ARCHIVE

Vol. 2, No. 1

JANUARY-JUNE, 2012

Research Articles

Research Notes and Statistics

Special Essay

Field Reports

Book Reviews

Mexican Agriculture and NAFTA:

A 20-Year Balance Sheet

Alicia Puyana*

*Professor of Economics, Latin American Faculty of Social Sciences (FLACSO), Mexico, alicia.puyana@gmail.com.

Abstract: The structural reforms institutionalized after the debt crisis of early 1980, and the implementation of the North American Free Trade Agreement (NAFTA), forced Mexican agricultural sector to compete with agricultural imports from the United States without any consideration to either the gap in productivity or the large subsidies given to producers under the U. S. Farm Bill, which reduces export prices well below production costs. Mexican producers had to confront the power of a handful of traders who controlled the domestic market and prevented any benefits from coming to small producers or consumers. The effects of NAFTA, consequently, have been several: a deterioration of rural incomes, the prevalence of rural poverty and income concentration, and a continuing threat to food security.

Keywords: Mexico, NAFTA, agriculture, peasants, poverty, foreign trade.

Introduction

Of the medium-sized economies in the world today, Mexico is among those that have taken economic liberalisation the furthest. Its economy is characterised by near-elimination of import tariffs, and, in general, by free movement of good, services, and capital. Mexico began to liberalise its economy from December 1982, gradually abandoning the import substitution industrialisation (ISI) model introduced in 1940. The role of the government in the economy was reduced by selling public enterprises, especially in the transport and telecommunication sector, by deregulating banks and financial institutions, and decreasing government investments. Only the oil and electricity companies in the public sector escaped the privatising drive. The process of liberalisation included opening up the country's economy to foreign capital inflows while maintaining a largely closed labour market. The liberalisation of the agricultural sector was carried out with identical or greater zeal than the liberalisation of the economy as a whole.

The net benefit that accrues to a country due to the opening up of its economy, or its integration in a larger economy depends on whether the overall benefits to those who end up as gainers are greater than the costs to those who come out as losers. Compensation to the latter group may be effected via tax transferences; that is, by levying taxes on the gainers, and transferring all or part of the revenues from such taxes to the losers. Fiscal policies of this kind, however, are mediated by political systems and by structures of power: what often prevails is a policy of leaving the primary distribution of income untouched, or making it even more unequal.

Several studies suggest that Mexico's agricultural sector and its income-poor rural population have thus far been the net losers from the liberalisation of the country's economy. The negative discrimination towards agriculture initiated during the import substitution phase has remained in place, and the agricultural sector has been a net loser since the reforms.

This paper explores the impact of trade reforms on the performance of Mexico's agricultural sector, with emphasis on the peasant sector. It is organised as follows: the second section presents a brief analysis of the liberalisation of the Mexican economy, and of the terms of negotiation of the North American Free Trade Agreement (NAFTA), signed in 1993 between Canada, Mexico, and the United States of America. The third section presents macroeconomic trends in the economy and agriculture of Mexico after liberalisation. Section four illustrates the main structural changes in agriculture linked to changes in prices, and the impact of such changes on rural income concentration and rural poverty. Section five discusses the survival strategies of the peasants and the official responses to these strategies. A large amount of statistical information is provided to familiarise readers with the not-so-brilliant track followed by Mexican agriculture and the Mexican economy at large.

Liberalising the Mexican Economy

The Path to the General Agreement on Tariffs and Trade (GATT)

The liberalisation of the Mexican economy took place in two stages. The first phase (1985–87) covered the move towards liberalisation, which led to accession to the General Agreement on Tariffs and Trade (GATT). The second period (1994–2011) covered the years of the North American Free Trade Agreement (NAFTA), from negotiations to full instrumentality. Total liberalisation of intra-regional trade was achieved in 2008.

Between 1983 and 1984, the Mexican authorities dismantled the protection afforded to the country's industry. Over those two years, 16.5 per cent of imports were excluded from import permits, and the average tariff rate was reduced to 22 per cent. On April 22, 1985, Mexico signed a Bilateral Trade Agreement on Compensatory Duties with the United States. This was followed, on July 24, 1985, by Mexico's formal entry into GATT (Puyana 2010). This stage of unilateral liberalisation was radical and marked by an anti-labour bias, since it liberalised labour-intensive manufactures and agriculture at a faster rate than other sectors (Hanson 2003). Sectoral policies in agriculture were reformed in line with those prevailing in the more developed countries: subsidies and reference prices were transformed into cash transfers for particular products, and quotas were eliminated. Rural development banks were transformed into private investment and financial institutions, and the State Trading Organisation (Compañía Nacional de Suminstros Populares, or CONASUPO) was dismantled (De Ingco et al. 2002). To complement these reforms, in 1992, seven years after joining GATT, the Mexican government reformed the country's Constitution, and changed the legal status of ejidal property by allowing communal land to be leased out or sold.1 This change, not related to the GATT or NAFTA negotiations (Cornelius et al. 1998), was based on the "modernisation" ideology of the Presidency of Carlos Salinas de Gortari (1988–94) (Frye 1994, Salinas 1997).

NAFTA and the Perils of Asymmetric Negotiations

President Miguel de la Madrid (1982–88) brought a modernising elite of highly educated economists and political scientists to positions of power. These were people who had undergone "academic training in neoclassical economics – often with graduate degrees from the most prestigious U. S. economics departments" (Fairbrother 2004 and 2005). They were convinced of the need to transform Mexico's political and economic institutions, and were instrumental in fashioning the reforms. This elite was promoted to even higher posts when Carlos Salinas was elected President. They intensified the reform process, and also acted as the architects of NAFTA (Babb 1998; Fairbrother 2004; Fourcade-Gourinchas and Babb 2002; Woods 2005).

President Salinas de Gortari saw NAFTA as a safety measure to prevent future governments from reversing (or putting the brakes on) the reform process initiated in 1983, after the eruption of the debt crisis. For him, the Agreement was a tool to pave the way towards a modern Mexico, in which few traces of the Mexican revolution and Mexican corporatism would remain (Salinas 1997). Salinas's implicit strategy included establishing more close and unwavering political and economic cooperation with the United States (Lustig 1992, p. 169). It was for that reason, some analysts suggest, that Salinas and the Mexican negotiators were eager to sign the Agreement at any cost (Ros 1994). The Mexican negotiators were convinced that NAFTA would solve all problems of underdevelopment in the country. Jagdish Bhagwati commented on their sense of urgency to reach an agreement as follows:

[The Mexican negotiators] look at problems from the same viewpoint as those from north of the Rio Bravo. They were highly impressed by the United States, and wanted to emulate it. They say, "the United States is performing well; if we join them all Mexican problems will be over" (Bhagwati 1999, p. 24).2

Within Mexico, two main groups supported NAFTA: the States and the political elite, which were motivated by the political reasons already mentioned, and the large, export-oriented business groups, which were interested in a less liberal agreement, with particularly stringent rules for sectors such as automobiles and textiles (Fairbrother 2004; Whally 1993). In fact, business lobbies were responsible for the most protectionist clauses of NAFTA (Thacker 2000).

In addition to economic disparities, the negotiators faced difficulties due to the differences between the two countries in other critical aspects. These included differences in institutional frameworks, differences with regard to the importance of the agreement for each country, and differences in the degrees of democracy to which the respective governments were subject. Mexico, with a more centrally controlled and regulated economy, had to change its model in accordance with the NAFTA regulations, in which the "Anglo-Saxon" free-market principles ruling the economies of Canada and the United States predominated (Wonnacott 1994). While Mexico's primary interest in signing NAFTA was because it saw it as an instrument that would guarantee stability, growth, and modernisation, the Agreement aroused little interest in the United States for these reasons (Lustig 1992, p. 168; Whally 1993, pp. 367–80). Taking these disparities into consideration, some analysts have suggested that the NAFTA negotiations have given rise to a centre–periphery model that yields greater benefits to the more developed economy (Bhagwati 1993).

Consequently, Mexico engaged in a negotiating process marked by several asymmetries. At the time of negotiating NAFTA, per capita GDP in the United States was between 16 to 21 times greater than in Canada and Mexico respectively, and Mexico's agricultural GDP was 15 per cent of that of the United States. External sales of the United States exceeded Mexican sales by a factor of 5, and Canadian exports were 1.8 times greater than Mexican exports. Mexico's GDP totalled USD 475 billion (in constant 2000 dollars) while GDP in the United States had reached USD 7.7 trillion. Nevertheless, NAFTA did not (and does not) include any compensatory mechanisms or transfers to speed up growth among the less developed member-countries. It was agreed in 1990, during the Houston meeting, that

Mexico would not be treated as a developing country in the negotiations, meaning that it would not receive preferential treatment in matters such as transition periods for the elimination of tariffs (Cameron and Brian 2000).

Smith (1993, p. 82) wrote that "Mexican participation in NAFTA is another major step in the dramatic liberalisation of the Mexican economy since the mid-1980s," and that

in spite of the differences in incomes and the worries about the costs to labour of the adjustment, the NAFTA negotiators are developing an accelerated chronogram and Mexico will rapidly be integrated into the economy of the rest of the region (ibid., p. 85).

Much Ado about Nothing?

Several studies carried out ex ante regarding the negotiations and implementation of the Treaty generally accepted that the overall negative effects of NAFTA would be rather small, and that it would benefit Mexico in greater proportion than the United States or Canada because of the relatively small size of the Mexican economy (Fairbrother 2004, p. 9; Puyana and Romero 2009). It was also acknowledged that the overall benefit that would accrue to Mexico would not be very significant, and would favour mainly capital-intensive industries with high economies of scale. Small industries and sectors with comparative advantages, i.e., intensive with respect to labour and land, would be left behind (Ros 1994, p. 96).

A number of factors explain why low economic benefits were expected from NAFTA. First, the Agreement implied only small changes in tariff rates, since trade flows between Mexico and the United States were practically free. Secondly, an increase in exports from the United States to Mexico would not have a major impact on GDP in the United States due to the relatively small scale of the Mexican market. Thirdly, trade between Mexico and Canada was fairly small, and was not likely to grow to a high level (Lustig 1994, p. 170). Fourthly, trade between Canada and the United States was liberalised under the Canada–United States Free Trade Agreement (CUSFTA).

At the time of signing the Agreement, the average trade tariff in Mexico was 10 per cent and the U. S. tariff was about 2.1 per cent. Half of Mexico's exports entered the U. S. market under the Generalized System of Preferences (GSP) programme, and another large proportion was geared towards the maquilas (the Mexican term for garment manufacturing). Under NAFTA, U. S. tariffs declined by a mere 0.61 per cent (Clinton 1997, p. 1). Textiles and apparel were subject to special clauses under the Multifibre Agreement, and some other sectors were a part of bilateral programmes, as was the case with the automobiles sector. In the agriculture sector, quotas and seasonal restrictions on trade were maintained, and a longer liberalisation period was agreed upon. Despite these commitments, Mexico fully liberalised all imports from the United States of maize, beans, and other agricultural products from the very first day of the implementation of NAFTA, January 1, 1994.

Mexico agreed to fast and total liberalisation of trade in agricultural products without regard to Mexico's dualistic social fabric and economic structure, in which a very large universe of small producers coexists with a handful of large producers, many of whom are linked to multinational corporations. For example, according to the most recently available data, agricultural producers owning plots smaller than 2 hectares constituted 34 per cent of producers, but owned a mere 3.8 per cent of all agricultural land (Puyana et al. 2012). Despite the land reform measures initiated after the Mexican revolution in 1917 and furthered during the Cardenas presidency of 1934-40, the Gini index of the distribution of land ownership is 0.62, considerably higher than the coefficient for the distribution of income, 0.50 (Deininger and Olinto 2000, p. 15). The gap between Mexico and the United States with respect to agricultural productivity and yields is large and increasing, as are the productivity and yield gaps between large and small agricultural producers within Mexico. A similar dual structure exists in the manufacturing sector, with almost 90 per cent of the establishments defined as micro or small firms with less than five workers each generating a large share of total employment. The effects of free trade will inevitably be different for each type of producer.

The Intensity of Liberalisation in Agriculture

Mexican agriculture has been the main loser of the economic reforms and NAFTA. To illustrate this, this section first discusses some features of the commitments made by Mexico under NAFTA, and, secondly, some sectoral developments in the Mexican economy.

It was recognized that there would be both gainers and losers from NAFTA, particularly in the agricultural sector, and that, to counterbalance losses, it was necessary to introduce intensive programmes of public investment aimed at creating non-agricultural rural jobs and sources of income (Casco and Romero 1997, p. 82). These programmes were not realised as a result of, inter alia, the 1994 financial crisis and the lack of political will thereafter (Puyana and Romero 2008 and 2009).

NAFTA was a key element in the policy of modernising the Mexican agricultural sector, which the modernising elite has considered to be the cause of low productivity growth in the national economy. Small peasants and ejidatarios (small owners of land, part of which was communal land and could not be sold) were labelled the most conservative sections of society, and a free market was seen as the way to force them into modernity (Salinas 1997). This push began with the amendment of Article 27 of the National Constitution and the measures adopted on joining GATT, together with programmes implemented within the framework of structural adjustment. Among the policy reform instruments introduced to bring about the changes necessary to raise sectoral productivity were increased cultivation of fruits and vegetables and a reduction in the production of basic grains and oilseeds, both of which led to land and investment being allocated to more competitive products with higher returns. NAFTA aimed to increase agricultural productivity by inducing the movement of labour, land, and capital away from grain and towards fruit and vegetables, while reducing overall employment in the agricultural sector.

The general idea was that the agricultural sector's share in total employment and total GDP should be similar to the United States. The share of agriculture in total employment was thus to fall from 23 per cent to about 6 per cent. Such intensive social engineering was to ensure a rise in aggregate wages, and the external trade balance was to change, with increased imports of basic grains and oilseeds, and the increased exports of fruit and vegetables. As will be seen below, some of these effects have indeed been felt.

The agreements reached under NAFTA do not reflect the asymmetries between the agricultural and livestock sectors of Mexico and its NAFTA partners. In the list of critical products scheduled for opening up after 10 to 15 years, during which time tariffs and quotas would apply, the United States included farm products representing 17.3 per cent of its imports from Mexico, while Mexico included only 12.6 per cent of its imports from the United States. Mexico reserved its market for imports of corn and beans, representing 7.2 per cent of total agricultural imports, for 15 years with quotas and tariffs, and the United States reserved vegetables, citrus, and other fruit, in which Mexico had been an efficient world exporter for decades. The United States imposed seasonal quotas on these products, limiting the trade-creation effect and hurting Mexican exporters. By contrast, the Mexican government decided, from the very first day of NAFTA's implementation, to import maize and beans in excess of the quotas without charging the respective tariffs, and thus exposed its market more rapidly than agreed to competition with subsidised imports from the United States (Puyana and Romero 2008, p. 132; Wise 2010, p. 15). This policy was in response to pressure from stockbreeders and millers.

Mexico granted the United States a 15 per cent tariff preference against imports originating in non-member countries (and to its national production) and received a preference of only 2 per cent in return. As a result of the United States' entering unilaterally in to several preferential agreements, the tariff preference for Mexico has fallen by 50 per cent (Puyana and Romero 2005c). The existing low tariff preference can be eliminated if there is a marginal revaluation of the real exchange rate or by gains in productivity or reduction of profit margins in competing countries.

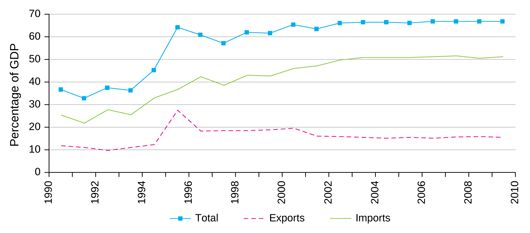

In 2010, Mexico's agricultural sector showed a higher degree of openness than the economy as a whole. The external coefficient of the agricultural sector (the ratio of exports and imports to GDP) was 66.7, almost 4 percentage points above the economy-level coefficient. Imports contributed substantially to increasing the openness, and came to represent more than 50 per cent of GDP. Exports accounted for less than 17 per cent of GDP (Figure 1). With such intense liberalisation, one would expect a strong impact of external prices on domestic producer and consumer prices, productivity, factor-location, employment, and income. It is evident that exports expanded in the aftermath of devaluation, as in 1995.

The liberalisation of trade in specific products was even greater and increased substantially after 1994. For example, from 1994 to 2008, the imported content of consumption of corn escalated from 10 per cent to 32 per cent. In wheat, the rise was from 19 per cent in 1994 to nearly 61 per cent in 2008 (Puyana 2010).3

Figure 1 External coefficient of Mexico's agricultural sector in percentages of sectoral GDP, 1990–2010

Note: External coefficient=ratio of exports and imports to GDP

Source: Author's calculations, based on INEGI, SNCN, http://www.inegi.org.mx/est/contenidos/proyectos/scn/default.aspx, viewed on July 12, 2012.

The dangers of such a strategy for Mexico emerge from the competitive character of the agricultural sectors of Mexico and the United States, in the sense that they produce the same goods at different costs. They both produce maize, wheat, rice, citrus, and other fruit and vegetables. Further, Mexico has been a major supplier of tomatoes, strawberries, and other fruits in the months coinciding with harvests in the United States. So Mexico has to accept seasonal quotas. An additional fact is the urban bias in public policy, such as the implicit objective of importing subsidised maize, rice, beans, and other agricultural food products from the United States in order to maintain low wage inflation in urban areas. Subsidised imports favour economic activity and job creation in the main cities, forcing an overall reduction of employment in agriculture, and inducing movement of labour, land, and capital out of cultivating grain and into fruit and vegetables.

One of the effects of these cheap imports has been a contraction of the share of rural income in total income, from 21.8 per cent in 1980 to 12.4 per cent in 2010. The share of rural households in total households experienced a sharper decline, from 35 in 1984 to 21.4 in 2010. The reduction in the number of rural households explains the relative increase in the average income per household.

Mexican Agriculture under NAFTA

The Macroeconomic Trend

As noted above, since the mid-1980s, the Mexican economy has evolved into an open economy, with one of the highest external coefficients relative to GDP in the western hemisphere. In 2011, the external coefficient of the economy was 63 per cent of GDP. Such a large external coefficient would generally suggest higher productivity and competitiveness, since both exportable and importable goods compete with foreign production. In Mexico, however, it indicates a larger dependence on imported supplies and inputs. The increased GDP elasticity of imports (3.5 per cent), means that a one percent increase in GDP induces a 3.5 percent growth in imports, which makes it difficult, if not impossible, to simultaneously ensure positive rates of GDP growth, balanced trade, and a manageable current accounts deficit, that is, one not larger than 2 per cent of GDP.4

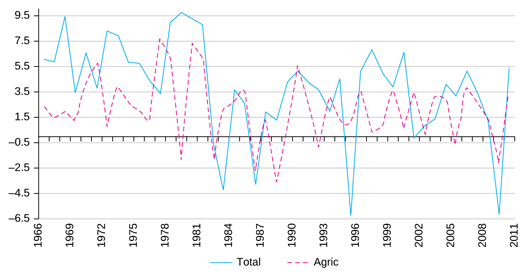

The Mexican economy has not performed better in the reforms era than in the import substitution period. The reforms introduced in 1983–84 were designed to eliminate some of the causes of the economic downturns the country had experienced since the 1970s, but they failed to shield Mexico from economic shocks in 1986, 1994, and 2009. In an attempt to stabilise the economy, various measures were introduced: devaluation, reduction of real wages, fiscal cuts, and monetary stringency (Moreno-Brid and Ros 2009). Overall, from 1982 to 2010, Mexico's total and per capita GDP, and GDP per worker registered the lowest growth rates since 1900 (Puyana 2011). On average, GDP growth between 1982 and 2010 was only 34.6 per cent of the rate registered over 1950–80. The expansion resulted from higher labour force participation rather than from productivity growth (Moreno-Brid and Ros 2009). In that context, the agricultural sector showed an even weaker trajectory, as Figure 2 indicates. In the period 1965–82, the economy expanded at an average annual rate of growth of 6.3 per cent, while agriculture lagged behind at 2.3 per cent. In the post-reforms period (1983–2010) these rates were 2.9 per cent and 1.6 per cent respectively, and under NAFTA, they declined to 2.6 per cent and 1.4 per cent.

Figure 2 Growth rates of value added in the agricultural sector and in the Mexican economy as a whole

Source: Author's calculations, based on INEGI, SNCN, http://www.inegi.org.mx/est/contenidos/proyectos/scn/default.aspx, viewed on July 12, 2012.

Macroeconomic reforms aimed at dismantling the import substitution regime were expected to eliminate discrimination against agriculture and to stimulate its productivity. To the contrary, however, severe adjustment programmes resulted in slowing down growth, affecting the internal demand for agricultural produce, and failing to remove the urban bias of the import substitution industrialisation policy. Some agricultural producers did nevertheless benefit from protection and subsidies during the import substitution period, in much the same way as a large part of the industrial sector did. Agricultural inputs for industry and large-scale modern production for exports were granted all types of subsidies, inducing higher real rates of protection. Producers of such goods were able to orchestrate opposition to preserve some of these support policies (Jaramillo 1998; Jisamatsu 1998). As a result of the adjustment programmes, the agriculture sector continued to decline as a source of growth of GDP and employment, and to register relatively low growth in productivity.

Why Is Mexican Agriculture in Decline?

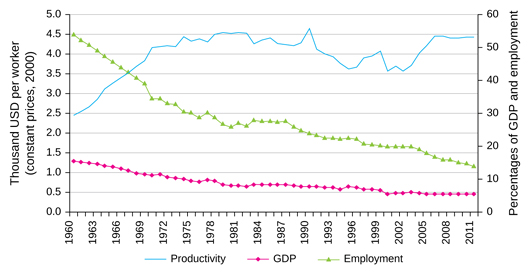

Contrary to predictions, the share of agriculture in total GDP and employment declined with little, if any, gains in productivity from 1994. The contribution of agriculture to total GDP did not grow as expected, but decreased. The strategy devised by the Mexican authorities to increase productivity in agriculture was aimed at displacing employment in agriculture and not at increasing the cultivation of agricultural products.5 During the period 1960–81, the share of agricultural employment in total employment fell by 50 per cent while agricultural productivity grew at an annual rate of 4.1 per cent. In 1981–2010, productivity fell by 1.6 per cent (Figure 3), and the share of employment decreased by 37 per cent. The critical years of 2007–08 witnessed a partial recovery of productivity in agriculture. This was a result of the increase in international prices of crops such as corn, which in turn is explained by the increase in demand to produce ethanol for fuel.

The productivity gap between Mexico and the United States continues to widen. As mentioned above, in 1994, agricultural productivity in the United States was 10 times higher than Mexico; in 2010, the factor increased to 15.5. Competing with the United States is becoming harder as time passes and as the United States consolidates its lead as an agricultural exporter, increasing its own competitiveness with generous policy instruments, such as the Farm Bill, which affect international prices. It is important to bear in mind that for the majority of agricultural products that Mexico exports to the United States, such as tomatoes, oranges, grapefruit, vegetables, etc., Mexicans are in competition with producers in the United States. Consequently, if domestic productivity does not grow faster, Mexico will only lose more ground.

Figure 3 Evolution of Mexican agriculture: productivity and sectoral participation in national total employment and value added, 1960–2010

Source: Author's calculations, based on INEG, SNCN, http://www.inegi.org.mx/est/contenidos/proyectos/scn/default.aspx, viewed on July 12, 2012.

Nevertheless, the relative decline in productivity is not the principal source of declining prices and incomes for the rural Mexican population (and it is theoretically possible to have both higher productivity and higher cost of cultivation per worker). In a competitive market one would expect international or export prices to reflect the marginal costs of production. This is not the case with the major farm products that Mexico imports exclusively from the United States, such as maize, beans, soyabean, and wheat, which are staples in Mexico's food consumption patterns.

Until 2006, Mexican agriculture faced the challenge of decreasing international prices and increasing stimuli provided by the Farm Bill to North American producers and exporters. Other negative factors were the dualism in the structure of land ownership mentioned above and the high concentration of market power in the hands of a few domestic traders. Rural producers in Mexico face extremely imperfect domestic and external markets. In such conditions, production costs are less significant than other factors in determining the comparative advantage of a country vis-à -vis its trade partner.

Changes in the Structure of Production and Land Allocation

The structure of production has changed in expected directions: there are noticeable decreases in the labour-intensive production of grain (mainly corn, wheat, rice, and beans), and smaller declines in the production of fodder and industrial raw material other than cotton. The only products whose share in the total value of production is increasing are fruit and vegetables.

While the production of fruit and vegetables has increased, the share of cultivated land has remained stable (Puyana and Romero 2008, p. 150). High initial costs, such as the investment needed in the case of fruit trees, which require a long period between planting and the first marketable harvest, make it difficult to extend these crops to new areas. Lack of investment in irrigation limits the potential for cultivating vegetables, as does the insufficiency of transport networks for enabling perishable products to reach their points of sale. Not least of the problems is the poor functioning of the markets for goods, capital, and technology.

Table 1 presents the changes, across two periods, in the structure of production and land use with respect to major groups of agricultural products. The first period is 1980–93, which covers the years of the reforms and the signing of NAFTA. This was a time of major transformation owing to structural reforms and radical changes in policies towards the agricultural sector, mainly the intensive programme of unilateral liberalisation prior to Mexico's accession to GATT. The second period is 1994–2010, during which the agricultural sector had to adjust to the changes introduced by the implementation of NAFTA. In both periods Mexican agriculture suffered the effects of changes in international prices, the fall in public and private investments, and the lack of financing and protracted overvaluation of the peso. While the share of the value of production of fruit and vegetables rose by 10.81 percentage points, their share of area cultivated in the distribution of the value of production rose by only 0.76 percentage points. Improved technologies and more intensive use of better land could explain the difference. Fodder gained in terms of share of land but lost in terms of share in value, due to decreasing prices.

Table 1 Changes in the structure of the total value of production and cultivated land in per cent

| Products | Share of value of production | Difference | Share of area cultivated | Difference | ||

| 1980–93 | 1994–2010 | 1980–93 | 1994–2010 | |||

| Grains | 53.38 | 45.20 | −8.18 | 73.09 | 68.14 | −4.95 |

| Fodder | 16.04 | 15.88 | −0.16 | 18.45 | 23.69 | 5.25 |

| Fruit and vegetables | 23.68 | 34.49 | 10.81 | 3.74 | 4.49 | 0.76 |

| Industrial inputs | 5.91 | 4.17 | −1.75 | 4.52 | 3.52 | −1.00 |

| Other | 0.99 | 0.26 | −0.73 | 0.21 | 0.15 | −0.06 |

Source: Author's calculations, based on SIECON-SAGARPA, http://www.siap.gob.mx/index.php?option=com_content&view=article&id=10&Itemid=15, viewed on July 12, 2012.

The structure of production changed in favour of less labour-intensive activities. For instance, the labour demand per unit of production in the cultivation of grain, corn, wheat, and beans, was 6.5 times higher than the demand per unit of production in the cultivation of fruit and vegetables.

The Widening External Trade Deficit in Food and Agricultural Raw Materials

In 2010, the United States absorbed 85 per cent of Mexico's total exports and provided 70 per cent of the country's imports. The value of total exports to the United States in that year amounted to USD 299 billion, a dramatic increase from the USD 19 billion registered in 1980.6 The increase in the value of imports was faster, soaring from USD 21.1 billion in 1980 to USD 302 billion in 2010. The export of manufactures was the most dynamic element of external sales, accounting for 16.5 per cent of GDP, almost half of all exports. Ever since NAFTA was enforced, Mexico has shown a permanent trade deficit, tempered only by a surplus in oil and subcontracting manufactures trade.

A second noteworthy feature of the situation is the transformation in the composition of the country's foreign trade. From exporting oil and resource-based manufactures, Mexico became an exporter of sophisticated manufactures, originating mainly in subcontracting. In 1982 oil exports accounted for almost 78 per cent of all exports, while the share of agriculture was 6 per cent and of manufacture around 14 per cent. Non-oil exports expanded after the massive devaluations of 1982, 1986, and 1994. By 2010, oil accounted for only 13 per cent of exports, agriculture for 3 per cent, and manufactured goods for 82 per cent. Maquila accounted for 74 per cent of exported manufactured goods and 31 per cent of total exports. Under NAFTA, there was a rise in exports of fruit and vegetables originating from the northern States, as well as of beverages. Imports of grain, cotton, poultry, dairy products, and other agricultural raw material grew (Puyana et al. 2012). Agriculture and agribusiness, petrochemicals and the automobile industry, textiles and food were all in the red (Puyana et al. 2012).

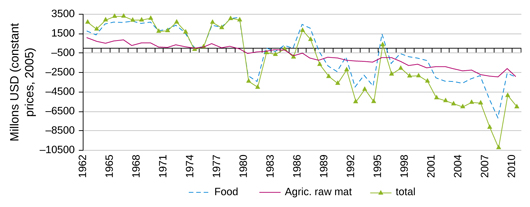

Since the debt crisis and the reforms that followed, the agriculture sector has shown an increasing trade deficit in food and agricultural raw material (see Figure 4). As a result of the massive devaluations that Mexico has experimented with (in 1983, 1986, and 1995), trade has tended to achieve equilibrium – until such time as inflation wipes out the effects of devaluation. In effect, from 1993 to 2010, external trade in agriculture grew in real terms at a slower rate than total external trade. The livestock sector registered a trade surplus, but not the agricultural and livestock sector as a whole, which has shown an increasing trade deficit since 1980.

Figure 4 External trade deficit in agriculture during 1962–2010 in USD (constant prices, 2005)

Source: Author's calculations, based on INEGI, SNCN, http://www.inegi.org.mx/est/contenidos/proyectos/scn/default.aspx, viewed on July 12, 2012.

The external trade of agriculture, livestock, and food products reveals a high sensitivity to changes in the real exchange rate. In 1995, after the intense devaluation of December 1994, imports diminished and exports increased, thereby registering a significant improvement in the sectoral trade balance.7 The relatively small devaluation of 2008 did not have the same effect.

The elimination of import tariffs, in addition to revaluation of the Mexican peso and the stimuli of the United States Farm Bill, explain the large -- USD 10 billion -- trade deficit in agriculture that Mexico has accumulated since NAFTA. As we will explain later, this inflicted huge losses on Mexican producers in 1997–2005, an amount calculated to be USD 12 billion (Wise 2009, p. 16).

Did NAFTA Grant Mexico Safe Access to the United States Market?

Mexico has not been able to maintain the position that it occupied in the U. S. market in 1993. Its presence in that market has reduced, pushed aside by external competitors, as indicated by the index of Revealed Comparative Advantage (RCA) or Index of Specialisation,8 which measures the competitiveness of a product by means of the growth of its share in total imports of the destination market. A fall in value registered over a year would imply a loss of comparative advantage, signalling that a country's exports grew at a lower rate than the total. In 2010, products that qualified as examples of Mexico's success as an exporter registered lower Indices of Specialisation than in 1990. For example, in 1990, Mexican tomatoes constituted around 90 per cent of total U. S. imports of this product. In 2010, Mexico supplied only 60 per cent of total imports of tomatoes to the United States. This points to a dramatic fall in the value of the Specialisation Index and shows that other countries took greater advantage than Mexico of the expansion of demand in the U. S. market for imports – and that they succeeded in doing so despite not enjoying NAFTA preferences. A similar fall in market share was registered, although to a lesser extent, in the case of other traditional fruit exports such as melons, grapes, and vegetables in general.

We have to remember that Mexico received a very small tariff preference, which was cut by half in the first year of implementation of NAFTA as a result of the United States' unilateral preferential trade agreements with other developing countries (Romero and Puyana 2008). Table 2 presents the evolution of the index of RCA of the main agriculture products exported by Mexico to the United States. In the last row of the table we can see the sharp decline, ranging from 66 per cent to 94.1 per cent, from the initial value of the RCA index. The countries that displaced Mexico are, among others, Costa Rica, Ecuador, Canada, and El Salvador.

Table 2 Revealed Comparative Advantage (RCA) index of main agricultural exports from Mexico to the United States

| Year | Guavas, mangoes | Leguminous | Tomatoes | Vegetablesnes | Vegetables* | Melons, watermelons | Avocados | Grapes, fresh or dried | Vegetables** |

| 1990 | 12.18 | 6.21 | 15.05 | 5.76 | 2.68 | 9.41 | 2.65 | 0.38 | 0.20 |

| 1995 | 2.57 | 0.50 | 2.58 | 1.53 | 0.68 | 1.25 | 0.25 | 0.30 | 0.05 |

| 2000 | 1.47 | 0.69 | 1.26 | 1.65 | 0.56 | 1.11 | 0.35 | 0.26 | 0.16 |

| 2005 | 0.64 | 0.46 | 1.58 | 1.38 | 0.61 | 1.23 | 2.16 | 0.26 | 0.16 |

| 2010 | 0.72 | 0.46 | 1.59 | 1.05 | 0.46 | 1.24 | 2.10 | 0.16 | 0.07 |

| Change | −94.08 | −92.65 | −90.06 | −81.72 | −82.69 | −86.86 | −20.76 | −59.70 | −65.94 |

Notes: RCAij = 100(Xij /Xwj )/(Xit /Xwt ), where Xab is exports by country a (w=world) of good b (t=total for all goods).

* Fresh vegetables; ** Frosen vegetables

Source: Author's calculations, based on ECLAC, Magic, 2012, http://www.cepal.org/magic/?error=USUARIO%20NO%20AUTORIZADO, viewed on July 12, 2012.

Declining Production per Inhabitant and Food Security

The general discourse suggests that as long as the country has a positive trade balance, it can afford to have a deficit in external exchanges in agriculture. Such arguments ignore the negative effect of changes in external markets, such as the devaluation of national currency, sudden increases in prices or reduction of farm subsidies. The effect is a general increase in prices of food, which has a more adverse impact on poor households that spend a large proportion of their income on food than on others.

Since the reforms, food security in Mexico has declined due to increasing dependence on imports, especially of soyabean, rice, corn, and wheat. At the same time, an important change has taken place in per capita consumption: a reduction in the intake of grain and a continuous increase in the consumption of poultry and eggs, which have become the primary source of proteins. Traditional sources of vegetarian protein, beans and corn, were replaced by animal protein, supplied mainly by multinational companies (such as Pilgrims), sometimes in association with big national companies such as Bachoco.

Table 3 Accumulated growth rates of external supply of domestic consumption and per capita consumption of main food products, 1980–2009

| Product | Apparent consumption* | Per capita consumption** |

| 1980–09 | 1980–09 | |

| Sesame | 61.22 | −65.0 |

| Cotton | 65.18 | −28.5 |

| Rice | 74.15 | −0.7 |

| Cardamom | 0.25 | −62.2 |

| Barley | 29.79 | 25.6 |

| Beans | 7.64 | −36.1 |

| Corn | 32.79 | 5.3 |

| Sorghum | 43.09 | −23.1 |

| Soyabean | 96.70 | 92.9 |

| Wheat | 65.12 | −9.4 |

| Poultry | 16.10 | 237.0 |

| Beef | 29.03 | 12.1 |

| Eggs (tons) | 0.73 | 86.2 |

| Milk (1000 litres) | 18.30 | 8.3 |

| Pork | 39.27 | −0.6 |

Notes: *AC=Apparent consumption, defined as imports=imports/production+imports−exports.

** PC=Growth rates of consumption per head in kg.

Source: Author's calculations, based on Economic Comission for Latin America and the Caribbean, Magic, 2012, http://www.cepal.org/magic/?error=USUARIO%20NO%20AUTORIZADO, viewed on July 12, 2012.

What is most alarming is the increasing share of imported corn in total consumption. For thousands of years, long before the Spanish conquest, corn was at the very root of Mexico's native culture. Today, Mexican peasants and the larger population represented by several non-government organisations that defend the rural population and agricultural production, have a slogan that says, "sin maíz no hay país" (without maize there is no nation). Since 1992, according to recent statistics from the Banco de Mexico, imports of corn have grown at an annual rate of 2.1 per cent. "It is not a sound economic strategy to import maize and to export peasants," declared Adleita san Vicente, member of the organisation "Sin maíz no hay país" (La Jornada, 14 April 2012, p. 16, column 5).

All in all, the result of the strategy of agricultural development has been stagnating productivity per worker, and stagnating or falling production per inhabitant, particularly in the case of rice, soy, and corn. In addition, Mexico has lost its share of the United States market for its most important exports, including tomatoes and strawberries (Puyana and Romero 2008, pp. 158–60).

A reason for the low productivity growth in agriculture could be the low investment per worker in agriculture, which amounted to approximately USD 100 per annum (Puyana and Romero 2009a, p. 79).

Confronting the Hazards of Unfair Policies and Impoverishing Trade

The reason for the disappointing trajectory of the agricultural sector is the fact that since the adoption of the export-led model, circa 1986, Mexican agriculture has been subjected to unfair competition in domestic and international markets, leading to long-lasting, negative trade terms of exchange in both markets. The external terms of trade of Mexican agriculture declined by 50.1 per cent, while the internal terms of exchange – that is, the ratio of the domestic prices of manufactured goods the rural population has to acquire, and the domestic producer prices of agricultural goods they put on the market – declined even faster, 52.8 per cent (Puyana et al. 2012). The combination of these trends inflicted permanent income losses on producers, especially food producers.

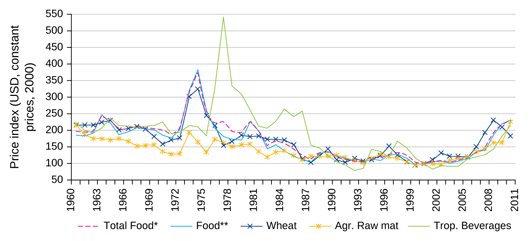

International Prices of the Main Mexican Commodities

After the positive trend registered from the early 70s to the early 80s, international commodity prices fell continuously from the year of the debt crisis (1982) up to 1999 (Figure 5).

Figure 5 International commodity price index, 1960–2010 in USD (constant prices, 2000)

Notes: * Total food=items SITC 0 (food and live animals)+1 (beverages and tobacco)+22 (oilseeds and oleaginous fruits)+4 (animal and vegetable oils, fats and waxes).

** Food items=SITC 0 + 22 + 4=Total food minus tropical beverages.

Source: Author's calculations, based on UNCTAD (2011).

Mexico exports manufactured goods and relatively minor quantities of oil, fruit and vegetables, including tomatoes, bananas, coffee, sugar, oranges, and some temperate-climate fruit. As an importer, Mexico profited, between the late 1970s and early 2000s, from declining international prices in agricultural raw material and food products (Puyana et al. 2012). This trend put pressure on domestic producers, who were unable to switch to export commodities, especially small producers of corn, bean, wheat, barley, and rice, who sell a part of their produce to buy food and manufactured goods.

In Table 4 we present the evolution of prices of the main import and export commodities of Mexico, at constant 2005 dollars. During the period under review, 1960–2011, the prices of all export commodities other than shrimp rose. Oil was the frontrunner. Oil prices in the years 1973–80 were exceptionally high, growing at 47 per cent, while they fell in 1981–99. At constant 2010 dollars, the price of a barrel of oil in 2010 was 18.43 per cent lower than in 1980.

At the bottom of Table 4, we present the unweighted averages of annual growth rates of export and import prices of commodities. These averages are illustrative of the changes in the import capacity of Mexico's export commodities. Only in two periods did average export prices grow faster than import prices: in 1960–80 (the period before the debt crisis and the liberalisation of trade regimes) and in 2005–11 (the years of escalating oil prices), when the difference between the two expanded by 4.58 percentage points. If we exclude oil from the calculation of average rates of growth, a different picture emerges: for instance, in the last period, 2005–11, the average growth rate of export prices then falls to just 1.04 per cent.

Table 4 Mexico: Annual Growth rates of international prices of the major commodities exported and imported, 1960–2011

| Commodities exported (annual growth rates in per cent) | |||||||

| Petroleum, crude | Cocoa | Coffee | Banana | Orange | Shrimps | Sugar, US | |

| 1960 | −5.52 | −20.30 | −4.88 | −7.36 | −18.26 | −2.05 | |

| 1970 | −10.43 | −29.31 | 22.95 | −2.11 | −7.10 | −1.27 | |

| 1980 | 12.42 | −28.12 | −17.64 | 5.34 | −11.22 | −21.91 | 75.84 |

| 1990 | 23.42 | −1.78 | −20.50 | −4.82 | 14.75 | −18.06 | −1.88 |

| 2000 | 59.24 | −18.67 | −14.57 | 15.62 | −14.06 | 5.72 | −6.46 |

| 2005 | 37.43 | −3.61 | 38.64 | 11.62 | −1.12 | −1.76 | 0.24 |

| 2011 | 20.88 | −12.62 | 27.07 | 2.40 | −20.77 | 9.11 | −2.73 |

| 1960–1980 | 17.07 | 5.58 | 4.08 | −0.85 | −1.68 | 2.58 | 7.04 |

| 1981–2011 | 4.58 | 0.74 | 3.78 | 2.64 | 2.16 | −0.71 | −0.05 |

| 2005–2010 | 14.12 | 6.85 | 15.98 | 5.77 | −2.18 | −1.02 | 6.81 |

| Commodities imported (annual growth rates in per cent) | |||||||

| Soybeans | Soy oil | Maize | Rice | Wheat | Beef | Iron ore | |

| 1960 | 16.78 | 25.87 | −0.90 | 8.69 | −1.41 | −9.18 | −5.34 |

| 1970 | 2.97 | 36.53 | 5.00 | −29.48 | −4.65 | 0.27 | −5.99 |

| 1980 | −9.55 | −17.95 | −1.42 | 19.28 | −2.11 | −13.00 | 8.67 |

| 1990 | −13.66 | −0.24 | −5.71 | −12.88 | −22.99 | −3.99 | 12.38 |

| 2000 | 7.08 | −19.35 | 0.04 | −16.95 | 4.73 | 6.85 | 6.37 |

| 2005 | −12.95 | −14.08 | −14.28 | 16.99 | −8.74 | 1.16 | 66.58 |

| 2011 | 10.42 | 18.81 | 44.12 | 2.03 | 14.35 | 10.79 | 17.40 |

| 1960–1980 | −0.50 | 0.00 | −0.80 | 0.40 | −0.70 | 0.50 | −0.90 |

| 1981–2011 | 6.20 | 10.00 | 13.10 | 12.20 | 8.60 | 4.00 | 22.90 |

| 2005–2011 | 10.00 | 13.10 | 8.60 | 4.00 | 22.90 | 8.60 | 4.00 |

Note: Calculated from constant USD (2005) prices.

Source: Author's own calculations, based on World Bank, 2012 Commodity Prices Pink Sheet, viewed on March 12, 2012.

It appears that the positive trajectory of oil prices will counterbalance the effects on income and growth of the decrease in prices of agricultural exports. This may not be the case, however, because of difference in systems of production. While coffee and other agriculture products use intensive methods of domestic production, especially with respect to labour, and in general are produced in small peasant units, oil is capital-intensive, and requires external technology and highly qualified manpower.

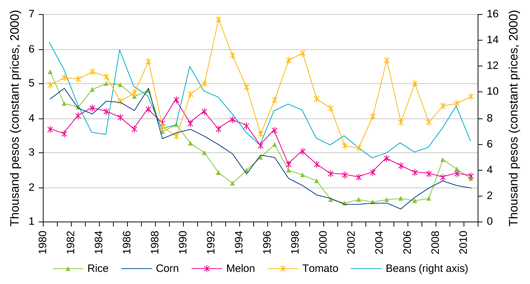

Domestic Prices of Mexican Agricultural Products

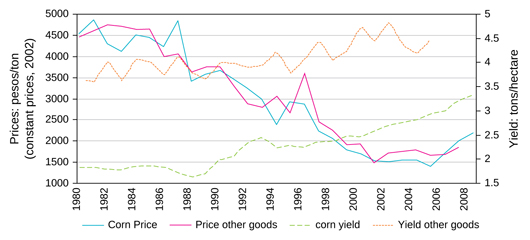

As shown below, the prices of both exportable and importable products fell (Figure 6). The decline of domestic producer prices of the main exportable goods, such as tomatoes, vegetables, and fruit – in which Mexico has a comparative advantage and is a world exporter – is puzzling. Their prices were supposed to rise closer to international levels, and benefit producers and exporters. But it did not happen that way. Revaluation of the peso and growing world supply, stimulated by the United States signing trade agreements with several developing countries exporting the same goods, may have something to do with this. As expected, the domestic producer prices of importable goods, such as maize, beans, and wheat, also declined. The rise in international prices in 2005–10 induced the increase of Mexican prices, which nevertheless remained below the record levels of the early 1980s and 90s.

Figure 6 Domestic producer prices of some major Mexican agricultural products, 1980–2010

Source: Author's own calculations, based on Secretaría de Agricultura, Ganadería, Desarrollo Rural, Pesca y Alimentación, (Ministry of Agriculture, Livestock, Rural Development, Fishing and Food), obtained from siap.sagarpa.gob.mx/AnxInfo, viewed on July 12, 2012.

It is worth noting how much the trajectory of domestic producer prices differs from one State of the Republic to another. The losing States are those with the smallest per capita GDP, and the largest share of agriculture in total GDP and total employment (these are highlighted in Appendix Table 1). This table presents the annual rates of growth of prices, volume, and value of production in two periods: the first period (1980–94), covers the debt crisis and the consolidation of the structural reforms, and the second (1994–2010) covers the NAFTA regime. In general, prices grew at a lower pace in the NAFTA period.

The decline in corn prices, as those of other products, can and should be imputed in large measure to NAFTA. McMillan, Peterson and Zwane (2005, p. 28) conclude that the changes in the price of corn were at least partially brought on by NAFTA. They point out that no less than 60 per cent of the poorest corn growers participate in the market and have been hit by the fall in world prices, which they link to the United States Farm Bill and other support measures of the U. S. government (ibid., p. 27). The authors also suggest, however, that the effect attributable to United States policies is rather small. Nevertheless, other authors state that U. S. agricultural policies, the reforms, and NAFTA explain the outcome (Ingco and Nash 2004, pp. 151–68; Polaski 2004; Puyana and Romero 2008; USITC 2003; Vollrath et al. 2001). After 1996, dumping by the United States of soya, cotton, and maize increased by 12 per cent, 50 per cent and 20 per cent respectively (Wise 2010, p. 10). This dumping explains the 413 per cent increase in U. S. exports to Mexico, which, from the early 1990s to 2005, brought about a 66 per cent contraction in Mexican domestic producer prices and reduced incomes in large measure (ibid., p. 3).

Effects of the Farm Policies of the United States:

Dumping, and Reducing Prices and Incomes

The Farm Bill and other subsidies allow the United States to place its agricultural exports on the international market at prices well below their production costs (Wise 2010), which in effect constitutes dumping by the definition of the World Trade Organisation (WTO). The WTO provides a second definition of dumping: exporting goods at prices below their domestic consumer prices. Some authors prefer to use the concept of dumping margin, which "shall be determined by comparison with ... the cost of production in the country of origin plus a reasonable amount for administrative, selling and general costs and for profits." (Wise 2010, p. 9). Dumping margins for United States goods in Mexico are substantial, varying between 12 per cent for soyabean and 38 per cent for cotton. There can be no doubt about their capacity to distort market relations. Table 6 presents the effects of the Farm Bill and other stimuli on Mexican producers. These effects were more intense for States with larger drops in prices (Appendix Table 1). Mexican producers lost around 13 billion dollars in 1997–2005. Half of this loss was borne by corn producers.

Table 5 Effects on Mexican producers of dumping by United States

| United States | Mexico | ||||||||

| Exports to Mexico (1000 mt) | Dumping margin | Producer price−drop (real pesos) (%) | Mexican product (1000 mt) | Losses 1997–2005 | |||||

| 1990–92 | 2006–08 | Growth (%) | Avg. 1997–05 | 2005/1990–92 | 1990–92 | 2006–08 | Growth (%) | 2000 US$ million | |

| Corn: all | 2,014 | 10,330 | 413 | 19 | −66 | 15,807 | 23,650 | 50 | 6,571 |

| Corn: ground or cracked* | 1,982 | 8,385 | 323 | ||||||

| Soyabean | 1,410 | 3,653 | 159 | 12 | −67 | 619 | 105 | −83 | 31 |

| Wheat | 360 | 2,515 | 599 | 34 | −58 | 3,871 | 3,611 | −7 | 2,176 |

| Cotton | 49 | 312 | 531 | 38 | −65 | 136 | 134 | −3 | 805 |

| Rice | 129 | 806 | 524 | 16 | −51 | 181 | 181 | −8 | 67 |

| Sub−total | 9,650 | ||||||||

| Beef | 54 | 204 | 278 | 5 | −45 | 1,677 | 2,191 | 31 | 1,566 |

| Pork | 27 | 218 | 707 | 10 | −56 | 814 | 1,140 | 40 | 1,161 |

| Poultry | 85 | 396 | 363 | 10 | −44 | 1,156 | 2,693 | 133 | 455 |

| Sub–total | 3,182 | ||||||||

| Total losses | 12,832 | ||||||||

Note: * ground or cracked in the markets of origin of the imports. The imports of these products were liberalised from the first day of the implementation of NAFTA eliminating any protection in favour ofraw corn.

Source: Wise (2010), Table 3.

The existence of such large dumping margins nullifies considerations of competitiveness based on relative production costs. The effects of dumping are several: first, a reduction of domestic prices of agricultural production; secondly, a fall in the demand for domestic agricultural production and its replacement by imports; thirdly, a fall in farmers' incomes and a contraction of their demand for goods and labour; and fourthly, negative terms of trade between domestic agriculture and manufactures. Further, since rural–urban migration intensifies, labour supply in the cities tends to grow faster than demand, the urban informal sector expands and wages decline. All in all, the economy moves to a low level of equilibrium with low incomes, low productivity, and low demand. As shown in Table 3, dumping margins in export prices of the United States are significant. Thus, for Mexico to be able to compete with U. S. exports, its production costs need to be below the level of U. S. production costs less the dumping margin. For maize, considering the production costs given in Table 6, this would imply a price that is at least 30 per cent less than the price registered in 2009. Even if the 19 per cent dumping margin on United States corn were not there, Mexican producers' prices would have to decline by 16.5 per cent to compare with those of the United States.

In 1994 Mexican yields were 25 to 87 per cent lower than yields in the United States (Table 6). By 2009 the disparities were wider. The gap between Mexican and United States producers' prices was higher than the gap between yields. If producers' prices are any indication of production costs, we can assume that Mexican costs are lower than United States costs minus the dumping margin.

Table 6 Yields and producers' prices in Mexico and the United States, 1994 and 2009

| Yields (ton/ha) | Producer prices United States (dollars/ton) | |||||||

| Mexico | United States | Mexico | United States | |||||

| 1994 | 2009 | 1994 | 2009 | 1994 | 2009 | 1994 | 2009 | |

| Maize | 2.23 | 3.24 | 8.70 | 10.34 | 194 | 208 | 89 | 146 |

| Beans | 0.65 | 0.86 | 1.77 | 1.94 | 563 | 893 | 496 | 681 |

| Barley | 2.65 | 2.17 | 3.02 | 3.93 | 201 | 237 | 93 | 230 |

Source: Author's calculations, based on FAO (2012), viewed on May 26, 2012.

Uneven Domestic Conditions

A second effect of unfair trade relates to the differences in yields per hectare of maize, beans and barley in different States (Appendix Tables 2–4). First, there is a big difference in maize yields between irrigated and rainfed farms. In 2007, at the national level, yields on rainfed farms were 32 per cent of yields on irrigated farms. The divergence widened in the period from 1991 to 2007. In some States, the yield of maize cultivated in rainfed areas was less than 20 per cent of the yield from irrigated land. The data also shows the unevenness of land productivity as between States. In maize the largest yields per hectare are registered in Sinaloa, a State that benefited from the construction of large-scale infrastructure for irrigation and all the benefits granted by the previous economic policy regime to large-scale, fully mechanized, and subsidized farming. Yields in Sinaloa and San Luis Potosí are 2.73 and 1.75 times the national average respectively. A similar situation exists for beans (Appendix Table 3). The unequal effects of the United States policy of dumping its farm products on Mexico are evident from a comparison of producers' prices in the States (Appendix Table 1).

Is There Fair Room for Complaint?

There are several reasons why Mexico has not made better use of the WTO to complain against the subsidies the United States gives to its own exporters of farm products. Since NAFTA came into force, disputes related to dumping and countervailing duties in trade of agriculture goods have been more frequent and intense between the United States and Canada than between the United States and Mexico. This is because, as Morales (1997) has argued, the legal process is long and costly and the outcomes uncertain, and Mexican companies do not have the resources to engage in protracted legal battles.

Under NAFTA, each signatory retains the right to apply compensatory duties on subsidised imports of agricultural products when the price of an import is considered to be less than its true value and a real threat to national producers can be shown to exist (Burfisher 2001). The application of subsidies to exports of agricultural products between Canada, the United States, and Mexico was considered "inappropriate." However, the three countries may apply subsidies to products exported between them in order to countervail the subsidised exports of other countries, principally the European Union (Gifford 2001, Wise 2010). This is significantly different from what happens in the European Union, where such corrective trade measures are not allowed at the intra-regional level.

The disputes originate in the ambiguities of NAFTA itself, since the text of the Agreement did not seek to harmonise the commercial legal systems of the three member countries with respect to unfair trading practices and the use of subsidies. This lack of harmonisation gives U. S. exporters the leeway to take advantage of the complexities of U. S. trade legislation (Morales 1997). As Rugman and Anderson (1997) illustrated, NAFTA did not create a settlement mechanism independent of North American commercial legislation. Foreign companies have fewer legal rights under U. S. commercial law than domestic complainants, and NAFTA did not change this administrative bias. NAFTA, like any international agreement, is open to interpretation, and in cases of differences in interpretation, or of conflicts between NAFTA regulations and U. S. legislation, it is the latter that prevails (Drache 2001). Neither does the recourse to bilateral panels for settlement of disputes guarantee that a judgment favourable to Mexico (or to Canada) will bring the litigation to a close, since the panels' recommendations are not mandatory. In such circumstances, U. S. producers can go on complaining (Puyana and Romero 2008). By contrast, the decisions of the European Court are mandatory for all member-countries of the European Union, thereby reducing the capacity of larger countries to influence outcomes (Drache 2001).

Since 1989 NAFTA members have been involved in 183 disputes, the majority of them filed by the United States and Canada, and only 48 filed by Mexico. Appendix Table 4 lists the disputes by subject. Although there are no disputes in agriculture, there are many anti-dumping disputes related to manufactures and services.

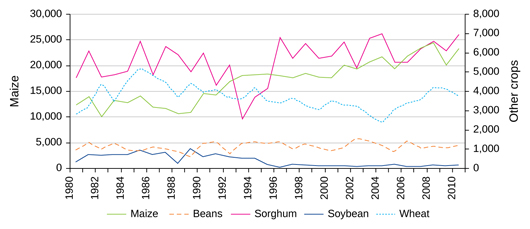

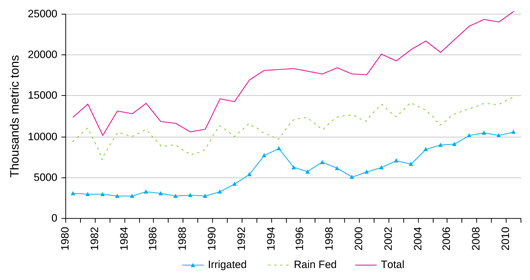

Peasants' Reaction to Unfair Trade

The reaction of small and poor peasants to the fall in prices was to improve their cultivation techniques in order to increase yields and the volume of production. It should be noted that small cultivators of rainfed land have consistently increased their production, while cultivation by the large, market-oriented producers in irrigated areas has been more volatile and has grown at a slower pace (Figure 7). These large producers are more able to shift to other products when prices are unfavourable, and have access to financial support that small producers do not.

Figure 7 Production of Major Agricultural Products 1980–2010 in metric tonnes

Source: Author's own calculations, based on Secretaría de Agricultura, Ganadería, Desarrollo Rural, Pesca y Alimentación (Ministry of Agriculture, Livestock, Rural Development, Fishing and Food), http://www.siap.gob.mx/index.php?option=com_content&view=article&id=10&Itemid=15, viewed on July 12, 2012.

Increases in Yields and Volume of Production Are Not Enough

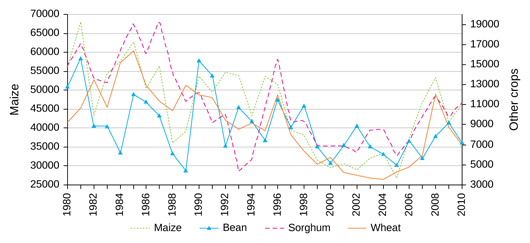

Increases in production were not adequate, however, to maintain either the value of total production and income, or the share of agriculture in total GDP, since the adjustment of prices outstripped the adjustment in quantities (Puyana and Romero 2008). This was especially true for corn and sorghum. Despite all their efforts, producers of maize and other food grain have been losers in the liberalisation process. Not even the substantial increase in international and local prices registered in 2005–09 helped restore the lost value of total production.

Figure 8 Value of major agricultural goods 1980–2010 million pesos (constant prices 2000)

Source: Author's own calculations, based on Secretaría de Agricultura, Ganadería, Desarrollo Rural, Pesca y Alimentación (Ministry of Agriculture, Livestock, Rural Development, Fishing and Food), http://www.siap.gob.mx/index.php?option=com_content&view=article&id=10&Itemid=15, viewed on July 12, 2012.

Small growers of corn and beans are among the main losers of the liberalisation process. The decline in prices of corn and beans (Figure 4) was sharper than for any other commodity (Puyana and Romero 2008, p. 130), and more acute than elsewhere in poor regions such as the States of Oaxaca and Chiapas, where maize is the main crop and agriculture the most important source of employment and income (Puyana et al. 2012).

Against all predictions, rainfed corn production survived.9 Poor peasants employ a diverse range of strategies in order to survive, and then help to explain some surprising developments that run counter to economic predictions but are well documented in Mexican statistics. For example, the production of maize on irrigated lands (mainly large, commercial farms) has declined ever since cheaper, subsidised United States corn was allowed into Mexico and subsidies for water use were reduced. However, maize production on non-irrigated, rainfed land (overwhelmingly small, subsistence plots) increased when household incomes contracted sharply during the severe recession that followed the peso crisis in 1995. These production levels have been maintained despite imports of cheaper United States corn (Polaski 2003, p. 21; Yúnez 2002).

Poor small producers need to increase production in order to maintain the income needed to meet their basic expenditure. The more corn prices fall, the more they have to sell to finance other consumption. With negative terms of trade between manufactures and agriculture, poor peasants need to market larger quantities of their produce to acquire the same amount of manufactured goods. Sometimes they have to forgo even basic food consumption. As Ingco and Nash suggest, peasants are indeed exposed to the full impact of international prices and are forced to respond by increasing production when prices fall (Ingco and Nash 2004, pp. 151–68; Yunez 2002). Another strategy is to diversify the sources of income by working in non-agricultural rural activities. And the last resort is to migrate.

Figure 9 Production of Maize in Irrigated and Rainfed Areas, 1981–2010

Source: Author's own calculations, based on SAGARPA- SIACON, Secretaría de Agricultura, Ganadería, Desarrollo Rural, Pesca y Alimentación - Sistema de Información Agroalimentaria (System of Information on Agriculture and Food).

The pressure of falling prices induced significant increases in yields per hectare, a process more evident in corn than in other agricultural products (Figure 10). By doing so, corn cultivators managed to reverse the growth in the coefficient of external supply of domestic consumption, and prevented an even higher deficit in the sectoral external trade balance. Figure 10 shows the paths of corn yields and prices and those of all other agricultural products.

Figure 10 Prices and Yields of Corn and Other Agricultural Products, 1980–2009

Source: Author's own calculations, based on Secretaría de Agricultura, Ganadería, Desarrollo Rural, Pesca y Alimentación, http://www.siap.gob.mx/index.php?option=com_content&view=article&id=10&Itemid=15, viewed on July 12, 2012.

Some Welfare Effects of the Liberalisation of Agriculture in Mexico

Income Concentration and Poverty Incidence

The share of agriculture in total income declined from 21.8 per cent in 1984 to just 12.8 per cent in 2010. Even accepting that the total rural population and rural employment had decreased (the number of rural households decreased 15.4 per cent between 1984 and 2010), the impact on rural incomes was still severe, since about 21.8 per cent of total households were rural. Income distribution was also affected. Table 8 shows the percentage distribution of income and number of households between 1984 and 2010. The gap between the percentage share of households and the proportion of income is clear. This gap points to the economic inequality that prevails among the rural population.

Table 7 Urban and rural household incomes, 1984–2010 in per cent

| Income Deciles | Share of total national income | Share of total households | ||||||

| Urban | Rural | Urban | Rural | |||||

| 1984 | 2010 | 1984 | 2010 | 1984 | 2010 | 1984 | 2010 | |

| Total | 78.23 | 87.59 | 21.77 | 12.41 | 64.95 | 78.63 | 35.05 | 21.37 |

| I | 0.41 | 0.65 | 0.78 | 0.76 | 34.83 | 44.95 | 65.17 | 55.05 |

| II | 0.94 | 1.72 | 1.72 | 1.05 | 35.93 | 61.69 | 64.07 | 38.31 |

| III | 1.87 | 2.75 | 1.99 | 1.13 | 47.96 | 71.14 | 52.04 | 28.86 |

| IV | 3.31 | 3.86 | 1.70 | 1.05 | 65.47 | 78.74 | 34.53 | 21.26 |

| V | 4.35 | 4.95 | 1.91 | 1.18 | 69.42 | 81.21 | 30.58 | 18.79 |

| VI | 5.29 | 6.40 | 2.37 | 1.06 | 69.07 | 86.28 | 30.93 | 13.72 |

| VII | 7.18 | 8.27 | 2.49 | 1.16 | 74.23 | 88.32 | 25.77 | 11.68 |

| VIII | 9.96 | 10.79 | 2.46 | 1.31 | 80.01 | 89.36 | 19.99 | 10.64 |

| IX | 13.89 | 15.08 | 3.10 | 1.52 | 81.86 | 90.95 | 18.14 | 9.05 |

| X | 31.02 | 33.13 | 3.24 | 2.20 | 90.74 | 93.66 | 9.26 | 6.34 |

Source: Author's own calculations, based on Encuesta Nacinal de Ingreso y Gasto de los Hogares (Survey of Household Incomes and Expenditures), 1984 and 2010, http://www.inegi.org.mx/Sistemas/TabuladosBasicos2/tabdirecto.aspx?s=est&c=27886, viewed on April 5, 2012.

Inequality of rural income tended to worsen after the reforms were introduced in 1984, with a clear increase in the share of income of the richest deciles. In 1984 the share of the richest decile in the total rural income was 14.9 per cent; this share escalated to 16.7 per cent in 2010. Table 8 illustrates the concentration of rural incomes, which, though lower than the concentration of urban incomes, shows an increasing trend, while urban income concentration tended to decrease. As the share of agriculture falls in GDP and income, income concentration increases. During the period 1984–2010, the share of the poorest three deciles of the rural population decreased by 2.17 percentage points. At the same time, the share of income that accrued to the four wealthiest deciles grew by 3.6 percentage points.

Table 8 Distribution of rural and urban incomes, 1984–2010

| Total | Urban income | Rural income | ||

| 1984 | 2010 | 1984 | 2010 | |

| I | 1.19 | 1.41 | 5.36 | 4.72 |

| II | 2.66 | 2.76 | 6.53 | 5.35 |

| III | 3.86 | 3.88 | 7.38 | 7.05 |

| IV | 5.01 | 4.91 | 11.08 | 10.01 |

| V | 6.26 | 6.13 | 10.69 | 10.33 |

| VI | 7.66 | 7.46 | 10.63 | 11.97 |

| VII | 9.68 | 9.42 | 11.43 | 12.23 |

| VIII | 12.42 | 12.10 | 11.32 | 12.36 |

| IX | 17.00 | 16.60 | 12.60 | 12.57 |

| X | 34.26 | 35.33 | 12.97 | 13.41 |

| Total | 100.00 | 100.00 | 100.00 | 100.00 |

Source: Author's calculations, based on ECLAC, (Economic Comission for Latin America and the Caribbean) Magic, 2012, http://www.cepal.org/magic/?error=USUARIO%20NO%20AUTORIZADO, viewed on July 12 2012.

Poverty and inequality are protracted problems that have proved difficult to overcome. Table 9 shows the incidence of poverty (a "head-count ratio") in rural and urban areas. The table also shows the ratio of the rural head-count ratio to the urban head-count ratio in respect of poverty and extreme poverty.10 The ratio of the incidence of those in extreme poverty in rural areas to those in extreme poverty in urban areas actually increased – from 1.50 to 1.77 – between 1970 and 2008.

Table 9 Incidence of urban and rural poverty, and ratios of discrimination, 1970–2008

| Poverty (in per cent) | Extreme poverty (in per day) | Ratio (rural/urban) | ||||||

| Year | Total | Urban | Rural | Total | Urban | Rural | Poverty | Extreme Poverty |

| 1970 | 34.0 | 20.0 | 49.0 | 12.0 | 6.0 | 18.0 | 2.45 | 1.50 |

| 1977 | 32.0 | ND | ND | 10.0 | ND | ND | 2.40 | 1.60 |

| 1984 | 24.0 | 28.0 | 45.0 | 11.0 | 7.0 | 20.0 | 1.61 | 1.82 |

| 1994 | 45.1 | 36.8 | 56.5 | 16.8 | 9.0 | 27.5 | 1.54 | 1.64 |

| 1996 | 52.9 | 46.1 | 62.8 | 22.0 | 14.3 | 33.0 | 1.36 | 1.50 |

| 2000 | 41.1 | 32.3 | 54.7 | 15.2 | 6.6 | 28.5 | 1.69 | 1.88 |

| 2002 | 39.4 | 32.2 | 51.2 | 12.6 | 6.9 | 21.9 | 1.59 | 1.74 |

| 2005 | 35.5 | 28.5 | 47.5 | 11.7 | 5.8 | 21.7 | 1.67 | 1.85 |

| 2006 | 31.7 | 26.8 | 40.1 | 8.7 | 4.4 | 16.1 | 1.50 | 1.85 |

| 2008 | 34.8 | 29.2 | 44.6 | 11.2 | 6.4 | 19.8 | 1.53 | 1.77 |

Source: Author's calculations, based on ECLAC, (Economic Comission for Latin America and the Caribbean) Magic, 2012, http://www.cepal.org/magic/?error=USUARIO%20NO%20AUTORIZADO, viewed on July 12, 2012.

Poor Peasants' Survival Strategies

Rural families adopt different survival strategies to compensate for the reduction in the monetary income needed by them to satisfy their demand for goods they do not produce. In Mexico, this constitutes between 60 and 76 per cent of the total income of rural families. The sources of monetary income available to peasant families are: agricultural self-employment, agricultural and non-agricultural wage labour, non-agricultural self-employment, and private and public transfers.

The first strategy followed by poor peasants was to maintain their plots of land, no matter how small they were. Contrary to the official view, the persistence of small producers is because of poverty and lack of access to economic alternatives elsewhere in the country (Fox and Haigh 2010, p. 33). The second strategy was to diversify sources of income by engaging in alternative part-time paid employment. Between 1992 and 2010, major changes occurred in the sources of income of rural families. The share of income from agricultural self-employment collapsed from 30 per cent of total income in 1992 to only 8 per cent in 2010, while wage income from agriculture-dependent activities increased from 10 to 25 per cent and the share of self-employment in non-agricultural activities increased from relatively low levels in 1992, to 25 per cent.

Transfers, both public and private, increased by more than 200 per cent in the period under review. In 2010 they accounted for around 32 per cent of total rural income. This was concentrated heavily in the first four deciles of monetary income, where transfers constituted over 45 per cent (Puyana et al. 2012, Table 8) of this total.

Remittances from abroad play an important role in the survival strategies of rural families. In fact, international migration is a manifestation of the displacement of rural families and today represents what can be said to be a major "peasant issue" (Araghi 2000, p. 152). Migration to the United States escalated after the implementation of NAFTA (Puyana and Romero 2009). The rise in migration is associated with the "emptying" of employment in family farms (Fox and Haight 2010; Rello 2001). In 2010, remittances represented around 38 per cent of the total income of rural households. The protracted overvaluation of the Mexican peso constitutes a tax on remittances that reduces their economic effects.

On the whole, a new composition of rural households has emerged, which points to the different paths of survival adopted by rural families. First, there was a massive reduction, from 19.8 per cent to 2.9 per cent, in the proportion of households that are able to take to the "agricultural path" (families for which agricultural self-employment provides 80 to 100 per cent of income). Secondly, there was a fall in share, to 23.3 per cent from 44.8 per cent, of households involved on the "multiple activity" path, or peasants who have diverse sources of income, which serve as insurance against economic, social or environmental risk. Thirdly, there was a dramatic increase in the share of families with no means of agricultural production, from 35.4 per cent to 73.9 per cent (Puyana et al. 2012).

The Official Response

The government has implicitly abandoned any active policy to promote the agricultural sector. That is clear, for instance, from the decision of President Calderon that the Ministry of Agriculture was to be a part of the social sector and not the economic sector (the latter sector covering, for instance, the Ministry of the Exchequer, the Ministries of Economy, Communications and Transport, and Mining, and Petroleos Mexicanos or PEMEX, the state oil company). By moving agriculture from the group of ministries that determine economic policy to the ministries dealing with social matters, the government was signalling that rural and agricultural problems, at least those that concerned small and medium food producers, were not problems of an economic character, to be handled with incentives to increase productivity. They were problems of a social and political nature, costs to be paid in order to gain political stability.

There are two main lines of policy action towards agriculture. The first includes policies to compensate for the reduction in tariffs and the removal of price supports, and the second includes all other sectoral development programmes existing since the 1960s. These programmes, which were implemented as a prerequisite to entry into GATT, were eliminated by 2008 as agreed under NAFTA. The main programmes were the Programa de Apoyos Directos al Campo (PROCAMPO) or Programme of Direct Rural Support, Alianza para el Campo or Alliance for the Countryside, and Apoyos y Servicios a la Comercializacion Agropecuaria (ASERCA) or Support Services for Agricultural Marketing, to finance exports (Puyana and Romero 2009). The budget for all programmes oriented towards agricultural development was reduced from 49 billion pesos in 1994 to 10.9 billion pesos in 2009 (at constant prices, Mexican pesos in 2003).

Total public investment has remained at a level lower than required to stimulate growth in the agriculture sector. To stimulate such growth, public investment as a percentage of total investments should be higher than the share of agriculture in GDP (Schiff and Montenegro 1995); in the case of Mexico, where public investment in agriculture should be not less than 5 per cent of total investment, it has never reached even 1 per cent of total investment over more than two decades (Puyana and Romero 2009). This suggests a chronic deficit, which, in order to be eliminated, demands investments that are at least five times greater that they have been over the past 25 years or so.

Another point to emphasise is the limited coverage and scope of the development programmes involving the agricultural sector. In effect, PROCAMPO, which has emerged as the country's main agricultural development programme, covers only 2.5 million producers, or only 30 per cent of the total (Scott 2010). Oportunidades, a scheme with a larger coverage, covers at least 4 million poor rural and urban households. The scheme seeks to reduce poverty levels through conditional cash transfers. Although both programmes were designed to reach the poorest households in Mexico's rural areas, in fact, these households are relegated to being beneficiaries of only anti-poverty programmes, like Oportunidades, which do not promote productive activity or employment. Thus, the allocations of social development programmes have a close correspondence with poverty distribution, while the allocations of agricultural development programmes are distributed according to the recipients' production capacity and thus favour large-scale producers (ibid., p. 76). This suggests that cash transfers to the poorest households (of which 31 per cent are self-employed in agriculture) are mainly related to welfare programmes, as against transfers to the larger and wealthier rural producers, which are linked to agricultural support programmes.

Concluding Remarks