s. There was a dip in production and sales in the early 1990s and a much larger fall in 2000–03, which was also a period of a serious agricultural crisis. There was another small decline, the third, during 2007–09.

Broadly, the growth in production of tractors may be divided into three phases: a phase of high growth from 1989–90 to 1997–98, followed by a phase of recession between 1998–99 and 2003–04, and, finally, a recovery phase from 2004–05 to 2009–10. These three phases of growth correspond roughly to three phases of change in India’s agrarian economy. The last phase of recovery was also a period of growth in the country’s industrial sector and in the automobile industry in particular.

While the factors affecting the growth in tractor sales are many, this note has examined two in detail: long-term (direct) credit for agriculture from scheduled commercial banks and public investment in agriculture. It was found that changes in these two have had a positive and significant effect on the growth of tractor sales. Further, during the 2000s, exports grew rapidly and export demand boosted domestic manufacturing.

An analysis of tractor sales across Indian States showed that growth was more rapid in States with an initially low level of tractorisation, resulting in a decline in the concentration of sales over time. In particular, growth declined or was even negative in Punjab, Haryana, and Uttar Pradesh, while it rose in states from the south, east, and west of India. In the early 1990s (1990–91 to 1994–95), Uttar Pradesh, Punjab, Haryana, Madhya Pradesh, and Rajasthan were the top five States in terms of average sales of tractors per year, but by the late 2000s (2004–05 to 2009–10), Punjab, Haryana, and Madhya Pradesh had been replaced by Andhra Pradesh, Maharashtra, and Gujarat in the list of the top five States.

In conclusion, these data indicate that domestic production and sales of tractors grew at a rapid pace during most of the years of the 1990s and 2000s with a few exceptions. The data do not support the view of an undifferentiated rural economic decline after 1991. On the contrary, they indicate continued and sizeable capital accumulation (by purchase of tractors) by some sections and in certain regions in the countryside over the last two decades.

Acknowledgement: I am grateful to Madhura Swaminathan for her guidance in preparing this article. I am also thankful to two anonymous referees of this journal for their comments on an earlier draft of this paper. The errors that remain are mine.

Notes

3 Patnaik (2003); Chand (2007); Walker (2008); Bhalla and Singh (2009); Reddy and Mishra (2010); Ramachandran and Rawal (2010); Ramachandran (2011).

4 According to Ramachandran (2011), in the 1997–98 to 2003–04 period, “Many things came together – the lagged effect of a decline in public investment, the withdrawal of state support to agriculture, the crisis in rural credit, the effects of the new WTO-driven trade regime, falling international product prices, and drought – to make this the worst period for rural India under liberalisation.”

5 According to the Annual Report, 2010–11, of the Department of Heavy Industry, Ministry of Heavy Industries and Public Enterprises, Government of India, “the Indian tractor industry is the largest in the world (excluding sub 20 HP belt driven tractors used in China), accounting for one third of global production.”

6 For detailed discussion on earlier phases of growth of the Indian tractor industry, see Aurora and Morehouse (1972); Bhatt (1978); Morehouse (1980); Patel and Gandhi (1996); and Singh (1998, 1998a, 1998b, 2000).

7 See Press Trust of India, “Tractor Exporters to get 4% Duty Refund,” Business Standard, October 21, 2009.

8 See Mail Today Bureau, “India Still Tiny Player in Auto Export Market,” India Today, October 5, 2010.

9 We have not converted the series into constant prices for methodological reasons, but it is clear that, after adjusting for inflation, the growth of both investment and agricultural credit is likely to be very low during the late 1990s to 2003 period.

10 The regression used the first difference of domestic sales of tractors as the dependent variable, and a de-trended first difference of long-term (direct) credit to agriculture (LTCSCB) and public investment in agriculture (GCF) as independent variables (see Sarkar 2013).

11 The viability of investment in and the under-utilisation of tractors in States like Punjab and Haryana have been discussed in various forums. According to a study by the Punjab Agricultural University (PAU), there were 410,000 tractors in Punjab, which is much higher than the 150,000 tractors the State actually needs (EPWRF 2003). A recent study shows that tractors are used for 751.26 hours per year, on average, in Punjab, which is far below the standard norm of 1,000 hours per year, and that nearly 70 per cent of farmers in Punjab use tractors for 500 hours, which is even lower (Singh 2010). Leading manufacturers of tractors now believe that the market for their product in States like Punjab and Haryana is saturated, and that they need to focus on other regions of the country, where the level of mechanisation is low (Indian Express 2008).

12 If we follow the convention in Bhalla and Singh (2009) of categorising the States of India into four regions – northwest, central, eastern, and southern – then, among the five States which emerged as major markets for tractor sales during this period, four States – Rajasthan, Maharashtra, Gujarat, and Madhya Pradesh – fell in the central region, and one State – Andhra Pradesh – fell in the southern region. The authors have shown that in the post-liberalisation era (1990–93 to 2003–06), the central region showed relatively better agricultural performance than the other regions. Output and yield growth rate were higher in the States belonging to this region than in other parts of the country. The growth rate of value of output and yield per hectare between 1990–93 and 2003–06 in the central region were 3.2 per cent and 2.6 per cent per annum respectively, while the average output and yield for the country as a whole grew at 1.7 per cent and 1.5 per cent annually. Growth rates of value of output of the individual States comprising the central region – Rajasthan, Maharashtra, Gujarat, and Madhya Pradesh – were 3.2, 2.1, 5.3, and 2.5 per cent per annum respectively, and growth rates of yields in these States were 2.3, 2.2, 4.6, and 1.9 per cent per annum respectively. In comparison, in Andhra Pradesh, output and yield grew at 1.76 per cent and 2.17 per cent per annum respectively.

References

| Acharya, Shankar (2007), “India’s Growth: Past and Future,” paper presented at the Eighth Annual Global Development Conference of the Global Development Network, Beijing, January 14–16; available at www.gdnet.org/CMS/conference/papers/acharya_plenary1.pdf, viewed on April 30, 2013. | |

| Aurora, G. S., and Morehouse, Ward (1972), “Dilemma of Technological Choice: The Case of the Small Tractor,” Economic and Political Weekly, vol. 7, nos. 31–33, Special Number, August, pp. 1633–44. | |

| Bhalla, Deepak (2010), “Tractor Industry in India: Market Share Analysis of Various Brands of Tractors,” Agricultural Engineering Today, vol. 34, no. 2, pp. 17–26. | |

| Bhalla, G. S., and Singh, Gurmail (2009), “Economic Liberalisation and Indian Agriculture: A Statewise Analysis,” Economic Political Weekly, vol. 44, no. 52, pp. 34–44. | |

| Bhalla, G. S., and Singh, Gurmail (2012), Economic Liberalisation and Indian Agriculture: A District-level Study, Sage Publications, New Delhi. | |

| Bhatia, M. S. (2006), “Sustainability and Trends in Profitability of Indian Agriculture,” Agricultural Economics Research Review, vol. 19, conference number. | |

| Bhatt, V. V. (1978), “Decision Making in Public Sector: Case Study of Swaraj Tractor,” Economic and Political Weekly, vol. 13, no. 21, pp. M30–M45. | |

| Business Line (2011), “Gujarat, Maharashtra Record Highest Growth in Farm Sector,” July 13; available at http://www.thehindubusinessline.com/industry-and-economy/gujarat-maharashtra-record-highest-growth-in-farm-sector/article2221709.ece, viewed on May 3, 2013. | |

| Chand, Ramesh (2007), “Demand for Foodgrains,” Economic and Political Weekly, vol. XLII, no. 52, pp. 10–13. | |

| Chandrasekhar, C. P. (2007), “The Progress of ‘Reform’ and Retrogression of Agriculture,” Macroscan; available at http://www.macroscan.com/anl/apr07/anl250407Agriculture.htm, viewed on February 19, 2013. | |

| Chandrasekhar, C.

P. (2009), “Global Economic Crisis and Its Impact on the Agrarian Situation in

India,” available at http://www.agrarianstudies.org/UserFiles/File/Chandrasekhar,%20_Global%20Economic%20Crisis%20 and%20Its%20Impact%20on%20the%20Agrarian%20Situation%20in%20India,_.pdf, viewed on February 19, 2013. | |

| Central Statistical Organisation (CSO) (various issues), Monthly Abstract of Statistics, Ministry of Statistics and Programme Implementation, Government of India, New Delhi. | |

| Central Statistical Organisation (CSO) (various issues), National Accounts Statistics, Ministry of Statistics and Programme Implementation, Government of India, New Delhi. | |

| Central Institute of Agricultural Engineering (CIAE) (2010), Agricultural Engineering Data Book, Central Institute of Agricultural Engineering, Bhopal. | |

| CRISIL Research (2011), Customised Research Bulletin, Sector focus: Automobile, September; available at http://crisil.com/pdf/research/CRISIL-Research-cust-bulletin_sept11.pdf, viewed on March 25, 2012. | |

| Department of Agriculture and Cooperation (DOAC) (various years), Annual Report, Ministry of Agriculture, Government of India, New Delhi. | |

| Department of Heavy Industries (various years), Annual Report, Ministry of Heavy Industries and Public Enterprise, Government of India, New Delhi. | |

| EPW Research Foundation (EPWRF) (2003), “Tractor Industry: Due for Restructuring,” Economic and Political Weekly, vol. 38, no. 43, pp. 4496 | |

| Galab, S., Revathy, E., and Reddy, P. Prabuddhikar (2010), “Farmers’ Suicides and Unfolding Agrarian Crisis in Andhra Pradesh,” in Reddy, D. Narasimha, and Mishra, Srijit (eds.), Agrarian Crisis in India, Oxford University Press, New Delhi, pp. 164–98. | |

| Gopal, Navjeevan (2008), “Bad Loans Put Brakes on Punjab’s Tractor Run,” Indian Express, May 23; available at http://www.indianexpress.com/news/bad-loans-put-brakes-on-punjab-s-tractor-run/313398/1, viewed on February 3, 2013. | |

| Kishor, Vimal, and Mor, R. S. (2001), “Economics of Tractors,” Occasional Paper 18, National Bank for Agriculture and Rural Development (NABARD), Mumbai. | |

| Mail Today Bureau, “India Still Tiny Player in Auto Export Market,” India Today, October 5; available at http://indiatoday.intoday.in/story/india-still-tiny-player-in-auto-export-mkt/1/115109.html, viewed on February 3, 2013. | |

| Morehouse, Ward (1980), “Technology and Enterprise Performance in the Indian Tractor Industry: Does Self Reliance Measure Up?” Economic and Political Weekly, vol. 15, no. 51, pp. 2139–52. | |

| Mukherjee, Sharmistha, and Modi, Ajay (2011), “Tractor Sales Grow on Demand from Agri and Non-Agri Sectors,” Business Standard, August 19; available at http://www.business-standard.com/article/companies/tractor-sales-grow-on-demand-from-agri-and-non-agri-sectors-111081900114_1.html, viewed on April 20, 2013. | |

| Patel, N. T., and Gandhi, Madalasa (1996), “Profile and Impact of Tractorisation,” Working Paper no. 1305, Indian Institute of Management, Ahmedabad. | |

| Patnaik, Utsa (2003), “Global Capitalism, Deflation and Agrarian Crisis in Developing Countries,” Journal of Agrarian Change, vol. 3, nos. 1 and 2, pp. 33–66. | |

| Pingali, Prabhu (2007), “Agricultural Mechanisation: Adoption Patterns and Economic Impact,” in R. Evenson and Prabhu Pingali (eds.), Handbook of Agricultural Economics, vol. 3, North-Holland, Amsterdam, Chapter 54, pp. 2779–805. | |

| Pingali, Venugopal (2004), Input Management, State of Indian Farmer: A Millennium Study, vol. 8, Department of Agriculture and Cooperation, Ministry of Agriculture, Government of India, New Delhi. | |

| Press Trust of India (2009), “Tractor Exporters to get 4% Duty Refund”, Business Standard, October 21; available at http://www.business-standard.com/india/news/tractors-exporters-to-get-4-duty-refund/76439/on, viewed on February 3, 2013. | |

| Ramachandran, V. K. (2011), “The State of Agrarian Relations in India Today,” The Marxist, vol. 17, nos. 1–2, pp. 51–89. | |

| Ramachandran, V. K., and Rawal, Vikas (2010), “The Impact of Liberalisation and Globalisation on India’s Agrarian Economy,” Global Labour Journal, vol. 1, issue 1, pp. 56–91. | |

| Reddy, D. Narasimha, and Mishra, Srijit (2009), “Agriculture in the Reforms Regime,” in D. Narasimha Reddy and Srijit Mishra (eds.), Agrarian Crisis in India, Oxford University Press, New Delhi pp. 3–43. | |

| Reserve Bank of India (RBI) (2012), Handbook of Statistics on Indian Economy, Reserve Bank of India, Mumbai. | |

| Sarkar, Anupam (2013), “Mechanisation in Contemporary Indian Agriculture,” Ph.D thesis, University of Calcutta, Kolkata. | |

| Sen, Abhijit (2004), “‘Shining’ Rural India,” Macroscan; available at http://www.macroscan.com/cur/may04/cur070504Rural_India_1.htm, viewed on February 28, 2013. | |

| Singh, G. (1998), “Production and Use of Tractors in India, in Increasing the Impact of Engineering in Agriculture and Rural Development,” Discussion Paper Series no. 30, Deliberations of a think tank, International Rice Research Institute (IRRI), February 26–28; available at www.irri.org. | |

| Singh, Gyanendra (1998a), “An Analytical Approach to Farm Mechanisation in India: Agricultural Mechanisation Development and Promotion,” Journal of Rural Development, vol. 7, no. 2, pp. 297–319. | |

| Singh, Gyanendra (1998b), “Modernisation of Agriculture in India, Part-1: Farm Mechanisation,” Agricultural Situation in India, vol. 46, no. 10, January, pp. 583–91. | |

| Singh, Gyanendra (2000), “Growth Pattern and Performance Characteristics of Tractors Used in India,” Landwards, vol. 55, no. 1, pp. 17–25. | |

| Singh, Karam (2010), “Agrarian Crisis in Punjab: High Indebtedness, Low Returns and Farmers’ Suicides,” in D. Narasimha Reddy and Srijit Mishra (eds.), Agrarian Crisis in India, Oxford University Press, New Delhi, pp. 261–84. | |

| Singh, Sukhpal (2010), Agricultural Machinery Industry in India: Growth, Structure, Marketing and Buyer Behaviour, Allied Publishers, New Delhi. | |

| Times News Network (TNN) (2008a), “Defaults Put Farm Loans on Hold,” Economic Times, May 20; available at http://articles.economictimes.indiatimes.com/2008-05-20/news/27696260_1_loan-waiver-scheme-farm-loans-bad-loans, viewed on February 3, 2013. | |

| Times News Network (TNN) (2008b), “Freeze on Tractor Loans by SBI due to Rising Defaults Justified,” Economic Times, May 21; available at http://articles.economictimes.indiatimes.com/2008-05-21/news/27691798_1_tractor-loans-loan-waiver-scheme-largest-agriculture-portfolio, viewed on February 3, 2013. | |

| United Nations Commodity Trade Statistics Database, http://comtrade.un.org/. | |

| Vaidyanathan, A. (2010), Agricultural Growth in India: Role of Technology, Incentives and Institutions, Oxford University Press, New Delhi. | |

| Vyas, V.S. (1982), “South Asian Experience in Agricultural Mechanisation,” Working Paper no. 430, Indian Institute of Management, Ahmedabad. | |

| Walker, Kathy Le Mons (2009), “Neo-liberalism on the Ground in Rural India: Predatory Growth, Agrarian Crisis, Internal Colonisation, and Intensification of Class Struggle,” Journal of Peasant Studies, vol. 35, no. 4, pp. 557–620. |

Appendix Table A1 Production, sales and export of tractors, 1989–90 to 2009–10

| Year | Production (000 numbers) | Annual percentage change in production | Total sales (000 numbers) | Annual percentage change in total sales | Domestic sales (000 numbers) | Annual percentage change in domestic sales | Quantity exported | Annual percentage change in export | Export as percentage of total sales |

| 1989–90 | 125 | – | 122 | – | 122 | – | 360 | – | 0.29 |

| 1990–91 | 143 | 14.40 | 140 | 14.75 | 139 | 14.56 | 371 | 3.06 | 0.27 |

| 1991–92 | 166 | 16.08 | 151 | 7.86 | 150 | 7.74 | 325 | –12.40 | 0.22 |

| 1992–93 | 147 | –11.45 | 144 | –4.64 | 143 | –4.51 | 845 | 160.00 | 0.59 |

| 1993–94 | 139 | –5.44 | 139 | –3.47 | 138 | –3.94 | 1041 | 23.20 | 0.75 |

| 1994–95 | 158 | 13.67 | 165 | 18.71 | 163 | 18.02 | 2163 | 107.78 | 1.31 |

| 1995–96 | 202 | 27.85 | 191 | 15.76 | 188 | 15.74 | 3041 | 40.59 | 1.59 |

| 1996–97 | 245 | 21.29 | 221 | 15.71 | 217 | 15.32 | 3811 | 25.32 | 1.72 |

| 1997–98 | 278 | 13.47 | 251 | 13.57 | 248 | 14.36 | 2890 | –24.17 | 1.15 |

| 1998–99 | 273 | –1.80 | 262 | 4.38 | 259 | 4.38 | 3136 | 8.51 | 1.20 |

| 1999–2000 | 280 | 2.56 | 273 | 4.20 | 270 | 4.34 | 2746 | –12.44 | 1.01 |

| 2000–01 | 285 | 1.79 | 255 | –6.59 | 250 | –7.56 | 4827 | 75.78 | 1.89 |

| 2001–02 | 226 | –20.70 | 225 | –11.76 | 220 | –12.12 | 5587 | 15.74 | 2.48 |

| 2002–03 | 192 | –15.04 | 173 | –23.11 | 162 | –26.07 | 10682 | 91.19 | 6.17 |

| 2003–04 | 179 | –6.77 | 190 | 9.83 | 175 | 7.64 | 15515 | 45.24 | 8.15 |

| 2004–05 | 242 | 35.20 | 248 | 30.53 | 231 | 32.32 | 16216 | 4.52 | 6.55 |

| 2005–06 | 254 | 4.96 | 296 | 19.35 | 268 | 15.79 | 28247 | 74.19 | 9.54 |

| 2006–07 | 311 | 22.44 | 353 | 19.26 | 324 | 21.14 | 28318 | 0.25 | 8.03 |

| 2007–08 | 304 | –2.25 | 347 | –1.70 | 308 | –5.04 | 38407 | 35.63 | 11.08 |

| 2008–09 | 303 | –0.33 | 343 | –1.15 | 295 | –4.09 | 47344 | 23.27 | 13.81 |

| 2009–10 | 383 | 26.40 | 394 | 14.87 | 359 | 21.44 | 34984 | –26.11 | 8.88 |

Note: These are estimates of “complete tractors” only, produced in the country as provided by CSO (and also Economic Survey, Ministry of Finance, Government of India). However estimates of tractor production as provided by different manufacturers’ associations, such as the Tractor Manufacturers Association (TMA), Automotive Component Manufacturers Association (ACMA), etc., are a little different. Specifically, estimates of tractor production provided by manufacturers’ associations in the period after 2002–03 are higher than the CSO estimates. Hence there are differences in periodic growth rates of production of tractors. But all these databases show the same broad trends in tractor production.

Source: Monthly Abstract of Statistics, CSO, various issues; Annual Report, Department of Agriculture and Cooperation, Ministry of Agriculture, Government of India, various years; United Nations Commodity Trade Database.